Record high-interest rates "drastically cut" into the number of pending home sales

Pending home sales posted the second-lowest monthly reading in two decades amid a high-interest-rate environment, according to the National Association of REALTORS.

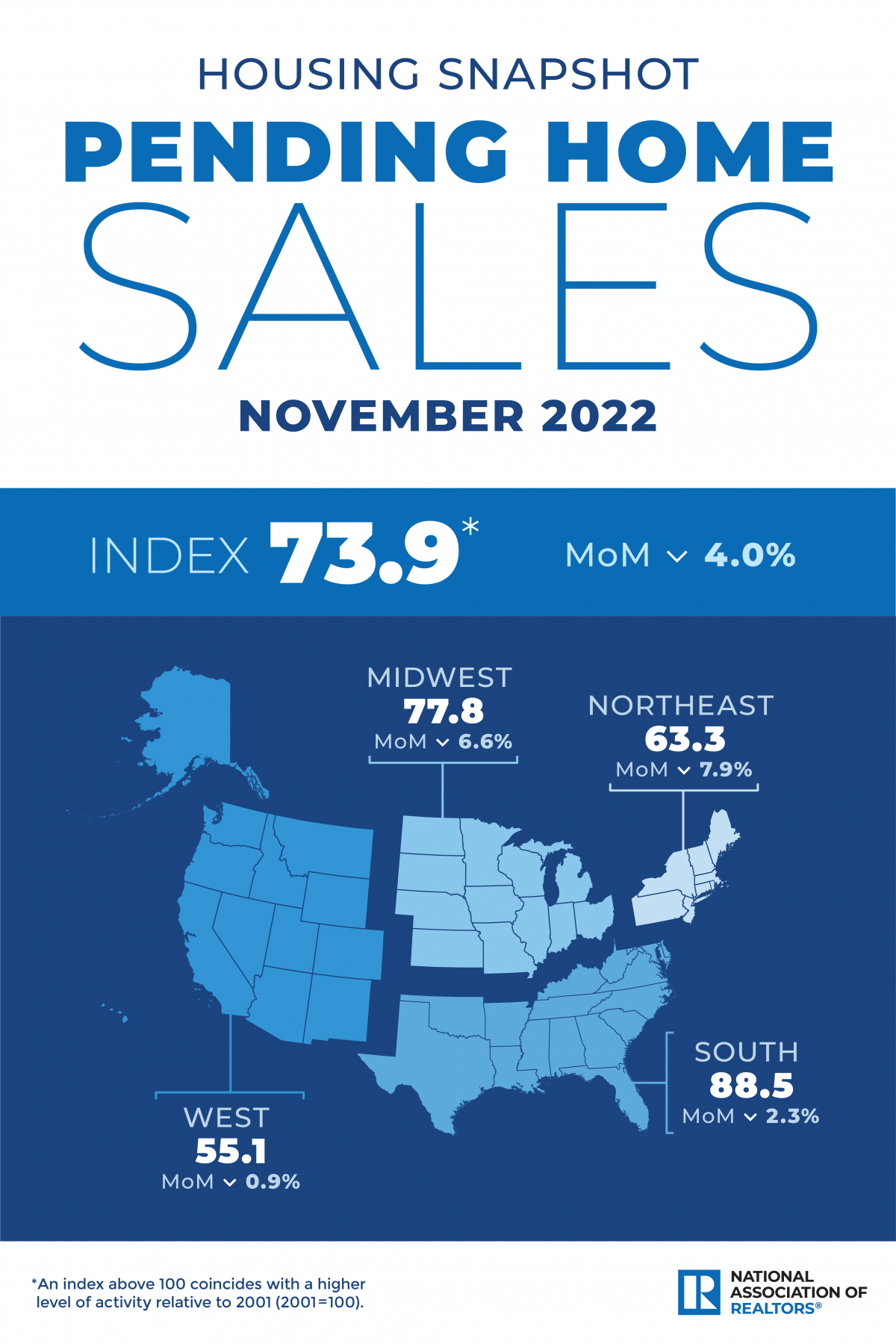

NAR’s Pending Home Sales Index (PHSI) – a forward-looking indicator of home sales based on contract signings – fell 4% for the sixth straight month to 73.9 in November. Compared to November 2021, contract activity levels were down by 37.8%.

“Pending home sales recorded the second-lowest monthly reading in 20 years as interest rates, which climbed at one of the fastest paces on record this year, drastically cut into the number of contract signings to buy a home,” said NAR chief economist Lawrence Yun. “Falling home sales and construction have hurt broader economic activity.

“The residential investment component of GDP has fallen for six straight quarters. There are approximately two months of lag time between mortgage rates and home sales. With mortgage rates falling throughout December, home-buying activity should inevitably rebound in the coming months and help economic growth.”

According to NAR, all four regions recorded annual and monthly decreases. The Northeast PHSI plunged 7.9% month over month to 63.3, a decline of 34.9% from November 2021. The Midwest index decreased 6.6% to 77.8 in November, a decline of 31.6% from one year ago. The South PHSI dropped 2.3% to 88.5 in November, down 38.5% from the prior year. The West index dipped by 0.9% in November to 55.1, down 45.7% from November 2021.

“The Midwest region — with relatively affordable home prices — has held up better, while the unaffordable West region suffered the largest decline in activity,” Yun said.

Want to make your inbox flourish with mortgage-focused news content? Subscribe to our FREE daily newsletter to receive well-curated articles and industry trends in your email, and always be the first to know.