ING's treasurer answers brokers' questions on how the budget will affect business

ING's treasurer answers brokers' questions on how the budget will affect business

This year’s federal budget didn’t prove to be front-page headline fodder for long, especially not compared to last year when the major bank levy was announced. Instead, Treasurer Scott Morrison presented a balanced and subdued budget on 8 May that promised tax relief, support for older Australians, as well as a big boost in infrastructure spending.

So what does all this mean for brokers? Here, ING treasurer Michael Witts answers brokers’ questions on how the budget will affect their businesses, the RBA cash rate and housing prices, among other issues.

REDOM SYED, Confidence Finance: Do you believe the income tax cuts in the budget will have an influence on consumption figures, inflation and/or the timing of RBA cash rate changes?

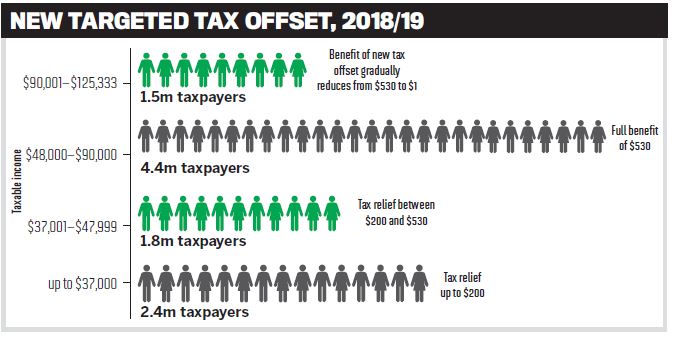

Michael Witts, ING: The tax cuts announced in the recent budget are the first instalment of broader income tax reforms due to be introduced over a number of years. Initially they focus on lower income levels, which could be expected to translate to additional spending – ie lower-income earners will have more to spend. However, given the high level of household indebtedness in Australia, lower-income earners might use the extra cash to reduce their debt.

Against this background it is highly unlikely the RBA will be influenced by the tax cut in its policy considerations.

REDOM SYED, Confidence Finance: Unlike last year, this year’s budget had little to say on housing affordability and, specifically, first home buyers. Do you think this government should be doing more to tackle housing affordability, or should this be a matter for individual state governments?

MW: We have seen first home buyers returning to the market as investor activity is reduced, employment markets remain strong and interest rates remain low. The broader question around housing affordability requires all levels of government and the community to work in a positive and cooperative manner to achieve meaningful reforms and progress.

MHAIRI MACLEOD, Astute Ability Finance Group: How can brokers better benefit from the $20,000 instant asset write-off and the tax reductions proposed in the Ten Year Enterprise Tax Plan, and what impact will this have on the greater economy? Why hasn’t the write-off become a permanent fixture?

MW: The extension of the instant asset write-off, which was first introduced in 2015/16, will be extended for a further 12 months. This will improve the cash flow of small businesses, helping them reinvest and remain up to date from a technology and productivity viewpoint. This will contribute to higher levels of business investment and spending across the economy.

The arguments in favour of the write-off are compelling, and it is perhaps more a function of the health of the budget overall. It has now been in place for three years.

PETER ELLIS, Lending Mate: With the continual rise in the cost of living and the current scrutiny of verification of living expenses, do you foresee loan application levels declining?

MW: In short, we do not see a decline in the number of loan applications driven by cost of living or living expenses. However, the profile of applications may change in terms of loan amount or borrowing amount.

SIMON ORBELL, Smartmove: Do you think that the government should be doing more to reduce the overall debt of the country?

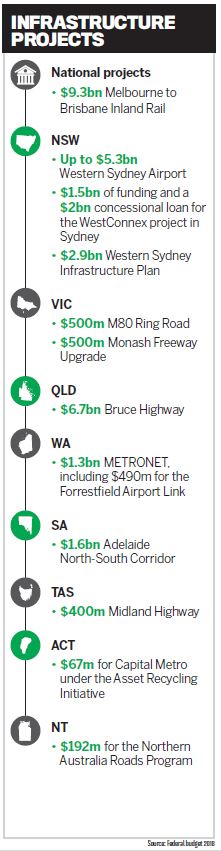

MW: The key point about the level of debt arising from the budget is why that level of debt has been incurred. In Australia’s case, the debt has been largely incurred as a result of spending on infrastructure-related projects. These projects will have a growth dividend in the future.

The most effective way to address the deficit is to have solid growth across the country. This generates additional tax revenue (company and individual) such that the deficit is eliminated and a surplus accrues which can be used to retire outstanding debt. The answer to the level of debt is controlled spending (in favour of infrastructure) and ensuring the economy’s growth potential is realised.

JAMIE KING, Bluerock Finance: In the 2017 budget, the government announced the First Home Super Saver Scheme whereby first home owners would be able to apply to withdraw voluntary contributions made to superannuation for the purchase of their first home. There was no mention of this in the 2018 budget. Will this scheme still be going ahead and how will it work?

MW: The Super Saver Scheme remains in place following the 2018 budget. The ATO website explains that the scheme is suitable for first home buyers if they live or intend to live in the premises they’re buying as soon as practical; or if they intend to live in the property for at least six months of the first 12 months of ownership. It’s best to visit the ATO website for more detailed information on the operation of the scheme, including eligibility and process.

What changes has the government proposed to reverse mortgages, and how will this new scheme help brokers and their retired clients?

MW: There is an existing pension loan scheme which will be expanded to give all age pensioners the option to boost their standard of living via accessing the stored equity in their property. Full-rate pensioners will be able to boost their income by up $11,799 (singles) or $17,787 (couples) per annum. There are a number of specific conditions, which can be found on the Human Services website.

With more seniors given the chance to stay in their own homes, do you think we’ll see a decrease or delay in those who decide to downsize, preventing these properties from being released to younger homebuyers?

MW: The scheme is related to accessing equity in a property of any size rather than encouraging people to stay in larger properties that are beyond their requirements at their stage of life.’

How might the government’s planned $24.5bn spend on transport and other infrastructure projects lift housing prices and fuel housing demand in some areas?

MW: Rather than lifting prices, the transport-related infrastructure spending is designed to reduce congestion and prompt the release of additional land areas adjacent to the expanded transport corridors. In other words, this will likely initially lead to a supply side response, and the demand response will follow in due course.

In light of the budget, has your outlook on the housing market changed, especially for areas like Sydney and Melbourne?

MW: The Sydney and Melbourne property markets have cooled over the first half of 2018. A combination of factors – regulatory and market – have contributed to this outcome. There could be further adjustments to fl ow through the market. The budget itself did not hold anything that is likely to impact the housing market in the short term. The infrastructure spending discussed above will have a potential impact on the housing market over time rather than in the near term.

Will the budget impact interest rates, and what should brokers be telling their clients?

MW: It is unlikely the budget will have any meaningful impact on interest rates. The RBA has stated that the cash rate is likely to be unchanged for an extended period of time and the next move in rates, when it comes, is more likely to be up than down. Against this backdrop, there has been increased interest from clients looking to fi x at least some of their loan exposure.