New customer rate increases easing but persisting

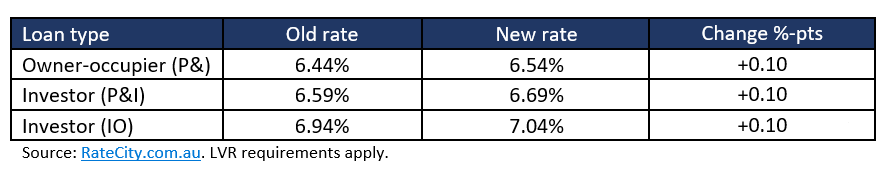

ANZ, Australia’s fourth-largest home loan lender, has raised the rate of its basic variable mortgage by 0.1 percentage point for both owner-occupiers and investors making principal and interest payments, as well as investors making interest-only payments.

The rate increase, separate from the November Reserve Bank rate hike, does not affect existing customers.

RateCity.com.au tabled below the latest change to ANZ’s Simplicity PLUS home loan:

“ANZ has said it would fight for new customers; however, today’s rate hike suggests it’s only prepared to go so far,” said Sally Tindall, RateCity.com.au research director.

“This will be disappointing news for potential customers who had their eye on this rate from ANZ. Those already in the process of getting a Simplicity Plus mortgage should ask the bank if it will honour the previous rate,” she said.

“ANZ still has a couple of cashback offers on the table with $2,000 for select refinancers and $3,000 for first-home buyers. This is likely to keep its home loan book moving at a decent pace, despite this new customer hike.”

New customer rate hikes slowing but persisting

While the surge in new customer rate increases by the big four banks has moderated compared to earlier this year, recent adjustments by Westpac and NAB highlighted the continuing upward trend in these rates.

ANZ’s latest increase marks the 25th upward adjustment among major banks for new customers since March 1, in addition to the RBA cash rate hikes.

Not only the big four banks, but also other lenders are raising rates for new customers, as seen in the RateCity.com.au database. In the past month, 17 lenders have implemented at least one new variable rate increase, in addition to the RBA hikes. Over the same period, a substantial 89% of all lenders have raised at least one new customer variable rate, in addition to the RBA hikes.

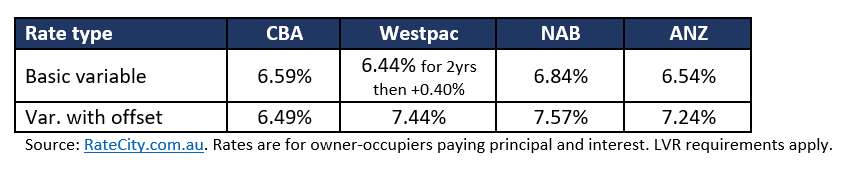

Big banks’ basic variable loan options

ANZ’s latest rate adjustment placed Westpac in the top position for a basic variable loan, albeit as an introductory rate lasting for two years. Notably, CBA continued to offer a pricier option for its basic variable loan at 6.59%, in contrast to its offset-inclusive loan at 6.49%.

See table below for the big four banks’ lowest advertised variable rates.

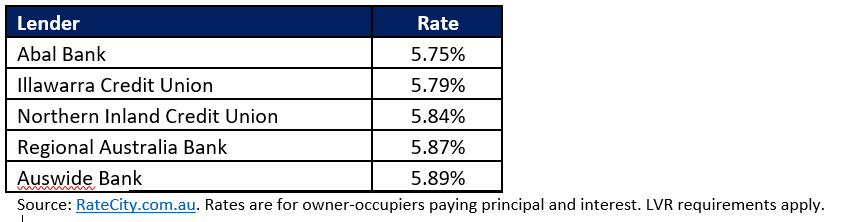

For the lowest ongoing variable rates available on the RateCity.com.au database, see table below.

Smaller lenders still fighting for new business

Tindall said that as the major banks compete for the title of having the least competitive advertised rates, smaller lenders remained ready to vie for new business.

“The RateCity.com.au database shows there are currently 31 lenders offering variable rates under 6% following the November RBA rate hike,” she said. “If you live in the home you own, and have a decent stake in it, you can still get a competitive variable rate, however, you might have to go with a lender you’ve never heard of before.”

Get the hottest and freshest mortgage news delivered right into your inbox. Subscribe now to our FREE daily newsletter.