At the end of the first quarter, 18.8% of American homeowners were underwater. Meanwhile, investors searching for higher yields are cooling on stocks and rushing into some of the riskiest corporate bonds. All this and more in today's rate snapshot

Another day with no direct data to think about. In early trade this morning the stock indexes were unchanged and treasury and MBS prices also about unchanged at 9:00. Yesterday’s volume of trading was one of the lowest in a long time with nothing to drive trades. At 9:30 the DJIA opened -12, NASDAQ -3, S&P -1; 10 yr 2.54% unch and 30 yr MBS price +2 bp.

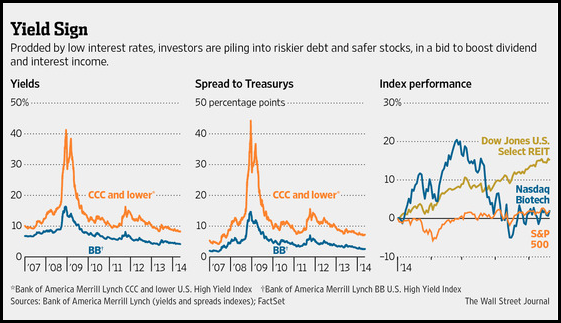

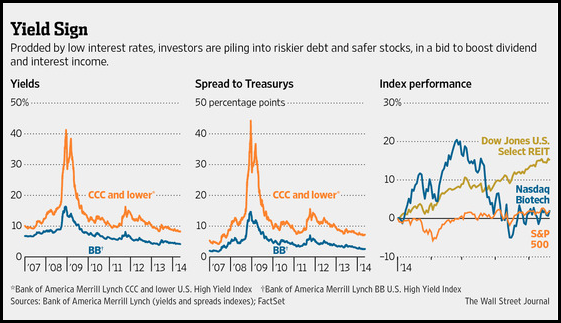

It is a rush for yield these days as investors cool a little on stocks and search for higher yields. Rushing into the riskiest corporate bonds, frustrated by low interest rates on safer investments and convinced that even companies with shaky finances are in little danger of default. One sign of that rush: Investors have been buying up corporate bonds with a triple-C rating, a grade that analysts and investors consider highly speculative. That buying is driving up prices on those bonds and pushing down their yields, which this month fell to 8.187% on a closely watched Bank of America Merrill Lynch index—the lowest level on record. The idea is to buy risky bonds while looking for safer stocks; the logic is difficult to rationalize but it is what is happening. Shunning treasuries and MBSs for low grade corporates and at the same time not willing to buy stocks that appear to be soft. The thinking is that even with stocks soft corporate debt will be repaid.

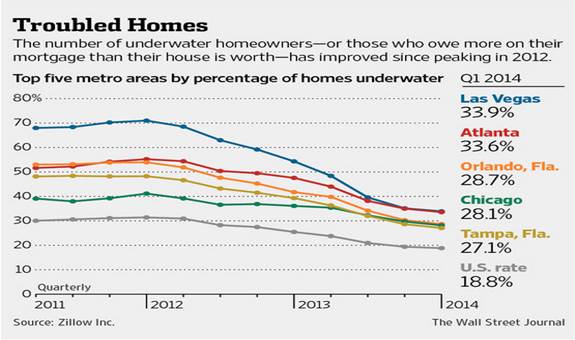

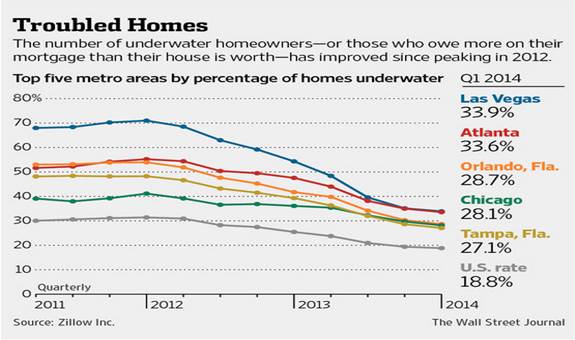

The question for the moment is, are interest rates declining because of a softening of the economic outlook, or because of geo-political events in Ukraine----or both? It is both, and until the Sunday election and the resultant impact that could lead into a civil war in the country Ukraine/Russia will keep a bid in the rate markets but not as much as was the case three weeks ago. It is more the uncertainty about the economic growth prospects that is keeping the equity markets frm improving and investors beginning to back off sizeable stock portfolios. The elephant in the room is the housing sector that has defied most analysts that were confident housing would do what it has always done in the past, lead the recovery. We may find more clarity Thursday and Friday when April existing and new home sales are reported; current estimates are an increase of 2.1% for existing and +8.6% for new home sales. At the end of the first quarter, some 18.8% of U.S. homeowners with a mortgage—9.7 million households—were "underwater" on their mortgage, according to a report scheduled for release Tuesday by real-estate information site Zillow Inc. In addition to the homeowners who are underwater, roughly 10 million households have 20% or less equity in their homes, which makes it difficult for them to sell their homes without dipping into their savings.

The question for the moment is, are interest rates declining because of a softening of the economic outlook, or because of geo-political events in Ukraine----or both? It is both, and until the Sunday election and the resultant impact that could lead into a civil war in the country Ukraine/Russia will keep a bid in the rate markets but not as much as was the case three weeks ago. It is more the uncertainty about the economic growth prospects that is keeping the equity markets frm improving and investors beginning to back off sizeable stock portfolios. The elephant in the room is the housing sector that has defied most analysts that were confident housing would do what it has always done in the past, lead the recovery. We may find more clarity Thursday and Friday when April existing and new home sales are reported; current estimates are an increase of 2.1% for existing and +8.6% for new home sales. At the end of the first quarter, some 18.8% of U.S. homeowners with a mortgage—9.7 million households—were "underwater" on their mortgage, according to a report scheduled for release Tuesday by real-estate information site Zillow Inc. In addition to the homeowners who are underwater, roughly 10 million households have 20% or less equity in their homes, which makes it difficult for them to sell their homes without dipping into their savings.

Russian troops are pulling back from Ukraine’s border, according to state television in Moscow, as the Russian Prime Minister warned the U.S. and the European Union they risked provoking a new Cold War. Ukraine, NATO and the U.S. all said they see no signs of a pullback so far. Russian state TV reported today that soldiers in three Russian regions bordering Ukraine have started to return to their bases after receiving an order to return to bases. Soldiers are packing and “deciding on routes to come back to their permanent bases,” state TV said. Ion Ukraine “There have been no changes in their deployment,” Ukrainian Foreign Ministry spokesman was cited as saying by Interfax. “The likelihood that Russian authorities are misinforming the whole international community is high.” Not likely that there is any question one way or the other abut a pullback with satellites that can count the hairs on your head.

We are not looking for much change in the bond market again today unless stock indexes fall as they are now doing (10:00). No direct news with traders looking ahead to Thursday and Friday. As the week progresses more will be taking time off for Memorial Day, the first ‘official’ summer holiday. The technicals still hold bullish outlooks for interest rates; to change that view the 10 would need to move up over 2.62%. After the huge rally in the bond markets they had become overbought based on most momentum oscillators, now though those oscillators are no longer in overbought levels and still are bullish when viewed from a wider perspective. With diminished participation this week and nothing to trade on until the housing data on Thursday, we are not expecting much movement in the bond and mortgage markets.

PRICES @ 10:00 AM

10 yr note: +3/32 (9 bp) 2.53% -1 bp

5 yr note: +2/32 (6 bp) 1.53% -2 bp

2 Yr note: +1/32 (3 bp) 0.34% -1 bp

30 yr bond: +4/32 (12 bp) 3.38% -1 bp

Libor Rates: 1 mo 0.148%; 3 mo 0.226%; 6 mo 0.322%; 1 yr 0.534%

30 yr FNMA 4.0 June: @9:30 105.20 +2 bp (-22 bp from 9:30 yesterday) (3.5 June 102.14 unch)

15 yr FNMA 3.0 June: @9:30 103.56 unch (-13 bp from 9:30 yesterday)

30 yr GNMA 4.0 June: @9:30 106.00 +2 bp (-20 bp from 9:30 yesterday)

Dollar/Yen: 101.31 -0.19 yen

Dollar/Euro: $1.3704 -$0.0005

Gold: $1288.40 -$5.40

Crude Oil: $102.32 -$0.29

DJIA: 16,439.17 -72.69

NASDAQ: 4100.44 -25.38

S&P 500: 1877.67 -7.41

10 yr note: +3/32 (9 bp) 2.53% -1 bp

5 yr note: +2/32 (6 bp) 1.53% -2 bp

2 Yr note: +1/32 (3 bp) 0.34% -1 bp

30 yr bond: +4/32 (12 bp) 3.38% -1 bp

Libor Rates: 1 mo 0.148%; 3 mo 0.226%; 6 mo 0.322%; 1 yr 0.534%

30 yr FNMA 4.0 June: @9:30 105.20 +2 bp (-22 bp from 9:30 yesterday) (3.5 June 102.14 unch)

15 yr FNMA 3.0 June: @9:30 103.56 unch (-13 bp from 9:30 yesterday)

30 yr GNMA 4.0 June: @9:30 106.00 +2 bp (-20 bp from 9:30 yesterday)

Dollar/Yen: 101.31 -0.19 yen

Dollar/Euro: $1.3704 -$0.0005

Gold: $1288.40 -$5.40

Crude Oil: $102.32 -$0.29

DJIA: 16,439.17 -72.69

NASDAQ: 4100.44 -25.38

S&P 500: 1877.67 -7.41