But cash rate's short-term future remains uncertain, says expert

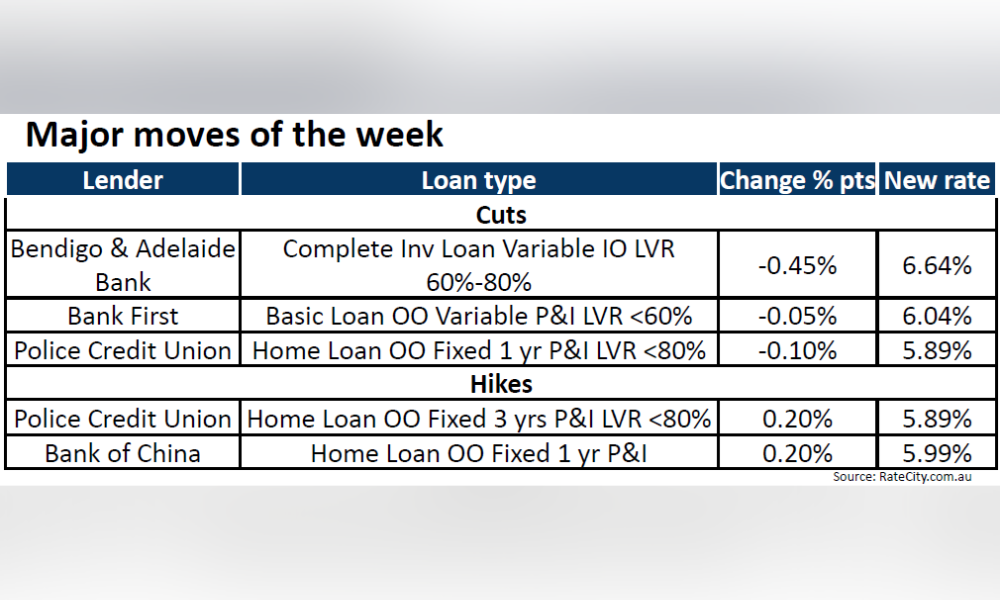

Latest consumer price data showing an increase in annual inflation rate did not prompt lenders to initiate a broad series of rate hikes, with only a couple of lenders hiking their fixed rates over the past week.

RateCity’s interest rates weekly wrap-up, however, showed several lenders implementing rate cuts, including a 0.45% rate cut from Bendigo & Adelaide Bank.

Rate hikes were observed for Police Credit Union’s home loan owner-occupier three-year fix, which increased by 0.20% to 5.89%, and Bank of China’s home loan owner-occupier one-year fix, which rose by 0.20% to 5.99%.

“Last week’s shock inflation figures, which saw the monthly CPI indicator for May rise from 3.6 to 4%, did not trigger a widespread round of rate hikes from lenders,” said RateCity research director Sally Tindall (pictured above). “The RateCity.com.au database shows just two banks have increased select fixed rates since this data was released – Police Credit Union and Bank of China.

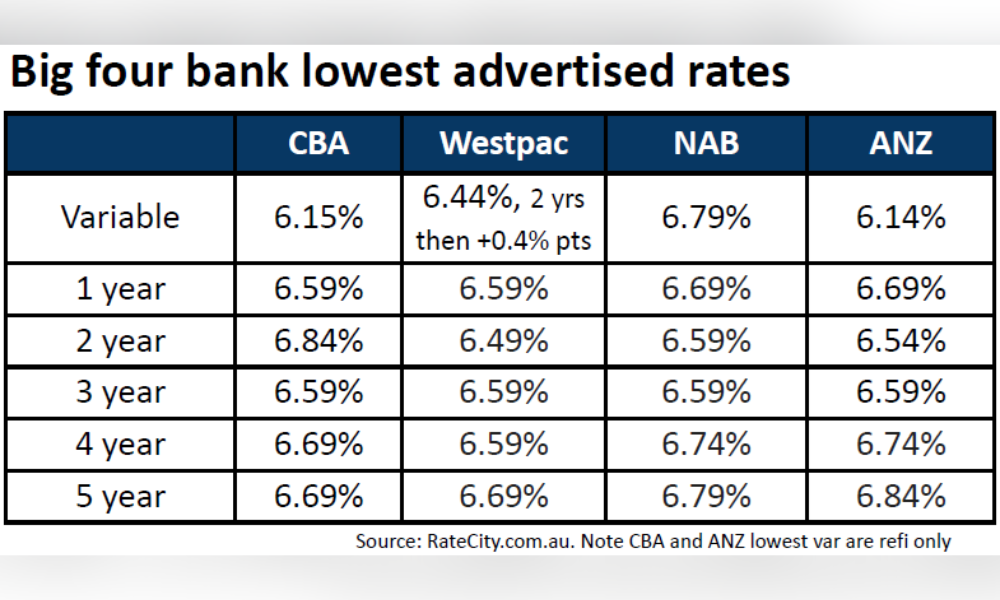

Among the big four banks, the lowest advertised variable rates are as follows: Commonwealth Bank (CBA) at 6.15%, Westpac at 6.44%, National Australia Bank (NAB) at 6.79%, and ANZ at 6.14%.

For fixed rates, the lowest advertised rates are 6.59% across all four banks for a one-year term. The two-year fixed rates are 6.84% (CBA), 6.49% (Westpac), 6.59% (NAB), and 6.54% (ANZ). For three-year fixes, the rate is 6.59% across all four banks. The four-year term rates are 6.69% (CBA), 6.59% (Westpac), and 6.74% (NAB and ANZ), while for the five-year fixes, the rates are 6.69% (CBA and Westpac), 6.79% (NAB), and 6.84% (ANZ).

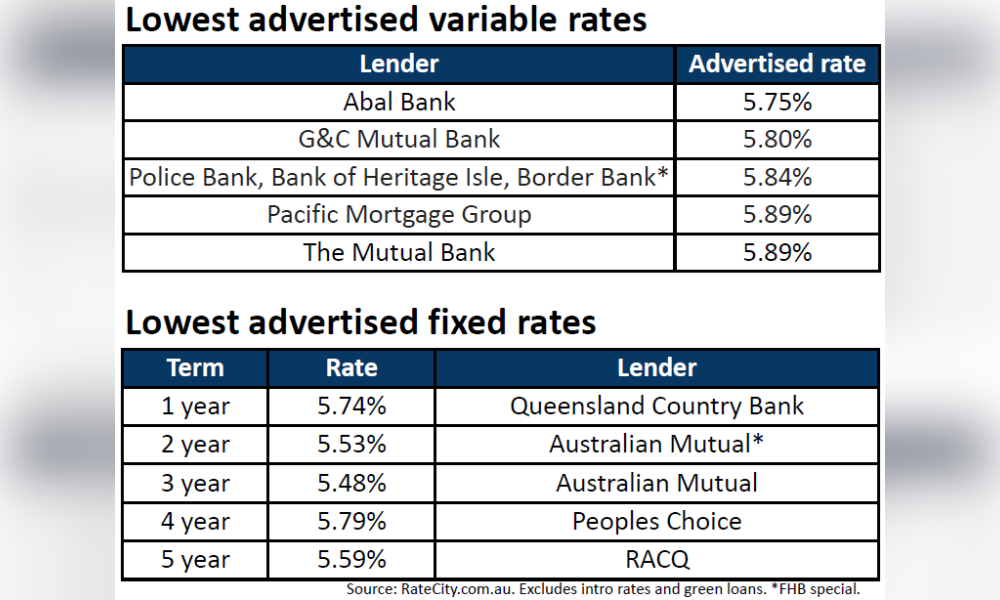

The lowest advertised fixed rates from other lenders are 5.74% for a one-year term (Queensland Country Bank), 5.53% for a two-year term (Australian Mutual), 5.48% for a three-year term (Australian Mutual), 5.79% for a four-year term (People’s Choice), and 5.59% for a five-year term (RACQ).

In the variable rate category, the top offerings include Abal Bank at 5.75%, G&C Mutual Bank at 5.80%, Police Bank, Bank of Heritage Isle, and Border Bank at 5.84%, Pacific Mortgage Group at 5.89%, and The Mutual Bank at 5.89%.

“The lowest one-year fixed rate is currently 5.74%, while the lowest variable is 5.75%, excluding introductory rate loans,” Tindall said. “This suddenly makes for an interesting equation for borrowers looking to protect themselves against the possibility of more rate hikes.

“However, the inflexibility of a fixed rate, and the extra admin that it brings is still probably enough to dissuade most borrowers at this stage.”

Tindall said the short-term future of the cash rate remains highly uncertain.

“The RBA board minutes released on Tuesday confirmed the board [spent] considerable attention on the case for a cash rate hike, and while, ruling it out at this meeting, is keeping the option firmly on the table,” she said.

“All four big bank economic teams still expect the RBA’s next move will be down; however, the sands are slowly shifting. Last month, ANZ shuffled back the timing of its forecasted rate cuts from November 2024 to February 2025 and has acknowledged a rate hike as soon as August is a possibility. Last week, NAB also moved back its expected timing of the first rate cut out to May 2025 – a delay of six months.

“While the popularity of fixing hit a record low months ago, and has continued to drop from this point, anyone who has already locked in a highly competitive short-term fixed rate might end up having the last laugh with the prospect of cash rate cuts moving further out on to the horizon.”

Want to be regularly updated with mortgage news and features? Get exclusive interviews, breaking news, and industry events in your inbox – subscribe to our FREE daily newsletter. You can also follow us on Facebook, X (formerly Twitter), and LinkedIn.