Invest in these cities and you can’t lose

The practice of fixing-and-flipping houses has skyrocketed since the end of the recession, creating a record level demand for fix-and-flip loans and an excellent business opportunity for brokers.

In today’s real estate market, demand for housing has risen, thanks to an improving economy and soaring rents that are forcing many families to consider buying instead of renting. According to a Money Magazine report, increased demand for housing – along with a dearth of available homes for sale – has sent housing prices soaring. This trend is spurring self-employed investors to pursue home flipping opportunities in dozens of cities across America.

According to Money, the average flipped house, for instance, has never been smaller, measuring out to only 1,422 square feet. However, there is still substantial money to be made. RealtyTrac reports that the average gross profit for flipped properties was almost $63,000 in 2016, with a 49.2 percent return on investment. Nevertheless, securing the capital to fund a home-flipping strategy can be challenging for some investors.

The Fix-and-Flip Funding Challenge

Many fix-and-flip investors don’t qualify for traditional bank loans because their income can be seasonal or irregular. Moreover, most banks offer longer-term loans that typically require more time to close. Flippers generally acquire, renovate, and sell their properties within a few months. So, waiting for a loan to close could translate into a lost opportunity for flippers.

Although Fannie Mae does provide a HomeStyle renovation mortgage program for 1-unit investment properties, it’s difficult to find a bank that offers the program. And, while crowdfunding websites offer loans to experienced flippers, approval rates for submitted deals run around 5 percent, are limited to only a few markets, and charge interest rates from 10 to 14 percent.

Alternative Lenders Fuel the Fix-and-Flip Market

Since bank loans are hard to find, flippers often look to alternative lenders as a source of funds. Alternative lenders can include hard money loans from private investment groups, as well as specialty finance companies, like Velocity, which concentrate on residential investment and commercial property loans.

Hard money lenders have lower qualification requirements and can typically close loans in a shorter period since they often avoid the appraisal process. However, investors pay for these luxuries with significantly higher interest rates, in the neighborhood of 10 to 20 percent. With no appraisal, the value of the property and the loan amount could be somewhat arbitrary. Moreover, hard money lenders usually tack on additional fees making the total cost even higher and their LTVs are typically capped at a conservative 65 percent. Together, the higher interest rates and fees take a bigger bite out of the profits for fix-and-flip investments financed with hard money, while the lower LTV forces borrowers to provide a larger down payment. As a general rule, it’s best to use hard money loans if the property must close within a few days and when borrowers can’t arrange alternative financing.

For most flippers, a specialty finance company like Velocity is typically a better option if a slightly longer time to close (14-21 days) is possible. The interest rates and fees charged by specialty finance companies are substantially lower than a hard money lender, so the borrower earns a higher return on their investment. Additionally, some specialty finance companies offer higher LTVs (up to 75 percent at Velocity) for fix-and-flip investments, so the borrower has a lower down payment.

The Value of Experience

Having prior experience is often a prerequisite for flippers since the lender is betting that the borrower knows what they’re doing when it comes to repairs and remodeling. Some lenders won’t lend to inexperienced flippers. Others, including Velocity, limit the loan-to-value ratio for flippers who don’t have an established track record.

Less experienced flippers will often tap into the home equity of their personal residence to fund their first investments. However, the practice can be risky since a loss from the investment could, in turn, result in the loss of the borrower’s personal residence.

The Importance of ARV in Fix-and-Flip Loans

A property’s as repaired value (ARV) is an appraiser’s estimate of the property’s value after the borrower completes their proposed renovations. Fix-and-flip investors often seek out lenders who offer to finance properties based on ARV because it allows them to obtain the capital needed to fund repairs and improvements to the property rather than paying for them out of pocket. For investors, this provides several benefits, including:

- Leverage – The short-term interest paid on a fix-and-flip loan allows investors to achieve a higher return on equity.

- Reputation – Completing several small fix-and-flip projects establishes a track record and credit history with lenders, allowing them to do more deals with higher loan-to-value ratios.

- Volume – Funding repairs and improvements through financing frees up capital to do more projects.

The Opportunity for Brokers

If you’re a broker seeking to cash in on the interest in investment properties, and particularly fix-and-flip investors, it’s wise to have an alternative lending source that meets their unique credit and short-term financing needs. Fix-and-flip loans often fund quickly, so it allows brokers to complete more deals. Moreover, fix-and-flip clients provide brokers with repeat business. Plus, the commission on fix-and-flip investment property loans may be higher than those for home mortgage loans, so you may earn more money per deal. You may also have an opportunity to finance a home loan for the borrower who purchases the renovated property.

The Top Markets for Fix-and-Flip Investing

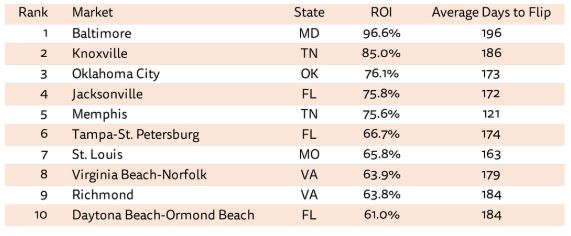

So, what are the top 10 real estate markets based on their average return on investment? According to Money’s rankings, they include:

You’ll find the complete list of all 25 markets included in the Money Magazine report here.