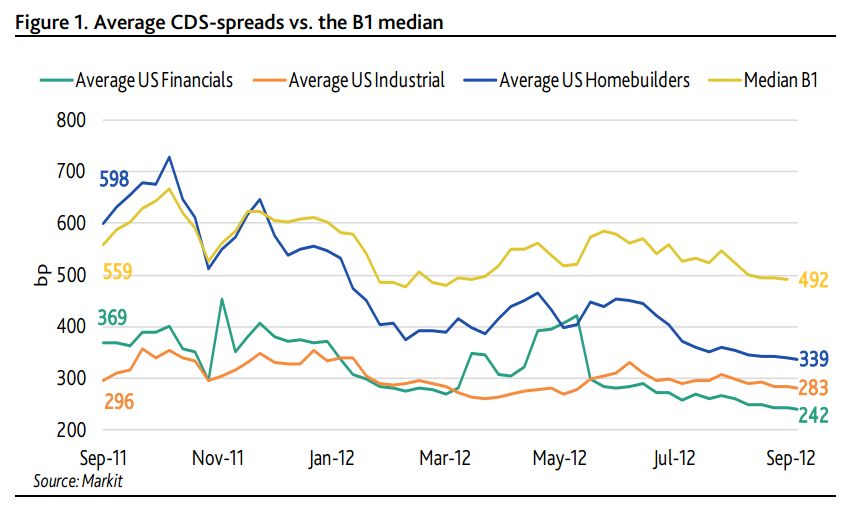

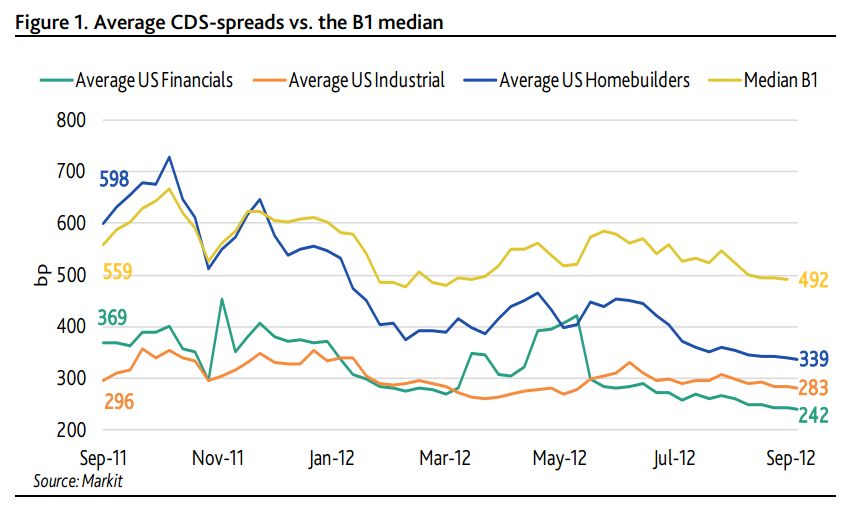

(Moody's) -- Homebuilders’ market signals outperform as the real-estate market shows signs of revival The market responded positively to recent upbeat news in the real estate sector, and all three market-implied ratings progressed significantly for the average homebuilder compared to the same time last year. Encouraged by record-low mortgage rates and cheap home prices, buyers are looking for opportunities again. Rising private home sales and prices have signaled improvement in the sector lately and some industry observers are even calling it a potential bottom. Market signals indicate that investors agree. Compared to the B1 level of a year ago, the average CDS-implied rating for the peer group US homebuilders with market-implied ratings is now two notches higher at Ba2. This widened the average CDS-implied rating gap from 0 to +2 notches. When an implied rating improves, and a positive implied ratings gap widens, the underlying securities have outperformed the broad market. The five-year median CDS spread for this peer group plunged from around 598 bp in September 2011 to 339 bp at present, or 43%, and the CDS-spread for every company in the peer group fell. By contrast the average CDS-spreads for US financials, US industrials, and the median B1 rated companies remained mostly flat (Figure 1). Standard Pacific performed the best in the CDS market last year, its CDS-implied rating improving by four notches, from B3 to Ba2. The other nine companies’ CDS-implied ratings rose between one and three notches. Figure 1. Average CDS-spreads vs. the B1 median

Read full press release from Moody's

Read full press release from Moody's

(Moody's) -- Homebuilders’ market signals outperform as the real-estate market shows signs of revival The market responded positively to recent upbeat news in the real estate sector, and all three market-implied ratings progressed significantly for the average homebuilder compared to the same time last year. Encouraged by record-low mortgage rates and cheap home prices, buyers are looking for opportunities again. Rising private home sales and prices have signaled improvement in the sector lately and some industry observers are even calling it a potential bottom. Market signals indicate that investors agree. Compared to the B1 level of a year ago, the average CDS-implied rating for the peer group US homebuilders with market-implied ratings is now two notches higher at Ba2. This widened the average CDS-implied rating gap from 0 to +2 notches. When an implied rating improves, and a positive implied ratings gap widens, the underlying securities have outperformed the broad market. The five-year median CDS spread for this peer group plunged from around 598 bp in September 2011 to 339 bp at present, or 43%, and the CDS-spread for every company in the peer group fell. By contrast the average CDS-spreads for US financials, US industrials, and the median B1 rated companies remained mostly flat (Figure 1). Standard Pacific performed the best in the CDS market last year, its CDS-implied rating improving by four notches, from B3 to Ba2. The other nine companies’ CDS-implied ratings rose between one and three notches. Figure 1. Average CDS-spreads vs. the B1 median

(Moody's) -- Homebuilders’ market signals outperform as the real-estate market shows signs of revival The market responded positively to recent upbeat news in the real estate sector, and all three market-implied ratings progressed significantly for the average homebuilder compared to the same time last year. Encouraged by record-low mortgage rates and cheap home prices, buyers are looking for opportunities again. Rising private home sales and prices have signaled improvement in the sector lately and some industry observers are even calling it a potential bottom. Market signals indicate that investors agree. Compared to the B1 level of a year ago, the average CDS-implied rating for the peer group US homebuilders with market-implied ratings is now two notches higher at Ba2. This widened the average CDS-implied rating gap from 0 to +2 notches. When an implied rating improves, and a positive implied ratings gap widens, the underlying securities have outperformed the broad market. The five-year median CDS spread for this peer group plunged from around 598 bp in September 2011 to 339 bp at present, or 43%, and the CDS-spread for every company in the peer group fell. By contrast the average CDS-spreads for US financials, US industrials, and the median B1 rated companies remained mostly flat (Figure 1). Standard Pacific performed the best in the CDS market last year, its CDS-implied rating improving by four notches, from B3 to Ba2. The other nine companies’ CDS-implied ratings rose between one and three notches. Figure 1. Average CDS-spreads vs. the B1 median  Read full press release from Moody's

Read full press release from Moody's