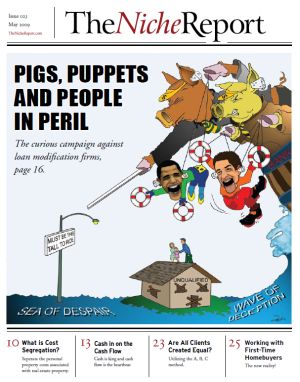

The Curious Campaign Against Loan Modification Firms

So, apparently we’ve got quite the foreclosure problem going on in this country. It’s true. It seems that a whole bunch of people bought homes they couldn’t afford for too much money and now they’re having trouble making their mortgage payments. Dummies. What were they thinking? Didn’t they see that The Great Depression Part 2 was just around the corner?

So, apparently we’ve got quite the foreclosure problem going on in this country. It’s true. It seems that a whole bunch of people bought homes they couldn’t afford for too much money and now they’re having trouble making their mortgage payments. Dummies. What were they thinking? Didn’t they see that The Great Depression Part 2 was just around the corner?

No need to worry though because our government has it handled. That’s right, President Obama, with the help of Treasury Secretary Tim Geithner and FDIC Chair Sheila Bair, showed up, carefully analyzed the problem, and fixed it just like that. Apparently, all troubled homeowners have to do is call a toll-free number and the government pretty much takes it from there. You can even find out if you qualify by clicking a couple of boxes on a Website. Isn’t the new technology fabulous?

Oh yeah, and the best part is… it’s all free! That’s right, President Obama says, even if we can’t refinance our mortgages, we can simply have them modified, and we shouldn’t even have to pay for a loan modification. Well, when President Obama says “free” he means about $300 billion, but that’s pretty close to free, right? Everything’s relative, as my mother used to say. I suppose President Obama considers bailing out the banks to be “reasonably priced”. So, relative to that, $300 billion is pretty much “free”. A “rounding error,” as accountants like to say.

Even if you don’t qualify for the president’s program, you don’t have to worry… the president said that all you have to do is call your bank directly and tell them you need help. I guess now, when you call your bank the electronic voice says: “Press ‘5’ if you’d like us to lower the amount you owe us. Press ‘6’ if your monthly payments are too high. Press ‘7’ if you’d like us to forget the whole thing.”

Wow… that’s change all right, but I’m not sure it’s the kind I can believe in. Why? Because it’s utter nonsense. Horsepucky. Absolute fiction. I’ve been telling people this for the past month or so, ever since I started spending my days calling banks and filming others as they try to do the same, and frankly, I’m tired of it. Call the government’s toll-free number yourself, and after that, give your bank a call and let me know how that goes. I’ll wait…

So, how’d it go? Not so well? Really, how so? You don’t mean to tell me that your bank hung up on you and the toll-free number was answered in India? Come on… really? That’s hard to believe.

Actually, it’s not. That’s exactly what happened to me when I called the oh-so-helpful Help Line, and I’ve had three banks hang up on me in the last two weeks, although I will admit that I do enjoy a smidgeon of sarcasm at times. Like when I asked my bank if they had any information on President Obama’s loan modification plan and they said no. I think I asked if they’d checked today’s mail. I wasn’t trying to be smart, it was just that the president had said I could call my bank directly almost two months before, so I thought maybe… oh, never mind.

I voted for Barack Obama because I believed him to be both smart and honest. So, imagine my disappointment at how he decided to fix the foreclosure crisis in this country: By rolling out a plan designed to help people mildly annoyed by their mortgage payments, while actively campaigning against the use of private sector loan modification firms.

So now, having given up on “smart,” I’m just praying for “honest”.

“If you have to pay, walk away.”

President Obama’s curious campaign against private sector loan modification firms began in earnest with that statement during his speech introducing his Affordability & Stability Plan back in February. Everyone clapped. “Yea! We don’t have to pay!” Everyone loves free stuff.

Somewhere along the line the president decided that the private sector firms that have been helping tens of thousands of troubled homeowners get their loans modified were just a bunch of scammers. At the time, I was in the middle of filming interviews with troubled homeowners who were all telling me how they had saved their homes by hiring private sector loan modification firms, so imagine my surprise to hear that the homeowners that I had been interviewing were lying. It was quite a shock, let me tell you.

Tabloid news shows leapt into action with shows profiling scams that had ripped off homeowners. And state regulatory agencies, such as the Departments of Real Estate, Corporations and even the State Bar Associations appeared all too happy to accept the idea that the firms offering to help homeowners obtain loan modifications were all fraudulent because they charged an upfront fee.

First of all, charging upfront for services has never been such a bad thing in this country. Charging upfront and not delivering was a bad thing, but just the charging part… not so much. And charging an upfront fee is the only way anyone would ever offer to assist someone with a loan modification, because once the mortgage was modified, the firm would have no assurance that the homeowner would pay the bill and essentially no recourse if the homeowner chose not to. Threaten to ruin the homeowner’s credit? Funny. Small claims court? Sure, if you’re interested in receiving payments of $25 a month.

How many scams in a torrent…

The California Department of Real Estate, in an interview with National Public Radio, said they were investigating 250 cases of fraud related to loan modifications, but in a state of 36 million people, and housing prices that have dropped by 30-40%, that number could only be considered endemic the way Y2K was an emergency. There had to be more than that, I reasoned, so I set out to find them.

On April 6, 2009, after Secretary Geithner and Attorney General Holder had their little moment in the sun while “Dad” was vacationing in Europe, the Associated Press reported the following:

“The Federal Trade Commission has sent warning letters to 71 companies it says were running suspicious advertisements and has filed five new civil cases to halt illegal loan modification scams.” Then, Holder went on to say: “The FBI is investigating about 2,100 mortgage fraud cases.”

Ah hah! 2,100 cases is a fair amount of cases, it seemed to me at the time. But, when I went to the FBI’s Website I found that “mortgage fraud,” has almost nothing to do with loan modification fraud. It seems that Holder wanted a number that was larger than 71, so he grabbed the 2100 from the FBI and ran. Now, you can call that whatever you want, but I was taught that what Holder did is called “lying”. Either that, or he didn’t know that “mortgage fraud,” isn’t the same thing as “loan modification fraud”.

The same AP article went on to report:

There’s also been plenty of state action in running down companies engaged in fraud. Illinois Attorney General Lisa Madigan filed two lawsuits recently against alleged Chicago-area mortgage rescue scams. “We have repeatedly found that these operations are swindling desperate homeowners out of money they can’t afford to lose,” Madigan said in a release.

“Plenty of state action”? And, “repeatedly”? Well I guess two is repeatedly, so never mind that one. Two in Illinois? Two foreclosure scams in Illinois. For God’s sake, aren’t there are more than two Illinois governors in prison in Illinois.

I want to get the bad guys too. Keep Guantanamo open just for them, as far as I’m concerned. But there are millions of Americans losing their homes to foreclosure. If there is a “flood” or “torrent” of loan modification scams, then there should be tens of thousands of people being defrauded by said scams. Not 11… 71… 5… and 2.

Meanwhile, back in Realityland... private sector loan modification firms throughout the country were busy earning fair compensation helping consumers get their loans modified so they could avoid foreclosure. One such firm that I interviewed, succeed in modifying 600 mortgages for distressed homeowners in April. Unfortunately, they did charge a fee for every one of them, so it goes without saying that they're a scam and should be shut down in favor of a government program?

The fact is, to-date, private sector loan modification companies are the only ones with any significant track record of success modifying mortgages on behalf of homeowners. The government programs have thus far proven themselves spectacular failures. The $320 billion Hope-4-Homeowners program, which was signed into existence by President Bush last July 30th, managed to modify just one mortgage. And that would be funny for all kinds of reasons, if it wasn’t so monumentally sad.

(I’m assuming we’ve still got most of the $320 billion left though, right? I wonder if the Treasury Department will tell me if I call and ask them.)

Okay, enough… I’m done joking around…

Ever since it began in late 2006, our government has mishandled the housing meltdown at virtually every turn. Claiming that loan modification firms are all “scams,” just because they charge an upfront fee, is only our government’s latest attempt to demonstrate how out-of-touch they really are.

Millions of people have been or are being affected. Hundreds of thousands of children will already grow up with the scars of losing homes in their youth. And no one is doing anything substantive to stop it. The programs so far are like watching someone remove sand from the beach with a small bucket. The only exception is the private sector… the ones who charge a fee… the “scams,” according to the president.

President Obama’s housing rescue plan isn’t even designed to help homeowners at risk of foreclosure. FDIC Chair, Sheila Bair, talking with ABC News in February, admitted that the President's plan would do little if anything to help those at the greatest risk of foreclosure, and without helping these folks, our economic problems are certain to continue unabated.

“Bair also said that the (program’s) huge expenditure won’t halt an avalanche of foreclosures, conceding that there are millions of homeowners that are now so far ‘underwater’ – their homes now worth less than their mortgages – that they will inevitably lose their homes.” ABC.com

What should the people who don’t qualify for the president’s plan do? Why, call their banks directly, of course. Inexplicably, the president feels certain that your bank will be all too willing to help you by reducing the amount of money you rightfully owe them. Why do you suppose President Obama would think that? I think it’s safe to assume that he personally has never actually tried to call a bank to ask for a mortgage modification. Did he ask Treasury about it?

You can ask anyone involved in obtaining a loan modification on behalf of a client and you’ll learn that the banks don’t like negotiating with third parties, and law firm third parties even less. “They refuse to acknowledge my representation of my clients all the time,” say Brian Columbana, an attorney at Mortgage Relief Center in Irvine, California.

“I send them a form telling them that a borrower has retained my firm to represent them and that they are not to contact my client… but they routinely ignore it,” Columbana says. “I’ve had numerous instances where banks called my clients to tell them that they don’t need to pay me, that they shouldn’t have hired me, that they could have used the money to pay them.”

In doing the research for this article, I filmed several loan modification firms in action. On one call, the firm’s representative was told that he had to have the borrower on the call and when he connected the borrower, the bank representative told the borrower “you don’t have to pay him”. I was shocked and interrupted the call, asking how she knew that “he” was being paid in the first place. The bank’s representative abruptly hung up the call to avoid answering my question.

The banks have proven that they don’t want to negotiate with an expert who is representing a homeowner. Chase’s message says: “Chase always works directly with our customers to offer the best solutions for your needs. Be cautious of any third parties who offer to help you obtain a loan modification and charge fees for their services.” Call Chase yourself at 800-446-8939. I got a mortgage from Chase once. I don’t remember them having a similar message cautioning me about third party mortgage brokers.

Telling me that I don’t need anyone representing me when attempting to get my bank to modifying my mortgage seems a lot like the police telling me that I don’t need a lawyer after I’ve been arrested because if I have any legal questions I can just ask the District Attorney. Gosh, thanks for that, but I think I’d prefer someone on my side of the table anyway, if it’s all the same to you.

So, how did the administration come to believe that there are so many loan modification scams in the first place? Here’s something that might have started the ball rolling:

The Washington Post, April 2009:

According to the Treasury Department’s Financial Crimes Enforcement Network, financial institutions filed an estimated 65,049 suspicious activity reports from 2007 through 2008, a 30% jump from 2006.

Did they now? Suspicious Activity Reports are known by the acronym “SARS” and they’re the kind of reports banks file with Treasury when they suspect money laundering or terrorist funding. Do you suppose that money laundering and terrorist funding had a 30% increase between 2006 and 2007? No kidding. I hadn’t heard.

Do you suppose that SARS forms (FinCEN Form 109) could be used to report loan modification firms? It is a wild coincidence, don’t you think? A 30% increase over 2006… the same year more loan modifications were being requested by all those fee-charging, obviously FRAUDULENT loan modification firms? Spooky.

I asked a bank insider why a bank would file a SARS report on a loan modification firm. His response: “It would have to be vindictive.”

I looked at the form and section ‘18’ asks for the category of crime suspected. There are four options: Money Laundering, Terrorist Funding, Structuring d. Other (Please explain) ____________. There’s no loan modification box, but there is room for “other”. That blank is certainly where I would have put something, if using the form for something it wasn’t intended for, wouldn’t you?

It still doesn’t prove it though. How could I know for sure, unless I could see an actual SARS filed against a loan modification firm, and that’s impossible. Maybe not… here’s what I found on FinCEN’s Website. Apparently, they found it necessary to send out an advisory to all of the banks on April 6, 2009:

In order to assist law enforcement in its efforts to target this type of fraudulent activity, we request that, if financial institutions become aware of this type of activity, they include the term "foreclosure rescue scam" in the narrative portions of all relevant Suspicious Activity Reports filed.

That’s what you call a “gotcha’ moment”. Treasury needed to issue the advisory so the banks would know how to use the form when using it to report a suspected loan modification scam… because apparently they didn’t want it listed under “Other” in section 18 on page one. The “narrative portions” are on page three. Well, at least the advisory Treasury sent out on April 6th straightened that out. Problem solved.

I’m confused. I thought fraudulent loan modification firms were taking money and delivering nothing in return. If they were scammers delivering nothing in return, why would the banks have the opportunity to file a Suspicious Activity Report about them? I guess maybe they’re the kind of scammers that, before they abscond with your cash, they first go through the headache and hassle of actually trying to get your loan modified… and then they take your hard earned cash and go to Brazil.

Now, does that make any sense at all to anyone?

So, it’s clear what has happened here, right? The banks didn’t like paid professionals helping homeowners because they’d get more for their clients than the banks would give to a nervous amateur. The banks don’t have skilled loan modification departments because they’ve never wanted to do loan modifications in the first place. So, they started using SARS reports to report loan modification firms. And no one knew because SARS reports report terrorist funding and money laundering, which are not the kind of crimes where the accused gets contacted before an investigation is conducted.

Private Sector Loan Modification Firms Under Fire…

Stop for a moment to consider why, with the president and countless others telling homeowners not to pay someone to help with a loan modification, are tens of thousands of homeowners still doing it every day? Don’t these people watch television?

According to Greg Feldman, Managing Partner of Feldman Law Center in Irvine, California, a firm that handles loan modifications for a fee, “Homeowners are smarter than the government gives them credit for. The vast majority of the homeowners that come to us for help have already tried for months to get help from government programs and their lenders. It didn’t work, so they came to us.”

Since the beginning of this year, Feldman has completed 712 mortgage modifications, an average of 178 per month. That’s 712 families that didn’t lose their homes since January 1, 2009, well over 1,000 children that weren’t forced to leave the safety of their bedrooms as a result of services Feldman provides.

Gary Erickson, Founder of Green Credit Law Center, also in Southern California confirms what Feldman says about homeowners. “Of course people know they can do it themselves. They know they can call a government help line. They know they can call their bank… and they do all of those things all the time. But when months have gone by and they’re still getting nowhere they call us, because their home is on the line. We’ve helped modify well over a thousand loans since the first of the year,” Erickson, a former Navy Capitan, says with more than a little pride in his voice. “And yet, the government still wrongfully intimates we’re doing something wrong.”

Cheryl Beckham, a homeowner from Moreno Valley, California, one of the areas hardest hit by the mortgage meltdown, tried everything she could think of before a friend suggested she call Green Credit.

“I called HUD, the government program, for five months, but no one ever called me back,” Cheryl explains. “Then I tried my lender, Chase. So, I was calling and calling and they said my loan modification was in process, but after three months nothing ever happened. My mortgage was going to adjust again, and I knew I wouldn’t be able to pay it. So, I called a friend and he suggested I call Green Credit. They were so much nicer than Chase. And less than six weeks later that they got it done. They got my payment to where it was before it started going up, and it’s a fixed loan, which is what I wanted.”

The Mota Family, from Menefee, California, had a similar story. They purchased a home for $445, 000 using an adjustable rate mortgage. One year later, the payment very near doubled and the home’s value was cut almost in half, so Washington Mutual told them that refinancing was out of the question.

Mrs. Mota was upset by the way their bank repeatedly treated her and her husband. “It was like they would laugh at us, they hung up on us, they just kept saying that if we didn’t make our payments they were going to put us out on the street. It was so stressful. I couldn’t sleep. I was crying all the time. Then I heard an ad on the radio for Green Credit, and I said… what the heck… and we called them. They got our payment down to $800 a month. From $4,000 to $800! Then it goes up a little each year, but it caps out at $1900 a month, which we can handle no problem.”

I’ve personally interviewed twenty reputable loan modification firms for this article. All of them told me stories of how banks treat homeowners who retain their services. I interviewed homeowners too. And they told me the same things the lawyers and company executives did. Not one inconsistency between any of them. If there was any question in my mind before I began, there certainly wasn’t when I was done.

Tim McFarlin of McFarlin and Geurts… Bryan Malickson of United Legal Services in Maryland, both trusted me enough to send me information even though we’ve never met. And the same is true about Barb Weidner and Roie Raitses of 1st Foreclosure Prevention, which is in Huntington Valley, Pennsylvania. Barb and Roie went so far out of their way to help me get the information I needed, that at one point they stayed at their offices on the phone with me until nearly midnight. And they authorized me to quote them and list them in this article. Are there scammers that do things like that? I wouldn’t think so.

There are but three possibilities for troubled homeowners who want to stay in their homes…

1. The President’s Plan… No need to discuss this. Whomever it helps, it helps. I’ll be keeping score, by the way. Oh yeah, and even though it’s free, it also costs American Taxpayers $300 billion.

2. Homeowners Call Banks Directly – Hasn’t worked, will not work. 50% re-default. Like asking a Tiger to play nicely with a gazelle.

3. Private Sector Loan Modification Firms – Costs the taxpayers nothing… zero. Proven effective for homeowners. Banks don’t like it but who cares?

Our economy cannot recover until we stabilize our housing markets. President Obama has created a fund of $50 billion that is to be paid to banks for modifying mortgages. Let’s start keeping score. Let’s know the real numbers. And let’s put the bad guys in jail. But shouldn’t the people that prove themselves most effective that should be compensated with federal funds. Right now, that’s the private sector loan modification industry, sure as I’m writing these last words.

To those in congress, in the administration… President Obama… all I can say to you is: See you in D.C. I’m coming. We need to talk.

Martin Andelman is the feature columnist on ML-Implode.com, the country’s leading watchdog and news site covering the economic meltdown and mortgage crisis. You can find him blogging at: http://www.ML-Implode.com… Look for the box at the top that says: Mandelman Matters. He promises to respond to every comment or email he receives.