"The performance of existing mortgages is exceeding expectations"

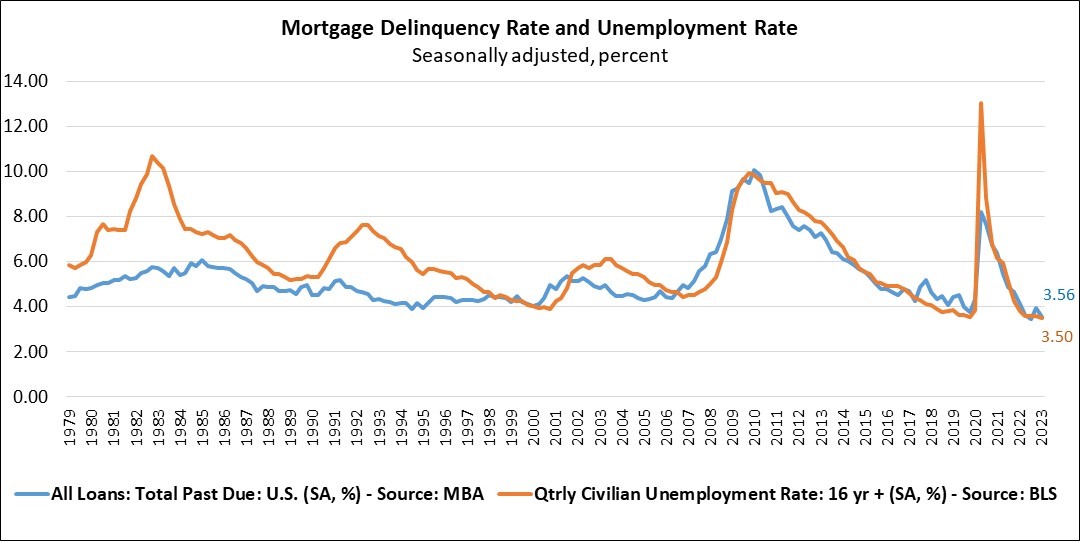

The mortgage delinquency rate decreased to a seasonally adjusted rate of 3.56% in the first quarter of 2023, the Mortgage Bankers Association’s new survey revealed.

The delinquency rate for mortgage loans on one-to-four-unit residential properties fell 40 basis points quarter over quarter and down 55 basis points year over year. The share of loans on which foreclosure actions were started was up two basis points to 0.16% in Q1.

“The mortgage delinquency rate fell to its lowest level for any first quarter since MBA’s survey began in 1979 and was the second lowest quarterly rate overall, just 11 basis points above the survey low in the third quarter of 2022,” said Marina Walsh, vice president of industry analysis at MBA. “Mortgage delinquencies and the unemployment rate continue to track each other closely, with the unemployment rate in April falling back to the 54-year low of 3.4% set in January.”

MBA expects an economic slowdown and increase in unemployment later this year and into 2024.

“Consistent with the resilient job market, the performance of existing mortgages is exceeding expectations,” Walsh said. “Across all states, there was an improvement in the first quarter compared to one year ago. Year-over-year delinquencies for all product types – FHA, VA, and conventional – were also down.”

By loan type, the total delinquency rate for conventional loans fell 34 basis points to 2.44% over the previous quarter. The FHA delinquency rate plunged 134 basis points to 9.27%, and the VA delinquency rate dropped by 18 basis points to 3.98% quarter over quarter.

Additionally, Walsh noted that the end of COVID-19 forbearance programs means some distressed borrowers may still be offered different forbearance and loss mitigation options.

Want to make your inbox flourish with mortgage-focused news content? Get exclusive interviews, breaking news, industry events in your inbox, and always be the first to know by subscribing to our FREE daily newsletter.