Executives take on expanded roles

Peachtree Group, an investment company focused on commercial real estate, has promoted three senior team members, strengthening the firm’s leadership structure.

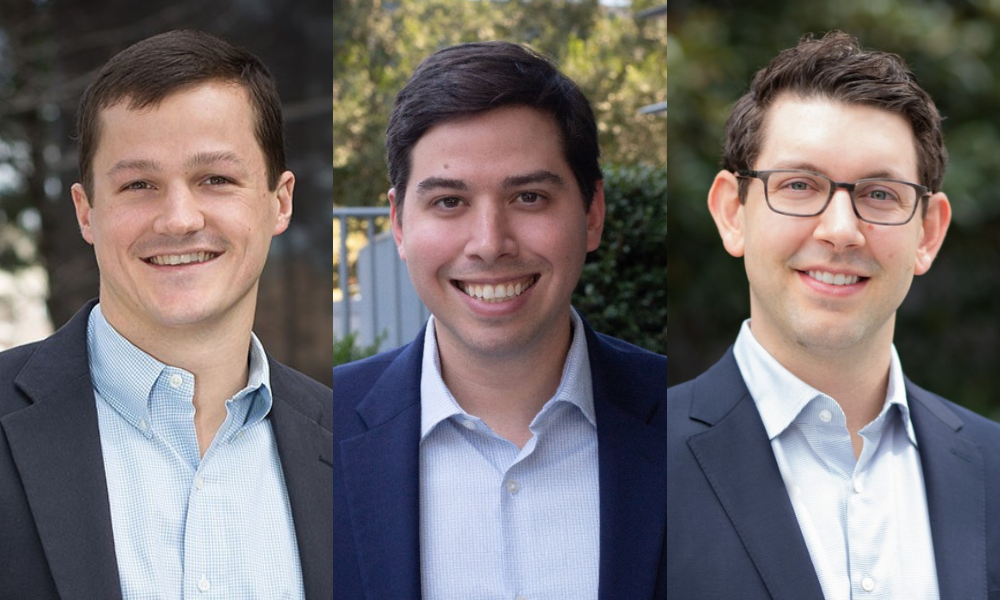

Michael Harper (pictured left) becomes president of hotel lending, overseeing Peachtree’s entire hotel credit platform. Jared Schlosser (pictured center) advances to executive vice president of hotel lending and head of CPACE. Michael Ritz (pictured right) is now the executive vice president of investments, managing the firm’s credit and equity investments across various industries.

“These appointments underscore Peachtree’s commitment to its core growth initiatives in hotel lending, as well as fostering talent from within our own ranks, with an eye toward further diversifying its allocation strategies as it taps into new investment opportunities,” Peachtree CEO Greg Friedman said in the Press release.

Since his start at Peachtree in 2014, Harper has progressively taken on leadership roles, primarily directing the company’s credit business. His responsibilities have spanned from loan originations to the strategic acquisition of credit portfolios. Harper’s leadership has guided the team through more than 500 investments, which cumulatively surpass $6 billion.

In his elevated role, Harper will oversee the entirety of Peachtree’s hotel credit platform, managing all credit business aspects and aiming to further the company’s success in the sector.

Joining Harper in the executive team is Schlosser, now serving as EVP of hotel lending and head of Commercial Property Assessed Clean Energy (CPACE). Schlosser has been with Peachtree since 2019 and has been a pivotal figure in advancing the company’s CPACE program. Under his leadership, the program has conducted over $800 million in transactions, positioning it among the largest in the United States. Since Schlosser took the reins of hotel originations at the start of 2022, Peachtree has executed more than $1.5 billion in hotel loans.

Read more: Three strategies to mitigate risk in real estate investing in 2024

Ritz, who joined the company in 2017, has been recognized for his expertise in managing and growing a robust portfolio of investments, now nearing $10 billion in transaction asset value. His role involves overseeing Peachtree’s credit and equity investments across commercial real estate and other ventures, contributing to the firm’s growth and investment strategy diversification.

Peachtree Group’s focus on the hotel lending sector is reflected in its recent ranking as the tenth-largest hotel lender by the Mortgage Bankers Association, marking its third consecutive year in the top 10.

The group operates as a vertically integrated investment management firm specializing in capitalizing on opportunities in dislocated markets, primarily anchored by commercial real estate.

Read more: Is commercial property investment profitable?

Stay updated with the freshest mortgage news. Get exclusive interviews, breaking news, and industry events in your inbox, and always be the first to know by subscribing to our FREE daily newsletter.