November data shows increases in household deposits and in loan books

The latest data from the Australian Prudential Regulation Authority (APRA) have revealed Australians were able to stash an extra $10.5 billion in the bank in November, resulting in another increase in household deposits.

“Another month, another record high for deposits as Australians stash their cash in defiance of the rate hikes,” said Sally Tindall, research director at RateCity.com.au.

“This data illustrates just how determined people are to keep a hold of their cash, ready for a rainy day. Australians managed to stash more than $10 billion extra in the bank in the month of November alone.”

This brings the total value of household deposits to a record high of $1.43 trillion. In addition, the data from APRA’s monthly authorised deposit-taking institution statistics shows an increase of more than $100 billion in household deposits compared to the same month the prior year.

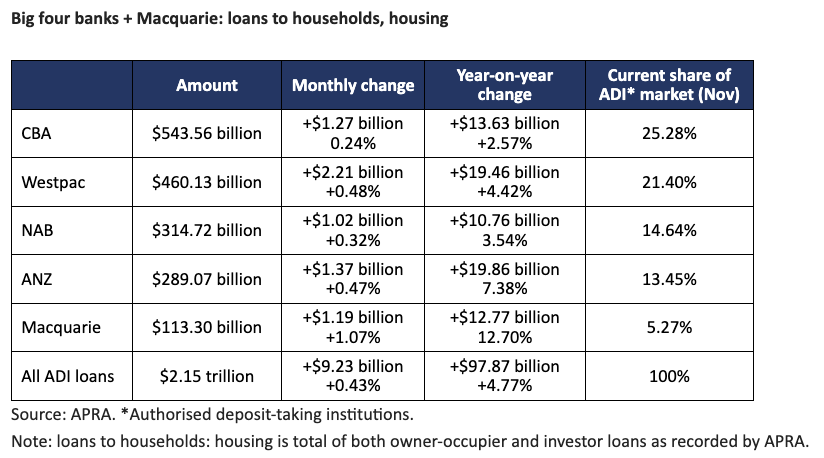

Also in November, the total value of home loans grew to $2.15 trillion, up 0.43% compared to the previous month and up 4.77% compared to the same month the previous year.

The big four banks also saw increases in their loan books in November: Westpac, up 0.48%; ANZ, up 0.47%; NAB, up 0.32%; and CBA, up 0.24%. Meanwhile, Macquarie posted an increase of more than 1% for a fourth time, with its loan books up 1.07% in November.

“There are two sides to every story – so while some people’s nest eggs are getting bigger, other households have barely scraped through Christmas,” said Tindall.

“ANZ posted yet another healthy rise in its home loan book as it woos refinancers still looking for a cashback deal. Westpac’s subsidiaries are also still flying the cashback flag which is likely to be at least partly responsible for the banking group’s above average growth in the month of November.”

Have thoughts about this story? Leave a comment below.