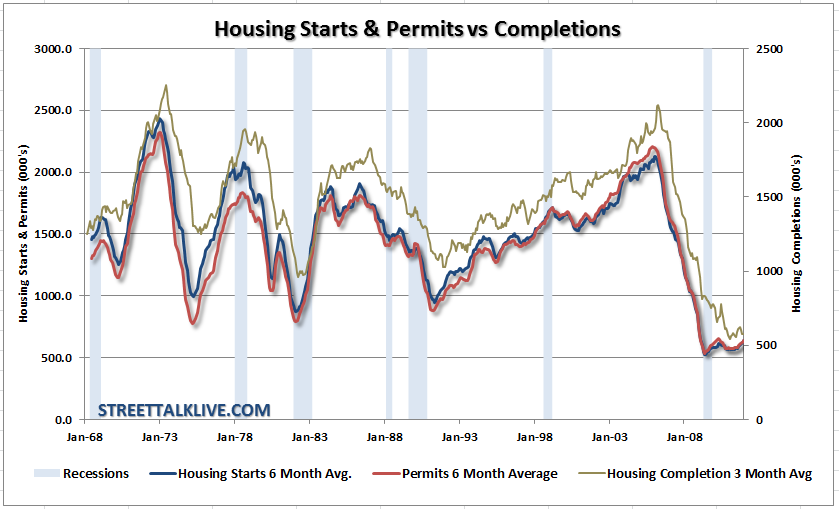

(SOURCE Streettalklive.com)  There has been a deluge of articles recently about the upticks in the housing data. The consensus is that these data points are surely pointing , finally, to a bottom in the depressing decline of real estate. Let me acknowledge that I do not dispute the improvement in the data regarding home starts, permits, pending sales, etc., however, let's be clear that all of these data points are still mired at very depressed levels. So, while optimism is certainly always a welcome thing, for the average American, the world is quite different. (Note: I suggest a review of recent posts on Housing Is Not Affordable and The Margin Effect for more background on why housing is going to be in the trenches much longer than expected) The point I want to specifically address today is home prices. After the past few bloody years of price declines, and repeated calls of a housing bottom each year, 2012 proves to be no different with yet more calls for a bottom. However, why shouldn't there be? Home prices have declined, according to our NAR/Core Logic Composite Index (an average of the two), by a whopping 36%. Interest rates are at their lowest levels ever and you can still get low down payment mortgage if you can qualify. (That last part is a bit tricky though) Therefore, the assumption is that if home building is stabilizing then it is only a function of time until home prices began to rise as well. Right? Not so fast. People Buy Payments - Not Houses When the average American family sits down to discuss buying a home they do not discuss buying a $125,000 house. What they do discuss is what type of house they need such as a three bedroom house with two baths, a two car garage and a yard. That is the dream part. The reality of it smacks them in the face, however, when they start reconciling their monthly budget. Here is a statement I hae not heard discussed by the media. People do not buy houses - they buy a payment. The payment is ultimately what drives how much house they buy. Why is this important? Because it is all about interest rates.

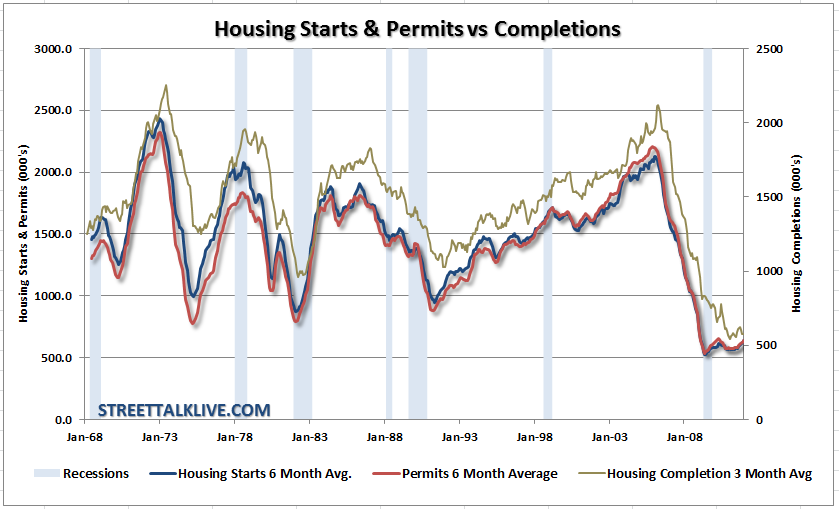

There has been a deluge of articles recently about the upticks in the housing data. The consensus is that these data points are surely pointing , finally, to a bottom in the depressing decline of real estate. Let me acknowledge that I do not dispute the improvement in the data regarding home starts, permits, pending sales, etc., however, let's be clear that all of these data points are still mired at very depressed levels. So, while optimism is certainly always a welcome thing, for the average American, the world is quite different. (Note: I suggest a review of recent posts on Housing Is Not Affordable and The Margin Effect for more background on why housing is going to be in the trenches much longer than expected) The point I want to specifically address today is home prices. After the past few bloody years of price declines, and repeated calls of a housing bottom each year, 2012 proves to be no different with yet more calls for a bottom. However, why shouldn't there be? Home prices have declined, according to our NAR/Core Logic Composite Index (an average of the two), by a whopping 36%. Interest rates are at their lowest levels ever and you can still get low down payment mortgage if you can qualify. (That last part is a bit tricky though) Therefore, the assumption is that if home building is stabilizing then it is only a function of time until home prices began to rise as well. Right? Not so fast. People Buy Payments - Not Houses When the average American family sits down to discuss buying a home they do not discuss buying a $125,000 house. What they do discuss is what type of house they need such as a three bedroom house with two baths, a two car garage and a yard. That is the dream part. The reality of it smacks them in the face, however, when they start reconciling their monthly budget. Here is a statement I hae not heard discussed by the media. People do not buy houses - they buy a payment. The payment is ultimately what drives how much house they buy. Why is this important? Because it is all about interest rates.  Over the last 30 years a big driver of home prices has been the unabated decline of interest rates. When declining interest rates were combined with lax lending standards - home prices soared off the chart. No money down, ultra low interest rates and easy qualification gave individuals the ability to buy much more home for their money. The demand for home ownership, promulgated by the Fed, the finance and real estate industry, drove prices far beyond rational levels. Easy credit terms combined with a plethora of pshychological encouragement from home flipping and house decorating television to direct advertisment of the "dream of homeownership" enticed families to bite off way more than they could ever hope to chew.

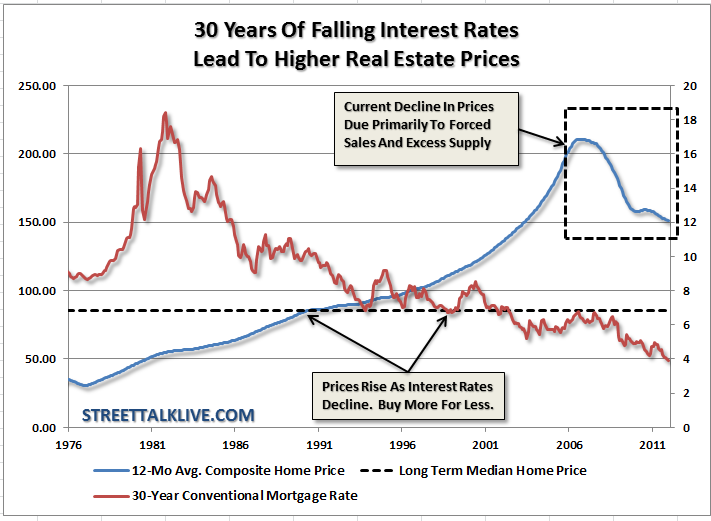

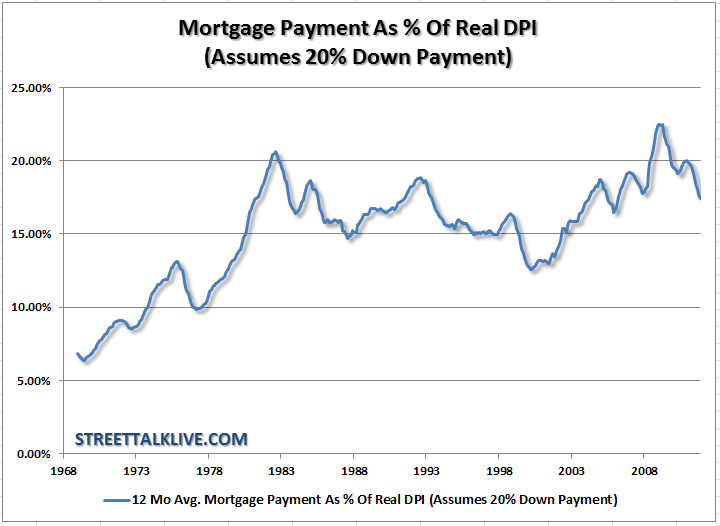

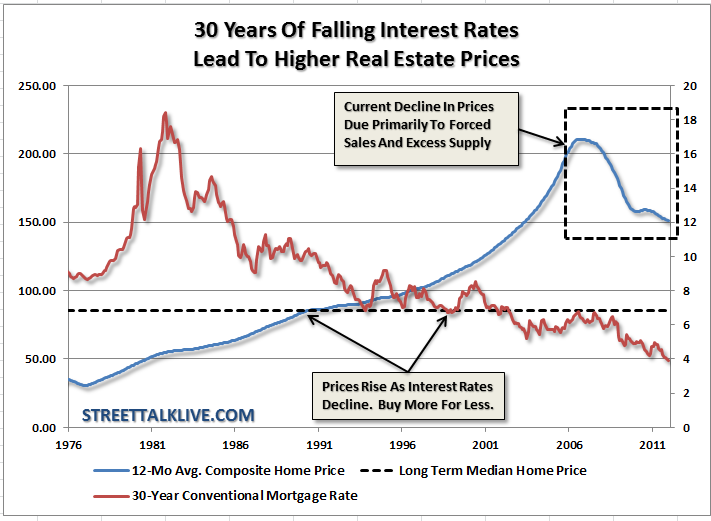

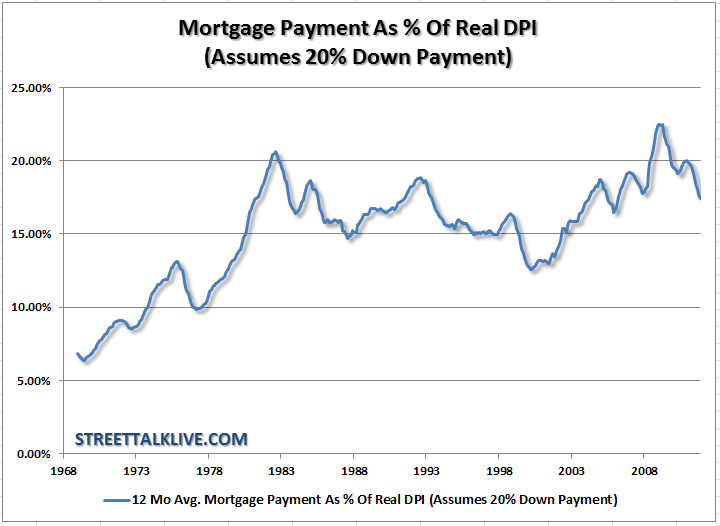

Over the last 30 years a big driver of home prices has been the unabated decline of interest rates. When declining interest rates were combined with lax lending standards - home prices soared off the chart. No money down, ultra low interest rates and easy qualification gave individuals the ability to buy much more home for their money. The demand for home ownership, promulgated by the Fed, the finance and real estate industry, drove prices far beyond rational levels. Easy credit terms combined with a plethora of pshychological encouragement from home flipping and house decorating television to direct advertisment of the "dream of homeownership" enticed families to bite off way more than they could ever hope to chew.  In 1968 the average American family maintained a mortgage payment, as a percent of real disposable personal income (DPI), of about 7%. Back then, in order to buy a home, you were required to have skin in the game with a 20% downpayment. Today, assuming that an individual puts down 20% for a house, their mortgage payment would consume more than 15% of real DPI. In reality, since many of the mortgages done over the last decade required little or no money down, that number is actually substantially higher. You get the point. With real disposable incomes stagnant as inflationary pressures rise that 15% of the budget is becoming much harder to sustain. The decline in home prices so far has largely been due to the intial process of the real estate bust and the deleveraging of the American household balance sheet. According to recent data as much as 2/3rds of the sales completed so far have been distressed in some form or fashion. However, the real potential for declines in price come when interest rates began to rise.

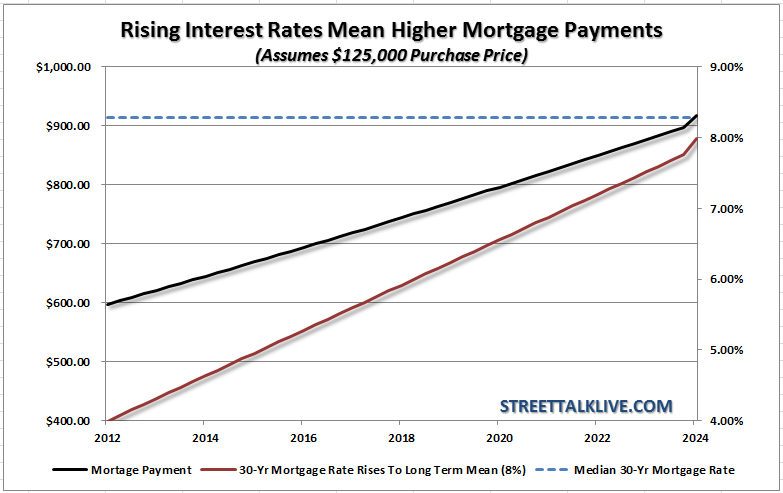

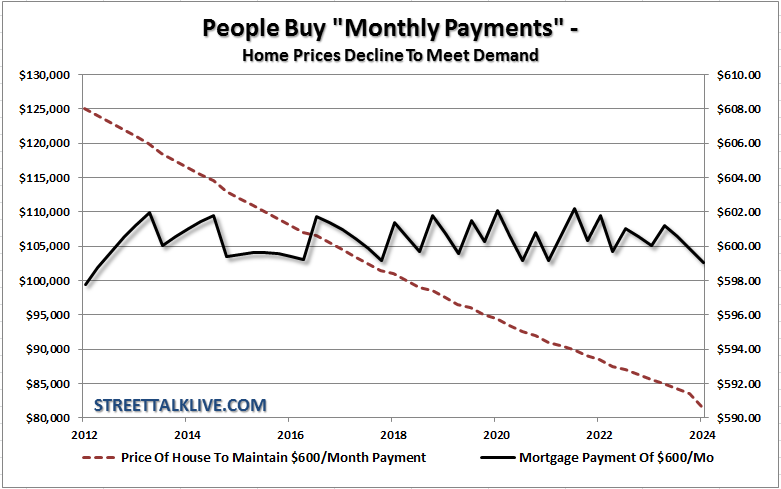

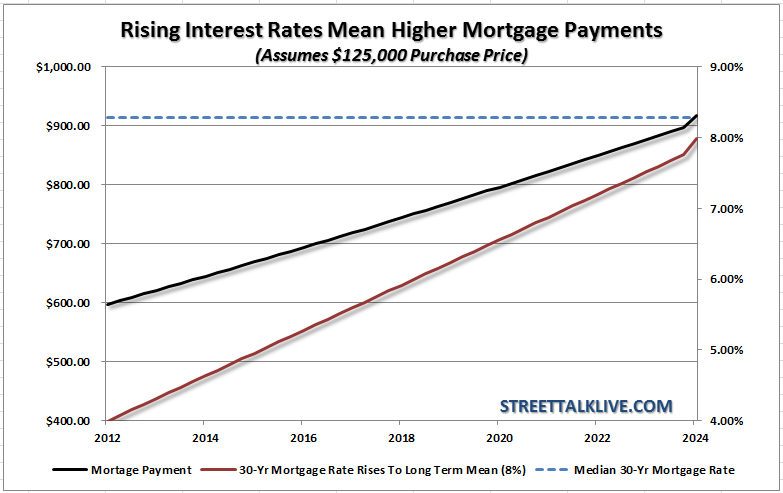

In 1968 the average American family maintained a mortgage payment, as a percent of real disposable personal income (DPI), of about 7%. Back then, in order to buy a home, you were required to have skin in the game with a 20% downpayment. Today, assuming that an individual puts down 20% for a house, their mortgage payment would consume more than 15% of real DPI. In reality, since many of the mortgages done over the last decade required little or no money down, that number is actually substantially higher. You get the point. With real disposable incomes stagnant as inflationary pressures rise that 15% of the budget is becoming much harder to sustain. The decline in home prices so far has largely been due to the intial process of the real estate bust and the deleveraging of the American household balance sheet. According to recent data as much as 2/3rds of the sales completed so far have been distressed in some form or fashion. However, the real potential for declines in price come when interest rates began to rise.  At some point in the future interest rates will begin to rise back towards the long term median of 8.9%. From the current 4% rate that is a substantial rise. However, before you guffaw the idea entirely, let me just remind you that 30-year interest rates were almost 7% in mid-2006. Therefore a rise to the long term median is not entirely out of the question - the only debate will be the timing and the trigger of the event. With this in mind let's review how home buyers are affected. If we assume a stagnant purchase price of $125,000, as interest rates rise from 4% to 8% by 2024 (no particular reason for the date - in 2034 the effect is the same), the cost of the monthly payment for that same priced house rises from $600 a month to more than $900 a month - a 50% increase. However, this is not just a solitary effect. ALL home prices are affected at the margin by those willing and able to buy and those that have "For Sale" signs in their front yard. Therefore, if the average American family living on $55,000 a year sees their monthly mortgage payment rise by 50% this is a VERY big issue. Let's look at this another way. Assume an average American family of four (Ward, June, Wally and The Beaver) are looking for the traditional home with the white picket fence. Since they are the average American family their median family income is approximately $55,000. After taxes, expenses, etc. they realize they can afford roughly a $600 monthly mortgage payment. They contact their realtor and begin shopping for their slice of the "American Dream."

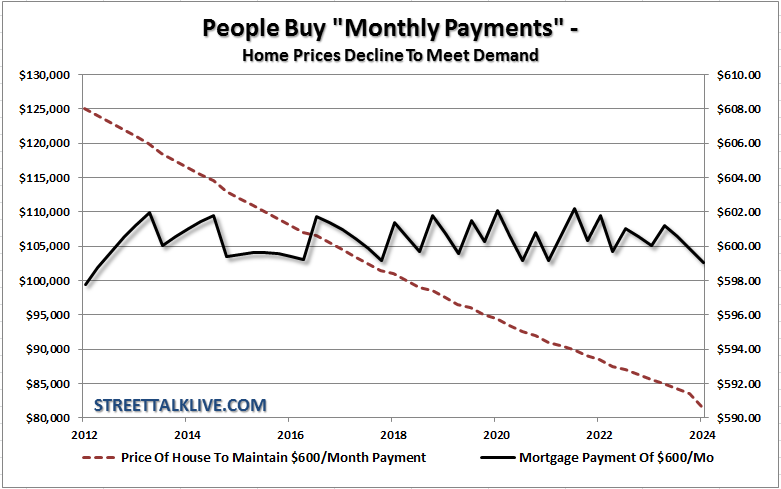

At some point in the future interest rates will begin to rise back towards the long term median of 8.9%. From the current 4% rate that is a substantial rise. However, before you guffaw the idea entirely, let me just remind you that 30-year interest rates were almost 7% in mid-2006. Therefore a rise to the long term median is not entirely out of the question - the only debate will be the timing and the trigger of the event. With this in mind let's review how home buyers are affected. If we assume a stagnant purchase price of $125,000, as interest rates rise from 4% to 8% by 2024 (no particular reason for the date - in 2034 the effect is the same), the cost of the monthly payment for that same priced house rises from $600 a month to more than $900 a month - a 50% increase. However, this is not just a solitary effect. ALL home prices are affected at the margin by those willing and able to buy and those that have "For Sale" signs in their front yard. Therefore, if the average American family living on $55,000 a year sees their monthly mortgage payment rise by 50% this is a VERY big issue. Let's look at this another way. Assume an average American family of four (Ward, June, Wally and The Beaver) are looking for the traditional home with the white picket fence. Since they are the average American family their median family income is approximately $55,000. After taxes, expenses, etc. they realize they can afford roughly a $600 monthly mortgage payment. They contact their realtor and begin shopping for their slice of the "American Dream."  At a 4% interest rate they can afford to purchase a $125,000 home. However, as rates rise that purchasing power quickly diminishes. At 5% they are looking for $111,000 home. As rates rise to 6% it is a $100,000 property and at 7%, just back to 2006 levels mind you, their $600 monthly payment will only purchase a $90,000 shack. See what I mean about interest rates? Since home prices on the whole are affected by those actively willing to sell - the rise of interest rates lead to declines in home prices accross the board as sellers reduce prices to find buyers. Since there are only a limited number of buyers in the pool at any given time the supply / demand curve is critcally affected by the variations in interest rates. This is why the Fed has been so adamant to suppress interest rates at very low levels and have injected trillions of dollars to acheive that goal. They understand the ramifications of rising interest rates, not only on home prices, but also on the $3 Trillion in debt they are currently carrying on their balance sheet. There are basically two possible outcomes from here. First, Ben Bernanke and gang artifically suppress interest rates for a very long period of time creating the "Japan Syndrome" in the U.S. which leads to rolling recessions and a general economic malaise. Or, secondly, interest rates rise back towards more normalized levels as the economy begins a real and lasting recovery. I am really hoping for the later. In either case there is a negative and sustained impact to housing going forward. The excesses that were created over the last 20 years will have to be absorbed into the system allowing prices to return to a more normalized and sustainable level. None of this means that home construction, sales, etc. can't stabilize at these lower levels even as prices revert back to their long term median price. However, stabilization and a recovery, such as the media is currently hoping for, are two vastly different things. We are very early in the entire deleveraging process and until the excesses are removed from the system the real housing bottom may be more elusive than anyone expects. Read Full Article

At a 4% interest rate they can afford to purchase a $125,000 home. However, as rates rise that purchasing power quickly diminishes. At 5% they are looking for $111,000 home. As rates rise to 6% it is a $100,000 property and at 7%, just back to 2006 levels mind you, their $600 monthly payment will only purchase a $90,000 shack. See what I mean about interest rates? Since home prices on the whole are affected by those actively willing to sell - the rise of interest rates lead to declines in home prices accross the board as sellers reduce prices to find buyers. Since there are only a limited number of buyers in the pool at any given time the supply / demand curve is critcally affected by the variations in interest rates. This is why the Fed has been so adamant to suppress interest rates at very low levels and have injected trillions of dollars to acheive that goal. They understand the ramifications of rising interest rates, not only on home prices, but also on the $3 Trillion in debt they are currently carrying on their balance sheet. There are basically two possible outcomes from here. First, Ben Bernanke and gang artifically suppress interest rates for a very long period of time creating the "Japan Syndrome" in the U.S. which leads to rolling recessions and a general economic malaise. Or, secondly, interest rates rise back towards more normalized levels as the economy begins a real and lasting recovery. I am really hoping for the later. In either case there is a negative and sustained impact to housing going forward. The excesses that were created over the last 20 years will have to be absorbed into the system allowing prices to return to a more normalized and sustainable level. None of this means that home construction, sales, etc. can't stabilize at these lower levels even as prices revert back to their long term median price. However, stabilization and a recovery, such as the media is currently hoping for, are two vastly different things. We are very early in the entire deleveraging process and until the excesses are removed from the system the real housing bottom may be more elusive than anyone expects. Read Full Article

There has been a deluge of articles recently about the upticks in the housing data. The consensus is that these data points are surely pointing , finally, to a bottom in the depressing decline of real estate. Let me acknowledge that I do not dispute the improvement in the data regarding home starts, permits, pending sales, etc., however, let's be clear that all of these data points are still mired at very depressed levels. So, while optimism is certainly always a welcome thing, for the average American, the world is quite different. (Note: I suggest a review of recent posts on Housing Is Not Affordable and The Margin Effect for more background on why housing is going to be in the trenches much longer than expected) The point I want to specifically address today is home prices. After the past few bloody years of price declines, and repeated calls of a housing bottom each year, 2012 proves to be no different with yet more calls for a bottom. However, why shouldn't there be? Home prices have declined, according to our NAR/Core Logic Composite Index (an average of the two), by a whopping 36%. Interest rates are at their lowest levels ever and you can still get low down payment mortgage if you can qualify. (That last part is a bit tricky though) Therefore, the assumption is that if home building is stabilizing then it is only a function of time until home prices began to rise as well. Right? Not so fast. People Buy Payments - Not Houses When the average American family sits down to discuss buying a home they do not discuss buying a $125,000 house. What they do discuss is what type of house they need such as a three bedroom house with two baths, a two car garage and a yard. That is the dream part. The reality of it smacks them in the face, however, when they start reconciling their monthly budget. Here is a statement I hae not heard discussed by the media. People do not buy houses - they buy a payment. The payment is ultimately what drives how much house they buy. Why is this important? Because it is all about interest rates.

There has been a deluge of articles recently about the upticks in the housing data. The consensus is that these data points are surely pointing , finally, to a bottom in the depressing decline of real estate. Let me acknowledge that I do not dispute the improvement in the data regarding home starts, permits, pending sales, etc., however, let's be clear that all of these data points are still mired at very depressed levels. So, while optimism is certainly always a welcome thing, for the average American, the world is quite different. (Note: I suggest a review of recent posts on Housing Is Not Affordable and The Margin Effect for more background on why housing is going to be in the trenches much longer than expected) The point I want to specifically address today is home prices. After the past few bloody years of price declines, and repeated calls of a housing bottom each year, 2012 proves to be no different with yet more calls for a bottom. However, why shouldn't there be? Home prices have declined, according to our NAR/Core Logic Composite Index (an average of the two), by a whopping 36%. Interest rates are at their lowest levels ever and you can still get low down payment mortgage if you can qualify. (That last part is a bit tricky though) Therefore, the assumption is that if home building is stabilizing then it is only a function of time until home prices began to rise as well. Right? Not so fast. People Buy Payments - Not Houses When the average American family sits down to discuss buying a home they do not discuss buying a $125,000 house. What they do discuss is what type of house they need such as a three bedroom house with two baths, a two car garage and a yard. That is the dream part. The reality of it smacks them in the face, however, when they start reconciling their monthly budget. Here is a statement I hae not heard discussed by the media. People do not buy houses - they buy a payment. The payment is ultimately what drives how much house they buy. Why is this important? Because it is all about interest rates.  Over the last 30 years a big driver of home prices has been the unabated decline of interest rates. When declining interest rates were combined with lax lending standards - home prices soared off the chart. No money down, ultra low interest rates and easy qualification gave individuals the ability to buy much more home for their money. The demand for home ownership, promulgated by the Fed, the finance and real estate industry, drove prices far beyond rational levels. Easy credit terms combined with a plethora of pshychological encouragement from home flipping and house decorating television to direct advertisment of the "dream of homeownership" enticed families to bite off way more than they could ever hope to chew.

Over the last 30 years a big driver of home prices has been the unabated decline of interest rates. When declining interest rates were combined with lax lending standards - home prices soared off the chart. No money down, ultra low interest rates and easy qualification gave individuals the ability to buy much more home for their money. The demand for home ownership, promulgated by the Fed, the finance and real estate industry, drove prices far beyond rational levels. Easy credit terms combined with a plethora of pshychological encouragement from home flipping and house decorating television to direct advertisment of the "dream of homeownership" enticed families to bite off way more than they could ever hope to chew.  In 1968 the average American family maintained a mortgage payment, as a percent of real disposable personal income (DPI), of about 7%. Back then, in order to buy a home, you were required to have skin in the game with a 20% downpayment. Today, assuming that an individual puts down 20% for a house, their mortgage payment would consume more than 15% of real DPI. In reality, since many of the mortgages done over the last decade required little or no money down, that number is actually substantially higher. You get the point. With real disposable incomes stagnant as inflationary pressures rise that 15% of the budget is becoming much harder to sustain. The decline in home prices so far has largely been due to the intial process of the real estate bust and the deleveraging of the American household balance sheet. According to recent data as much as 2/3rds of the sales completed so far have been distressed in some form or fashion. However, the real potential for declines in price come when interest rates began to rise.

In 1968 the average American family maintained a mortgage payment, as a percent of real disposable personal income (DPI), of about 7%. Back then, in order to buy a home, you were required to have skin in the game with a 20% downpayment. Today, assuming that an individual puts down 20% for a house, their mortgage payment would consume more than 15% of real DPI. In reality, since many of the mortgages done over the last decade required little or no money down, that number is actually substantially higher. You get the point. With real disposable incomes stagnant as inflationary pressures rise that 15% of the budget is becoming much harder to sustain. The decline in home prices so far has largely been due to the intial process of the real estate bust and the deleveraging of the American household balance sheet. According to recent data as much as 2/3rds of the sales completed so far have been distressed in some form or fashion. However, the real potential for declines in price come when interest rates began to rise.  At some point in the future interest rates will begin to rise back towards the long term median of 8.9%. From the current 4% rate that is a substantial rise. However, before you guffaw the idea entirely, let me just remind you that 30-year interest rates were almost 7% in mid-2006. Therefore a rise to the long term median is not entirely out of the question - the only debate will be the timing and the trigger of the event. With this in mind let's review how home buyers are affected. If we assume a stagnant purchase price of $125,000, as interest rates rise from 4% to 8% by 2024 (no particular reason for the date - in 2034 the effect is the same), the cost of the monthly payment for that same priced house rises from $600 a month to more than $900 a month - a 50% increase. However, this is not just a solitary effect. ALL home prices are affected at the margin by those willing and able to buy and those that have "For Sale" signs in their front yard. Therefore, if the average American family living on $55,000 a year sees their monthly mortgage payment rise by 50% this is a VERY big issue. Let's look at this another way. Assume an average American family of four (Ward, June, Wally and The Beaver) are looking for the traditional home with the white picket fence. Since they are the average American family their median family income is approximately $55,000. After taxes, expenses, etc. they realize they can afford roughly a $600 monthly mortgage payment. They contact their realtor and begin shopping for their slice of the "American Dream."

At some point in the future interest rates will begin to rise back towards the long term median of 8.9%. From the current 4% rate that is a substantial rise. However, before you guffaw the idea entirely, let me just remind you that 30-year interest rates were almost 7% in mid-2006. Therefore a rise to the long term median is not entirely out of the question - the only debate will be the timing and the trigger of the event. With this in mind let's review how home buyers are affected. If we assume a stagnant purchase price of $125,000, as interest rates rise from 4% to 8% by 2024 (no particular reason for the date - in 2034 the effect is the same), the cost of the monthly payment for that same priced house rises from $600 a month to more than $900 a month - a 50% increase. However, this is not just a solitary effect. ALL home prices are affected at the margin by those willing and able to buy and those that have "For Sale" signs in their front yard. Therefore, if the average American family living on $55,000 a year sees their monthly mortgage payment rise by 50% this is a VERY big issue. Let's look at this another way. Assume an average American family of four (Ward, June, Wally and The Beaver) are looking for the traditional home with the white picket fence. Since they are the average American family their median family income is approximately $55,000. After taxes, expenses, etc. they realize they can afford roughly a $600 monthly mortgage payment. They contact their realtor and begin shopping for their slice of the "American Dream."  At a 4% interest rate they can afford to purchase a $125,000 home. However, as rates rise that purchasing power quickly diminishes. At 5% they are looking for $111,000 home. As rates rise to 6% it is a $100,000 property and at 7%, just back to 2006 levels mind you, their $600 monthly payment will only purchase a $90,000 shack. See what I mean about interest rates? Since home prices on the whole are affected by those actively willing to sell - the rise of interest rates lead to declines in home prices accross the board as sellers reduce prices to find buyers. Since there are only a limited number of buyers in the pool at any given time the supply / demand curve is critcally affected by the variations in interest rates. This is why the Fed has been so adamant to suppress interest rates at very low levels and have injected trillions of dollars to acheive that goal. They understand the ramifications of rising interest rates, not only on home prices, but also on the $3 Trillion in debt they are currently carrying on their balance sheet. There are basically two possible outcomes from here. First, Ben Bernanke and gang artifically suppress interest rates for a very long period of time creating the "Japan Syndrome" in the U.S. which leads to rolling recessions and a general economic malaise. Or, secondly, interest rates rise back towards more normalized levels as the economy begins a real and lasting recovery. I am really hoping for the later. In either case there is a negative and sustained impact to housing going forward. The excesses that were created over the last 20 years will have to be absorbed into the system allowing prices to return to a more normalized and sustainable level. None of this means that home construction, sales, etc. can't stabilize at these lower levels even as prices revert back to their long term median price. However, stabilization and a recovery, such as the media is currently hoping for, are two vastly different things. We are very early in the entire deleveraging process and until the excesses are removed from the system the real housing bottom may be more elusive than anyone expects. Read Full Article

At a 4% interest rate they can afford to purchase a $125,000 home. However, as rates rise that purchasing power quickly diminishes. At 5% they are looking for $111,000 home. As rates rise to 6% it is a $100,000 property and at 7%, just back to 2006 levels mind you, their $600 monthly payment will only purchase a $90,000 shack. See what I mean about interest rates? Since home prices on the whole are affected by those actively willing to sell - the rise of interest rates lead to declines in home prices accross the board as sellers reduce prices to find buyers. Since there are only a limited number of buyers in the pool at any given time the supply / demand curve is critcally affected by the variations in interest rates. This is why the Fed has been so adamant to suppress interest rates at very low levels and have injected trillions of dollars to acheive that goal. They understand the ramifications of rising interest rates, not only on home prices, but also on the $3 Trillion in debt they are currently carrying on their balance sheet. There are basically two possible outcomes from here. First, Ben Bernanke and gang artifically suppress interest rates for a very long period of time creating the "Japan Syndrome" in the U.S. which leads to rolling recessions and a general economic malaise. Or, secondly, interest rates rise back towards more normalized levels as the economy begins a real and lasting recovery. I am really hoping for the later. In either case there is a negative and sustained impact to housing going forward. The excesses that were created over the last 20 years will have to be absorbed into the system allowing prices to return to a more normalized and sustainable level. None of this means that home construction, sales, etc. can't stabilize at these lower levels even as prices revert back to their long term median price. However, stabilization and a recovery, such as the media is currently hoping for, are two vastly different things. We are very early in the entire deleveraging process and until the excesses are removed from the system the real housing bottom may be more elusive than anyone expects. Read Full Article