[/caption]

[/caption]

(TheNicheReport.com) The financial instruments that brought down Wall Street in 2008 and triggered periods of economic recession around the world are once again capturing the interest of investors. Mortgage bonds backed by subprime home loans were once labeled as toxic assets in the portfolios of investors, but according to a recent report appearing on the Wall Street Journal, the market for subprime bonds is heating up.

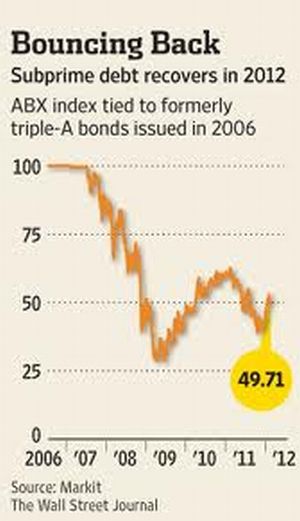

Financial information services provider the Markit Group maintains an index that compiles the values of different subprime mortgage bonds. The ABX index has been rallying since the beginning of the New Year, and portfolio managers are paying close attention to some recent significant transactions. The Federal Reserve Bank of New York, for example, realized a $6 billion profit when it unloaded a substantial amount of subprime bonds it had acquired in the aftermath of bailing out the controversial American Insurance Group (AIG).

[/caption]

[/caption]

The two buyers of those bonds were Goldman Sachs and Credit Suisse Group, two major investment banking firms that were plagued by the subprime mortgage meltdown in 2008. These bonds may seem attractive on the surface, as their yield currently stands between 7 and 9 percent -a bond rate that is currently very hard to find in the United States.

Subprime mortgage bonds are financial instruments tied to home loans extended to borrowers with less-than-desirable credit histories and risky terms. A purchase loan made on a subprime mortgage may not require a down payment, something that often means the homeowner is assuming a residential property with zero or negative equity. The lack of equity isn't the only risk. The paperwork and underwriting required for subprime mortgage applications used to be minimal, the Annual Percentage Rate (APR) of interest tended to be high, and the borrower's ability to repay was questionable at best.

Still, subprime mortgage loans were in high demand by American borrowers in the early part of the 21st century, and Wall Street investors exhibited a healthy appetite by bonds tied to these questionable home loans.

The subprime action may not be limited to Wall Street. The stringent underwriting guidelines imposed by government mortgage agencies Fannie Mae and Freddie Mac in the wake of the bursting of the American housing bubble are beginning to loosen their standards, according to a recent report published in Time magazine. The auto lending industry last year decided to cater to subprime credit customers once again, something that contributed to a considerable rise in car sales. The mortgage lending industry may be following suit, according to some financial analysts.