Early access to higher conventional loan limits now available

Home lenders A&D Mortgage and CrossCountry Mortgage (CCM) have moved ahead of the Federal Housing Finance Agency (FHFA) by increasing their conventional loan limits before the FHFA’s official announcement expected in November.

CCM introduced its “Early Bird Product,” which enables homebuyers to access up to $802,650 for conventional loans, an increase from the current $766,550 limit. The company said this offering allows borrowers to take advantage of higher loan limits early before the FHFA officially updates the guidelines.

“CCM understands the challenges faced by homebuyers in the current market and is committed to providing innovative solutions to meet their needs,” CrossCountry chief operating officer Jenn Stracensky said in a Press release. “The Early Bird Program is our way of helping borrowers seize opportunities and navigate their path to homeownership.”

In a similar move, non-QM lender A&D Mortgage has also raised its loan limits for conventional mortgages. These new limits are expected to assist homebuyers looking to finance one- to four-unit properties in high-cost markets by offering increased loan options.

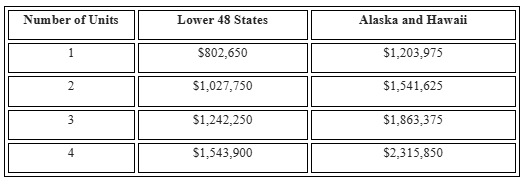

The updated loan limits are as follows:

Both lenders are focusing on offering higher loan limits to keep up with housing prices that continue to climb, particularly in competitive markets. As shown in the accompanying table, the new loan limits vary depending on the region and property size, with significant increases for borrowers in high-cost areas like Alaska and Hawaii.

Read next: Eighth month of slowing home price growth brings market closer to normalcy

“We’re excited to offer early access to these new loan limits ahead of the official FHFA announcement later this year,” said Max Slyusarchuk, CEO of A&D Mortgage. “This change reflects our ongoing commitment to providing innovative solutions that meet the evolving needs of our clients. By increasing the available loan amounts, we are empowering homebuyers and real estate investors to take advantage of greater purchasing power, ensuring they can succeed in today’s competitive market.”

Stay updated with the freshest mortgage news. Get exclusive interviews, breaking news, and industry events in your inbox, and always be the first to know by subscribing to our FREE daily newsletter.