Thinktank's head of sales and distribution presents an overview of changes in Australia's commercial property markets

Thinktank's head of sales and distribution presents an overview of changes in Australia's commercial property markets

Thinktank Commercial Property Finance specialises in providing lending solutions for the purchase, refinance and release of equity using commercial property as security. As such, Thinktank is continually monitoring the state of commercial property across the country and we produce monthly updates on the present and future outlook for the entire property market.

RBA rates have been left unchanged in August for yet another month at the record low of 1.50% reaching one year at this level. The series of regulatory actions to curb housing price growth in Melbourne and Sydney appears to be spreading to commercial sectors but residential markets seem to have temporarily bounced in July. The unemployment rate stayed steady but it was low on the Consumer Price Index (CPI) annualised for the second quarter that sealed the no change position.

Further evidence of discounting of new unit prices in Melbourne and Sydney has been widely reported. Statistics showed strong gains in Melbourne residential unit prices. Auction clearance rates for July were also up in the Victorian capital. The commercial and industrial sectors in both cities remain strong.

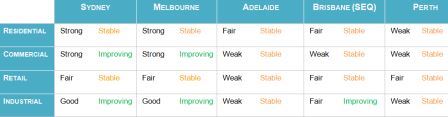

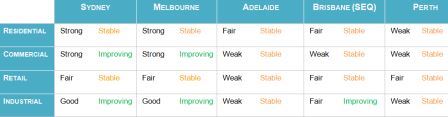

At Thinktank we have made no changes to our trends or ratings in part of the result of confirmation the RBA’s position on Monetary Policy. We still have six markets that are strong and good and seven that are weak. Sydney and Melbourne retail remain fair and stable. In contrast, Perth and Adelaide have six ratings weak but all trends are stable. Brisbane has one improving trend which is Industrial, and commercial there remains weak and stable. Residential units continue to be a concern, especially in the east coast capital cities with a recognition that a substantial correction in that sector may have an impact on other Residential property prices as well as flow on effect to Retail.

The following table provides a summary as to Thinktank’s view of the commercial property sector :

Peter Vala is head of sales and distribution at non-bank lender Thinktank Commercial Finance. He's also worked at ANZ, ME, St George Bank and NAB. For a more detailed commentary or information on commercial property loans including SMSF LRBAs, you can visit thinktank.net.au or Thinktank's LinkedIn page.

Peter Vala is head of sales and distribution at non-bank lender Thinktank Commercial Finance. He's also worked at ANZ, ME, St George Bank and NAB. For a more detailed commentary or information on commercial property loans including SMSF LRBAs, you can visit thinktank.net.au or Thinktank's LinkedIn page.

Thinktank Commercial Property Finance specialises in providing lending solutions for the purchase, refinance and release of equity using commercial property as security. As such, Thinktank is continually monitoring the state of commercial property across the country and we produce monthly updates on the present and future outlook for the entire property market.

RBA rates have been left unchanged in August for yet another month at the record low of 1.50% reaching one year at this level. The series of regulatory actions to curb housing price growth in Melbourne and Sydney appears to be spreading to commercial sectors but residential markets seem to have temporarily bounced in July. The unemployment rate stayed steady but it was low on the Consumer Price Index (CPI) annualised for the second quarter that sealed the no change position.

Further evidence of discounting of new unit prices in Melbourne and Sydney has been widely reported. Statistics showed strong gains in Melbourne residential unit prices. Auction clearance rates for July were also up in the Victorian capital. The commercial and industrial sectors in both cities remain strong.

At Thinktank we have made no changes to our trends or ratings in part of the result of confirmation the RBA’s position on Monetary Policy. We still have six markets that are strong and good and seven that are weak. Sydney and Melbourne retail remain fair and stable. In contrast, Perth and Adelaide have six ratings weak but all trends are stable. Brisbane has one improving trend which is Industrial, and commercial there remains weak and stable. Residential units continue to be a concern, especially in the east coast capital cities with a recognition that a substantial correction in that sector may have an impact on other Residential property prices as well as flow on effect to Retail.

The following table provides a summary as to Thinktank’s view of the commercial property sector :

Peter Vala is head of sales and distribution at non-bank lender Thinktank Commercial Finance. He's also worked at ANZ, ME, St George Bank and NAB. For a more detailed commentary or information on commercial property loans including SMSF LRBAs, you can visit thinktank.net.au or Thinktank's LinkedIn page.

Peter Vala is head of sales and distribution at non-bank lender Thinktank Commercial Finance. He's also worked at ANZ, ME, St George Bank and NAB. For a more detailed commentary or information on commercial property loans including SMSF LRBAs, you can visit thinktank.net.au or Thinktank's LinkedIn page.