Far from a management fad, 'agile' is increasingly being adopted by the mortgage industry and offers much to brokers

Far from a management fad, 'agile' is increasingly being adopted by the mortgage industry and offers much to brokers

Here's a scenario brokers will be all too familiar with. A bank redesigns its IT system, promising faster turnaround, fewer errors and easier access. Two to three years and several million dollars later, the new system is released, but it’s difficult for brokers to use and already out of date. Turnaround times blow out, and the bank goes back to square one.

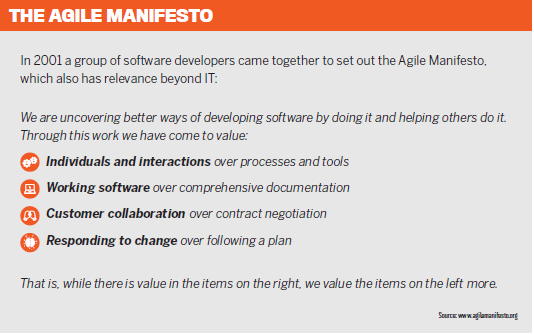

This is the nightmare scenario that ‘agile’ working is designed to eliminate. Originally used in software development, agile is a set of principles for project management, spawning more than 70 management strategies, such as Scrum, Kanban and Lean. Yet the principles, as set out in the ‘Agile Manifesto’ (see box below) are relatively simple: to design new projects piece by piece and constantly test them with the end user – in this case, the broker and borrower.

This year, agile will make waves in mortgages. ANZ was the first Australian bank to take up agile, in 2017, but Bankwest is perhaps the bank that has taken the approach furthest in lending. MPA spoke to Bankwest general manager of third party Ian Rakhit and Andy Weir, executive general manager, technology and transformation, to learn more about agile and its consequences for lending.

‘A very overused term’

In recent years, Bankwest has released several small and popular tools into the broker space. The non-major’s ‘Broker Chat’ system, which allows brokers to message Bankwest’s processing staff, is regularly applauded in MPA’s Brokers on Banks report. In July the bank unveiled a new loan portal; in October it introduced a real-time pricing tool, then in November a new website.

“Everything we’ve built on the Bankwest website is based upon broker feedback,” says Rakhit. “Working through an agile methodology allows you then to create quickly, test quickly and implement quickly.” Rather than roll all these improvements into one major relaunch, Bankwest has released a steady stream of new tools, with additional functions added after launch.

Within Bankwest, the new approach is not referred to as agile. “It’s not an agile transformation, it’s an organisational transformation,” Weir explains. In fact, he believes that “agile is a very overused term” and restricts its use to its original purpose in software development. Bankwest’s coders adopted agile several years before the rest of the organisation.

As an organisational transformation, Weir says, “the key thing for us is that we are organising all of our colleagues into multidisciplinary teams, or ‘tribes’, to be orientated around delivering specific outcomes to our customers, and transforming the customer experience for those groups”.

Bankwest is currently creating the first ‘tribe’, focusing on homeowners, with four more planned in the near future.

Dealing with pushback

Weir is conscious of the potential for pushback. “As with any big organisational change,” he says, “there has to be a big investment in organisational change management practices … there are people who really embrace and love change, and there are people who manage that process effectively, and there are some people who struggle with change.”

To aid the shift, Bankwest has invested in communications programs, cloud-based and open-API technology, and engaged with staff, Weir explains. “They can come along, ask a lot of questions, have access to our executives, have access to the team that are leading the transformation, to look and see and feel the changes that we are making in action.”

Feedback so far has been good, he says. Staff are excited about becoming more connected to customers and in touch with their needs.

Bankwest’s immediate aims are relatively straightforward. “A lot more prototyping, a lot more use of analytics, and really improving our speed to market and really differentiating customer experiences,” Weir says. Longer term, he is more ambitious: “We believe these ways of working allow us to deliver the kinds of experiences our customers are looking for, not just now but also in the future.”

Can agile work for small businesses?

Where agile is yet to make an impact is in smaller businesses. There are some reasons for this: small businesses don’t have the time or money to hire management consultants or indulge in mass restructuring. Many small businesses don’t feel they need agile, as they’ve never suffered from the slow-moving bureaucratic processes that blight their larger counterparts. Yet small businesses have much to gain from agile and may find it easier to adopt.

What brokers have done for years – and banks have neglected – is what agile is all about: listening to your customers. Now brokers are becoming more systematic in collecting feedback, and many aggregators are willing to help brokers design post-settlement surveys. In an agile system, the broker would consult this feedback, and what it reveals about customer needs, when making a change to their business, such as diversifying into a new area of lending.

Agile consultant Matt Sharpe, talking to accounting software provider MYOB, urged smaller businesses to “really understand what [your customers] actually need – which is not necessarily what they think they need – and give it to them. This will lead to greater satisfaction and loyalty. For example, if you are in a service business, is there any way to simplify what you offer, to address a core need first and delight the customer before starting to upsell?”

Agile means encouraging collaboration, for example between brokers specialising in different areas, and processing and marketing personnel, and encouraging all staff to think about the end customer. As agile-working expert Lynne Cazaly explains, agile is all about focus: “This isn’t just about being more productive or getting more work done; it’s actually about getting more value out of the work you’re doing – so yes, it’s smarter, not harder.”

Agile may not suit all businesses, but it is one response to universal trends that no business can afford to ignore. Bankwest’s Weir sums up the challenge: “Customer preferences are changing quite rapidly in terms of where, when and how they want consumer financial services, as well as new competitors coming into the environment.