WASHINGTON, D.C. (February 16, 2012) — The delinquency rate for mortgage loans on one-to-four-unit residential properties decreased to a seasonally adjusted rate of 7.58 percent of all loans outstanding as of the end of the fourth quarter of 2011, a decrease of 41 basis points from the third quarter of 2011, and a decrease of 67 basis points from one year ago, according to the Mortgage Bankers Association’s (MBA) National Delinquency Survey. The non-seasonally adjusted delinquency rate decreased five basis points to 8.15 percent this quarter from 8.20 percent last quarter.

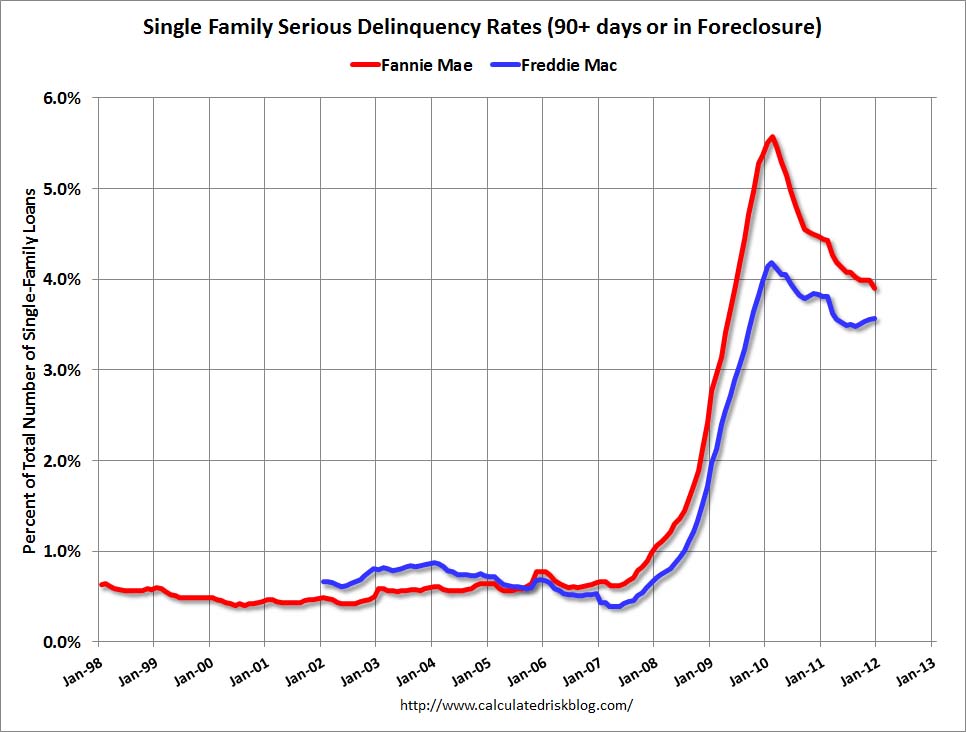

The percentage of loans on which foreclosure actions were started during the third quarter was 0.99 percent, down nine basis points from last quarter and down 28 basis points from one year ago. The delinquency rate includes loans that are at least one payment past due but does not include loans in the process of foreclosure. The percentage of loans in the foreclosure process at the end of the fourth quarter was 4.38 percent, down five basis points from the third quarter and 26 basis points lower than one year ago. The serious delinquency rate, the percentage of loans that are 90 days or more past due or in the process of foreclosure, was 7.73 percent, a decrease of 16 basis points from last quarter, and a decrease of 87 basis points from the fourth quarter of last year.

[/caption]

[/caption]

The combined percentage of loans in foreclosure or at least one payment past due was 12.63 percent on a non-seasonally adjusted basis, a 10 basis point decrease from last quarter and was 107 basis points lower than a year ago.

"Mortgage performance continued to improve in the fourth quarter, reflecting the improvement we saw in the job market and broader economy. The total delinquency rate and foreclosure starts rate decreased and are back down to levels from three years ago. A major reason is that the loans that are seriously delinquent are predominantly made up of loans originated prior to 2008 and this pool is steadily growing smaller as a percent of total loans outstanding. In addition, employment is the key driver of mortgage performance and the mortgage delinquency rate is actually falling faster than the unemployment rate is declining,” said Jay Brinkmann, MBA’s Chief Economist and Senior Vice President for Research and Education.

“People often ask where we are in the housing recovery and how far we still have to go. This year-end report is a good time to take stock. By several measures, mortgage delinquencies are about half way back to long-term, pre-recession levels. The total delinquency rate peaked at 10.1 percent in the first quarter of 2010. It now stands at 7.6 percent, about half way to the longer-term pre-recession average of roughly 5 percent. The rate of foreclosure starts peaked in the third quarter of 2009 at 1.4 percent but has now dropped to 1 percent, about half way to the longer-term average of slightly under .5 percent. When it comes to real estate, however, all national measures are essentially meaningless since the important measures are local ones. This is certainly true here where the delinquency measures in some markets are much closer to their longer term averages while other markets have much further to go.

“The one exception is the percentage of loans in foreclosure which, while down somewhat at 4.4 percent, is still much closer to the all-time high of 4.6 percent reached in the fourth quarter of 2010 than the longer-term average of roughly 1.2 percent, despite the drop in delinquencies and foreclosure starts. Here the differences are clearly attributable to local conditions and legal structures. States with non-judicial foreclosure systems are seeing the backlog of foreclosures clear more rapidly and are down to an average rate of 2.8 percent. In contrast, the percentage of loans in foreclosure in the judicial system states has hit an all-time high of 6.8 percent, almost two and a half times higher than rate for non-judicial states.

“Total delinquency rates and foreclosure starts rates fell on a quarter-over-quarter basis for every loan type: prime fixed, prime ARM, subprime fixed and subprime ARM. The one exception was FHA where all delinquency and foreclosure measures were up over the previous quarter. Part of the reason is that the FHA book of business has shown rapid growth, and purchase loans originated in 2008 and 2009 are only now entering the peaks of a normal delinquency curve.

“Finally, the improvements shown in this survey are broad-based geographically, with more than half of the 50 states and DC showing no change or a decline in foreclosure starts and 90+ day delinquencies. California, Florida and Arizona also showed marked improvement in most measures, but Nevada showed a large uptick in 90+ day delinquencies, possibly a sign that new foreclosures are being delayed for various reasons. The concentration of loans in foreclosure is still very much focused in a handful of states with Florida, California, Illinois, New York and New Jersey accounting for over 52 percent of loans in foreclosure in the US, while only making up 32 percent of loans serviced.”

Change from last quarter (third quarter of 2011)

On a seasonally adjusted basis, the overall delinquency rate decreased for all loan types except FHA loans. The seasonally adjusted delinquency rate decreased 20 basis points to 4.12 percent for prime fixed loans and decreased 151 basis points to 9.22 percent for prime ARM loans. For subprime loans, the delinquency rate decreased 157 basis points to 19.67 percent for subprime fixed loans and decreased 267 basis points to 22.40 percent for subprime ARM loans. VA loans also saw a decline, with the delinquency rate decreasing three basis points to 6.55, while the delinquency rate for FHA loans increased 27 basis points to 12.36.

The percent of loans in foreclosure, also known as the foreclosure inventory rate, decreased from last quarter to 4.38 percent. The foreclosure inventory rate for prime fixed loans declined four basis points to 2.52 percent and the rate for prime ARM loans decreased 33 basis points from last quarter to 8.72 percent. For subprime loans, the rate for subprime ARM loans decreased 56 basis points to 22.17 percent and the rate for subprime fixed loans decreased 17 basis points to 10.65. In contrast, the foreclosure inventory rate for FHA loans increased 27 basis points to 3.54 while the rate for VA loans increased 12 basis points to 2.37.

The non-seasonally adjusted foreclosure starts rate decreased seven basis points for prime fixed loans to 0.62 percent, 33 basis points for prime ARM loans to 1.83 percent, 17 basis points for subprime fixed to 2.33 percent and 86 basis points for subprime ARMs to 3.79 percent. The foreclosure starts rate increased 10 basis points for FHA loans to 0.88 percent and four basis points for VA loans to 0.60 percent.

Change from last year (fourth quarter of 2010)

Given the challenges in interpreting the true seasonal effects in these data when comparing quarter to quarter changes, it is important to highlight the year over year changes of the non-seasonally adjusted results.

Compared with the fourth quarter of 2010, the foreclosure inventory rate decreased 150 basis points for prime ARM loans and decreased 15 basis points for prime fixed loans, while the foreclosure inventory rate increased 79 basis points for subprime fixed, 17 basis points for subprime ARM loans, 24 basis points for FHA loans and two basis points for VA loans.

Over the past year, the non-seasonally adjusted foreclosure starts rate decreased 22 basis points for prime fixed loans, 55 basis points for prime ARM loans, 42 basis points for subprime fixed, 45 basis points for subprime ARM loans, 14 basis points for FHA loans and 28 basis points for VA loans.