Interest rate hikes over the past couple of years have reduced borrowing capacity

Australia’s housing affordability crisis is eroding faith in the Great Australian Dream, with average homes increasingly out of reach for typical earners, experts say.

Investment bankers are now advocating for rental reforms to support the rising number of long-term tenants as house prices outpace income growth, Domain reported.

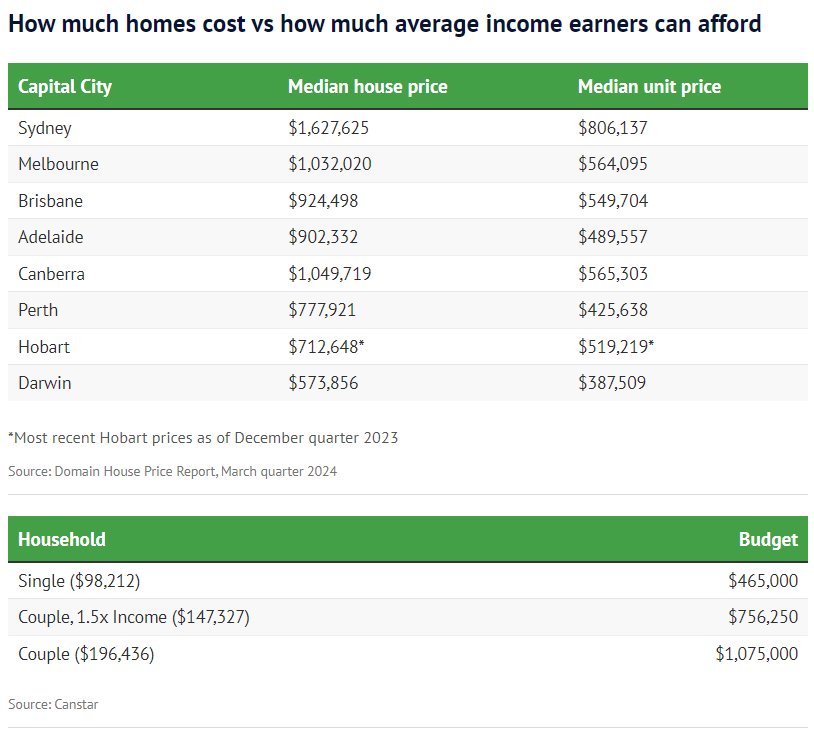

According to Canstar modelling, a household with one partner earning an average income and the other working part-time could afford a home worth $756,250 if they saved a $151,250 deposit plus transaction costs. This budget falls short of the average house price in all capital cities, except Hobart and Darwin.

For dual full-time earners, the budget increases to $1.08 million with a $215,000 deposit. This amount covers median house prices in most cities, except Sydney, where it is half a million dollars short.

Single workers looking to buy a unit have a budget of $465,000, which is insufficient for the median unit price in any capital city, except Perth and Darwin.

Over the past two years, 13 interest rate hikes have reduced borrowing capacity, pushing once-affordable suburbs out of reach as property prices remain high.

“We effectively capitalised zero interest rates into house prices during the boom over 2021,” said Carlos Cacho (pictured left), chief economist at corporate finance and markets firm Jarden. “Since then, we know that borrowing power has gone back by roughly 30%, a little bit more or less depending on the household. The person who could afford to buy when rates were zero can no longer afford to buy.”

Prices have been sustained by wealthier buyers with family financial support, Cacho added.

“This significant generational wealth transfer that has allowed people to enter the market that, arguably if it was just based on their income, they would struggle, but because they’ve been able to subsidise their income with cash or gifts or guarantees that’s allowed them to borrow,” he said.

“Unfortunately and sadly, it means the average household can no longer afford the average home. You see across most of the capital cities, you now need to be in the top 40% of income earners to afford an average home if not higher in cities like Sydney, and that’s a big shift.

“For some it will mean home ownership will be delayed or perhaps not achieved. If we do see a rise over time of long-term renters, how do we adjust our regulatory settings.”

AMP chief economist Shane Oliver (pictured right) also highlighted the challenges average households face in purchasing homes.

“The combination of very high house prices relative to people’s incomes along with the rapid rise in interest rates which have taken them back to levels last seen early last decade have resulted in a bit of a double whammy, dramatically blowing out the shortfall that an average home buyer would have in trying to get into the property market,” he said.

“There’s been a pool of buyers who can rely on the bank of mum and dad or they might have had excess savings built up through the pandemic.”

Some buyers are relocating to Brisbane or Perth to afford homes, he added. Increased housing construction is needed to boost supply, but rising building costs have complicated this.

“Builders have been going bust,” Oliver said. “It’s hard to see how precisely it resolves itself.”

Want to be regularly updated with mortgage news and features? Get exclusive interviews, breaking news, and industry events in your inbox – subscribe to our FREE daily newsletter. You can also follow us on Facebook, X (formerly Twitter), and LinkedIn.