New study shows lack of protection despite rising risk

(1).jpg)

Most American owner-occupier homes are covered by homeowner insurance (91%) but most homeowners are shunning the protection of flood insurance.

A survey from ValuePenguin, which is now part of LendingTree, found that just 7% of homeowners are covered by flood insurance. That’s despite almost three-quarters of respondents saying they think destructive weather events including hurricanes are getting worse; and 40% having been impacted by a weather event that forced them to evacuate their house or caused damage.

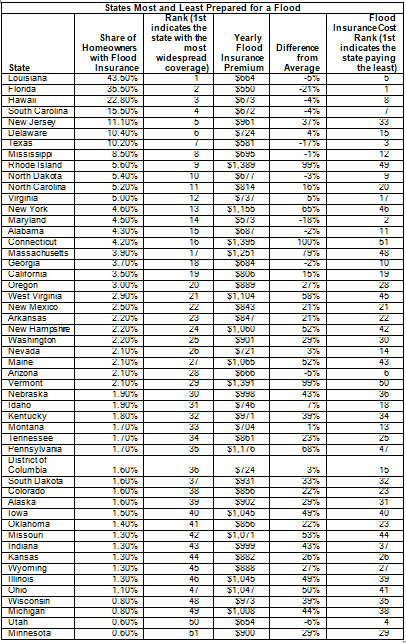

The average cost of a flood insurance policy through the National Flood Insurance Program (NFIP) is $699 per year, but there are large differences in premiums across the country.

Floridians pay the least at $550, 21% below the average, but the state has the second widest coverage of flood insurance with 35.5% of homeowners covered.

Louisiana has the highest share of homeowners covered by flood insurance (43.5%) and the fifth lowest premiums ($664).

At the other end of the scale, Connecticut, Rhode Island, Vermont, Massachusetts, and Pennsylvania, have premiums of between 69-100% above the national average.

The states with the lowest rate of coverage are Minnesota (0.6%), Utah (0.6%), Michigan (0.8%), Wisconsin (0.8%), and Ohio (1.1%).