Lenders provide plenty of finance options for SMEs

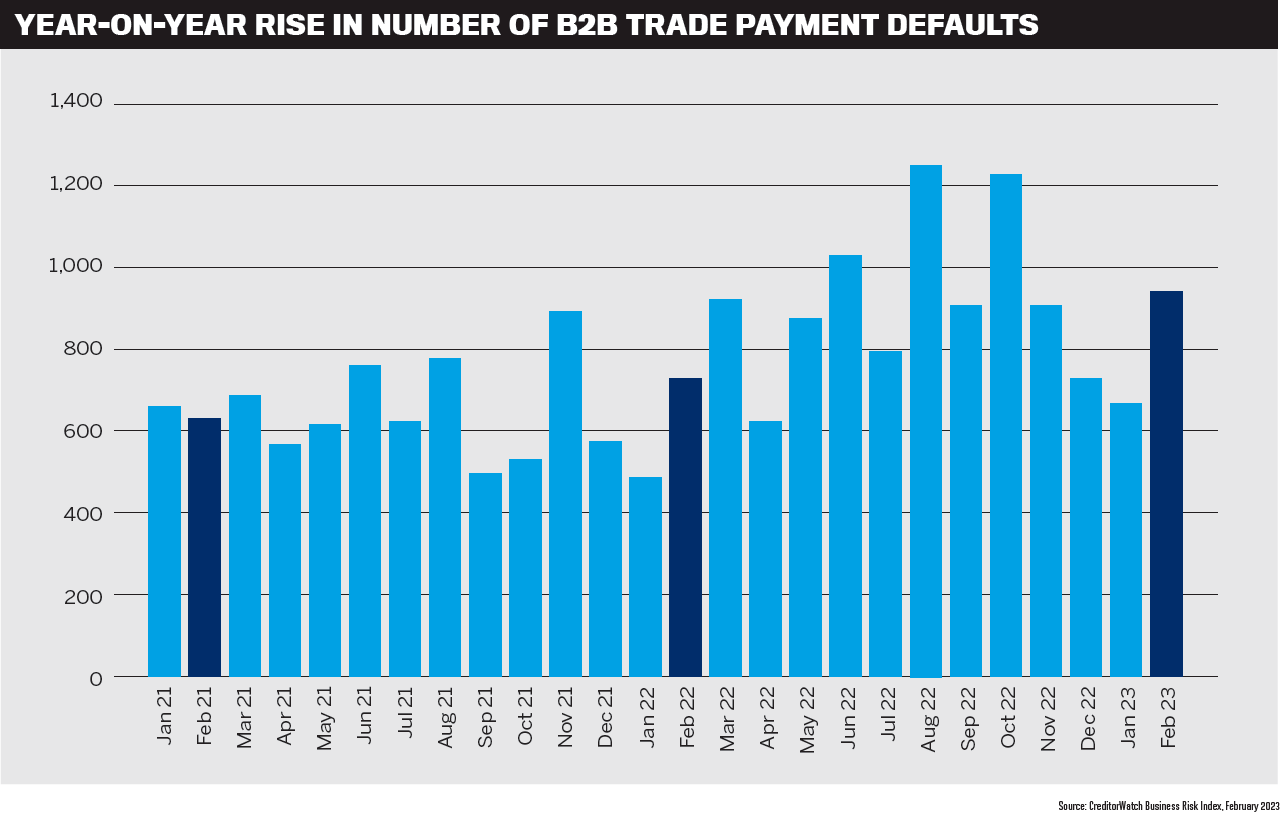

It’s a challenging time right now for business owners. Following a rise in consumer demand and confidence last year as the economy bounced back from the pandemic, a new reality has set in – people are not spending as much.

This is due to more of their income being taken up by higher interest rates, driven by 11 increases in the official cash rate as at time of printing.

The impact on the economy cannot be understated, with the vast majority of mort- gage holders in Australia on variable home loan rates. Many are paying rates of 5% plus, a far cry from the sub-2% rates of a little over a year ago.

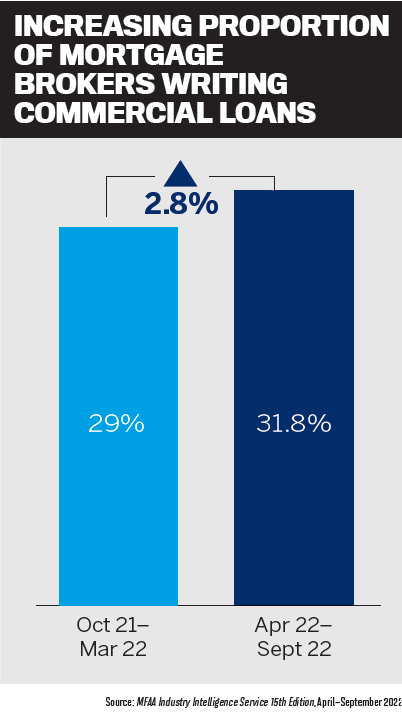

This falling consumer demand – combined with inflation sitting at 7%, labour shortages and supply chain problems – has hit many SMEs hard. The CreditorWatch Business Risk Index for February 2023 shows that business condi- tions have tightened, particularly around payment times, due to high inflation and interest rates along with falling demand. Trade payment defaults are up 30% year-on-year, while B2B trade receivables are down 10% year-on-year.

Cash flow is difficult for SMEs when trading conditions are tough, but savvy brokers know there are lenders in the market that understand how businesses operate and can provide tailored finance products to assist them through challenging times.

MPA gauged the views of some leading SME lenders to get a further understanding of the market and insights into how brokers can help provide debt solutions to smooth out business cash flow and aid growth. We spoke to ING Australia national sales manager commercial John Kolyvas, Grow Finance co-CEOs David Verschoor and Greg Woszczalski, Aquamore head of distribution Matthew Porch, and Thinktank general manager partnerships and distribution Peter Vala.

Porch (pictured above) says Australian SMEs contribute to a large majority of the country’s GDP.

“Whilst at a macroeconomic level the senti- ment is bleak, in reality things aren’t as bad as the mainstream media portray,” he says.

“Unemployment is still relatively low at 3.5%, but this has inflationary pressures, which are not letting up as fast as the Reserve Bank would like with their rate increases.

“Inflation and higher rates are squeezing SMEs, and employees are demanding pay rises, hurting cash flow. Businesses need to manage this cash flow. Tailored, structured lending can assist with working capital management. Prudent, diligent brokers are well placed to help SMEs navigate through this period of adjustment.”

In terms of business confidence improving, Porch says it’s a waiting game right now.

“Spending needs to drop off to cool inflation, but once spending eases, sales will be hit. It’s therefore a balancing act, and many cost reductions need to be realised for SMEs to trade profitably.”

However, Porch says some sectors are currently booming, such as domestic manufacturing, transport and logistics and civil construction.

Kolyvas says many business owners are being savvy about how they manage the current economic climate.

“Some are reviewing their market, clients, suppliers and how they run their business on a regular basis,” he says. “They’re also staying ahead of the curve by leaning on their key advisers proactively – like accountants and brokers – making tough decisions as early as possible.”

He says just as brokers do regular health checks on their customers’ home loans, they should be doing the same for their SME customers’ business loans.

“Checking in with your customers will allow you to pick up on early warning signals. As part of this, the broker should be encouraging their SME customers to get help from their accountants and banks as soon as possible – even facilitating this with the customer’s blessing.”

Current uncertainty about interest rates will be contributing to SME customers’ stress levels, but Kolyvas says once rates stabilise business confidence should improve.

Verschoor and Woszczalski (pictured above) say that in general, SME owners have become more proactive in seeking alternative financing solutions to help future-proof their busi- nesses and maintain margins.

“Supply chain issues have resulted in increased demand for funding of used equipment,” Verschoor says. “This is especially prevalent in the manufacturing sector.”

The CEOs say it’s important for brokers to understand their clients’ needs and work closely with lenders to present viable long-term options that avoid boxing customers into high-interest, inflexible products and terms.

Vala (pictured above) says the challenging economic conditions have certainly impacted SMEs and the self-employed (both negatively and positively), depending on their type of business and location.

“The need to either shore up operating costs or free up cash to take advantage of opportunities has seen an increase in requests for debt consolidation to reduce monthly repayments and improve cash flow,” he says.

“This is when a trusted broker becomes animportant ally for a business owner to source the most effective lending solution, which is often a non-bank alternative offering maximum flexibility.”

Thinktank’s 30-year loan terms and set- and-forget facilities allow borrowers to free up cash flow, while also providing peace of mind and certainty because there’s no need for ongoing covenant reporting and revaluation requirements, says Vala.

“The most important factor in all of this is for the broker and lender to work closely together to provide current and comprehensive solutions for the SME that respond efficiently and effectively to the changing market conditions.”

Business finance solutions

Kolyvas says ING offers set-and-forget secured commercial loans that SME owners can use to invest in their businesses or for working capital requirements. “Critically, these loans are mostly offered over longer terms, allowing SME customers to manage their cash flow better.”

Grow provides SMEs with quick, easy access to capital to support growth and more efficient operation of their businesses, Verschoor says. As a non-bank lender, Grow can provide customers with multiple debt solutions very quickly.

“All of Grow’s products are designed to help businesses with their working capital and cash flow requirements,” Verschoor says.

“The company has a healthy appetite for new, used and obscure equipment, in addition to our overdraft facility, which provides the flexibility to make interest-only payments versus the principal and interest offered by many of our competitors.”

“The company has a healthy appetite for new, used and obscure equipment, in addition to our overdraft facility, which provides the flexibility to make interest-only payments versus the principal and interest offered by many of our competitors.”

Vala says all of Thinktank’s lending solutions are designed for flexibility and hassle-free borrowing. “Both these factors have been crucial and desirable for SMEs and the self-employed during recent years.”

Thinktank has seen a significant uptake of its mid-doc loans, which only require a self-certified income declaration and one other form of documentation (accountant’s letter, last two BAS, or six months’ bank statements) to support current income for serviceability.

Vala explains that this offers businesses with volatility in their trading performance, as a result of circumstances such as COVID, a way forward to obtain finance. “Thinktank loans are available for refinance, restructuring, consolidation and equity release – apart from SMSF – to aid freeing up important cash flow,” Vala says.

The non-bank lender also offers a line of credit, which is an option with both full-doc and mid-doc loan products. With this option, there are no line or unused facility fees, Vala says, and it provides an ideal standby facility of up to $500,000 for approved borrowers.

“With our 30-year terms, set-and-forget facilities and ability to borrow up to $4m against commercial property security, every aspect of our offering is geared towards helping the borrower take control or take advantage of their current financial position and longer-term wealth objectives.”

At Aquamore, Porch says the private lender provides flexible finance solutions designed to assist SMEs through leverage against property assets.

“Aquamore’s debt solutions are for business purposes and are structured via a fully drawn advance,” he says.

Businesses can access from $300,000 to$5m via full-doc, alt-doc or no-doc products for up to 36 months, with the option to extend this term.

“The assessment criteria are simple and clear, using judgmental credit principles to assist clients who may not fit mainstream

lenders’ rigid policies. In addition, clients can reduce their debt without penalty at any time throughout their facility on serviced loan options.”

Support, education for brokers

Woszczalski says Grow has established a specialist team dedicated to supporting and educating mortgage brokers and other professional service providers who are diversifying their product offerings.

“We have a BDM presence in all states,” he says. “Each BDM has a designated account manager to enhance efficiencies. The Grow relationship management team works closely with the broker, whether in person, on the phone or online.”

High-touch BDM support is backed by Grow’s highly sophisticated technology, which is intuitive, automated and expedites the loan application process, Woszczalski says. In addi- tion, the company provides regular product training and spearheads education initiatives. “Brokers are also provided with access to our online portal, where they can easily create quotations and actively manage applications.”

Aquamore hosts regular education workshops and seminars to upskill brokers on commercial lending.

“This includes how to spot opportunities, along with helping implement strategies brokers can implement to support their client base,” Porch says. “The company also collaborates with various non-bank lenders to host in-person and online events promoting market, category, scenario and product awareness.

“We also spearhead industry webinars, such as the recent Commercial Finance Market Update panel event in conjunction with Lumi, Accendo Financial and a specialist commercial broker, that provided brokers insights on the economy, market trends and where we see things headed in the near future.”

Market trends

Porch says Aquamore hosts broker education sessions highlighting topics such as spotting opportunities, managing conversations with business clients, and structuring an approach designed to leverage potential clients in the non-coded space.

“This is particularly helpful for brokers who are used to dealing with coded residential mortgage lending only and may be unsure how to diversify into commercial finance.”

Vala says Thintank’s support for the broker channel comes in many forms and is driven first and foremost by dedicated relationship managers who are there with the broker from initial workshopping of a deal through to settlement.

“From an educational perspective, we regularly work in conjunction with our aggregator partners to deliver ongoing programs ranging from group sessions held in person or via webinar through to one-one- one workshops,” he says.

These can include sessions covering simple property-based commercial lending solutions as well as the concepts of more difficult cash flow lending structures. Thinktank also provides tools to help identify, and then convert, lending opportunities and the many ways brokers can assist SMEs, the self-employed and their referral partners.

Vala says that while remote delivery has a significant role to play, face-to-face sessions offer the most effective and valuable learning outcomes. “We encourage any broker looking to understand more about commercial lending or even just to workshop client scenarios to reach out to their aggregators or speak directly to one of our Thinktank team to come along to one of our upcoming courses.”

Kolyvas (pictured above) says ING’s commercial loan process has been developed to mirror its home loan process, and the bank’s BDMs and sales support staff are used to dealing with brokers who have less experience with processing commercial loans.

“Rather than asking the broker to introduce the client only, ING prefers to have the broker manage the client relationship and stay involved in the end-to-end process,” he says.

“Our assessors also talk to the broker once the application is received. This ultimately gives the broker a much better understanding of the decision early on, resulting in a better outcome for all parties.”

Diversification opportunities

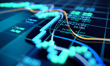

MFAA statistics for the December 2022 quarter show that brokers facilitated 69.3% of all residential home loans. However, for the six-month period between April and September 2022, only 31.8% of mortgage brokers also wrote commercial loans.

While the percentage of brokers working in commercial finance is improving, up 2.8% on the six months to March 2022, there’s massive scope for growth in an underutilised market, especially considering the intense competition in home mortgages.

Vala says with challenging market conditions expected to persist, borrowers are increasingly reevaluating their financial positions to improve cash flow.

“Brokers who have close relationships with their clients can make the most of these opportunities, particularly where they have the skills to support alternative lending and debt restructuring options. Now is a great time to act,” he says.

Diversification into commercial helps provide more comprehensive financial solutions for borrowers, Vala says, serving to deepen relationships by giving clients the enhanced lending support they need in ever-changing times.

“Borrowers do not want or have the time to retell and share their story with multiple brokers or lenders,” he says. “So brokers who can meet both the residential and commer- cial needs of their clients with a broad range of product offerings are in a strong position to not just protect their loan book from competition but expand it.”

Vala says diversification also enables brokers to have a consistent income in a fluctuating market, such as when the residential sector and parts of the commercial market are behaving in the countercyclical manner we are seeing now.

“The old line is unchanged: if a broker is not writing the commercial loan, someone else is, which means they may end up losing the existing home loan and connection with the client,” he says.

“Why take this risk when the move to diversifying into commercial is a genuinely easy transition to make?”

Porch says, “Diversification is key to managing concentration risk. This is especially the case now.”

Being skilled at commercial lending enables brokers to adopt a whole-of-wallet approach, managing all aspects of their clients’ require- ments, Porch says. “This creates ‘stickier’ clients and additional revenue streams.”

Kolyvas says the residential property market, commercial property market and small business demand are all independent of each other. “This means that when the residential market is subdued, the commer- cial property market and SME sentiment may be stable – or vice versa. Most brokers that are home loan focused may already have a solid base of SME customers.”

Diversifying into SME lending helps a broker retain their SME customers, says Kolyvas. “Business owners have more regular needs for finance and more complex needs as well. This facilitates deeper relationships with less focus on just interest rates. Furthermore, offering more services allows brokers to also balance and protect their own business and cash flow.”

Verschoor and Woszczalski say brokers who offer additional services can provide more value to existing customers and also attract new clients. When properly managed, this increases customer retention and brokerage revenue.

Looking ahead

Woszczalski says that historically, Australian SMEs have proven to be resilient through challenging periods, and while some industries are expected to face greater headwinds, others will flourish.

“Grow expects continued strong demand for business loans, overdraft facilities and asset finance via non-bank lenders as banks tighten credit lending requirements and SMEs focus more and more on their bottom line and look for ways to improve cash flow,” Woszczalski says.

Porch says the well-established businesses and experienced operators that have been through peaks and troughs before, and have borrowed diligently and put money aside to assist with cash flow challenges, are expected to move through this market volatility.

“Conversely, we expect to see mergers and acquisitions increasing as some operators seek to cash out or cut their losses,” Porch says.

Vala says that due to various structural factors, commercial property-secured loan rates are typically a bit higher than they are for residential property loans, but it’s important to note that rates are still within the 1990–2023 average historical range.

“While the next 12 months will still see difficulties amid supply chain issues, higher interest rates and labour shortages, we remain positive that these areas will continue to improve over time and in turn support continued growth in the economy,” he says.

For brokers and their SME or self-employed clients, Vala says it’s about positioning a business to take advantage of changes as they occur.

“A key aspect of this is ensuring sufficient liquidity and cash flow is available to meet current and future commitments and any finance is structured to smooth out and support the business through any unforeseen events with the flexibility to adapt accordingly.”