After the difficulties of last year, the banks are back on top, with most scores rising well above the highest ranking received in 2019. With the lift in broker sentiment also came a complete shake-up of the top spots

LAST YEAR’S responses to the Brokers on Banks survey mirrored the mood of brokers across Australia following the royal commission and the subsequent difficulties of working with the banks. This year, however, all that seems to be behind us.

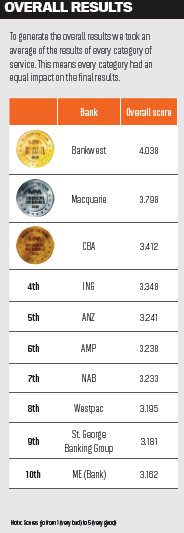

In 2019, for the second year in a row, the winner of the survey was major bank ANZ; its overall ranking was 2.54, and it was one of six banks with a score above 2. In contrast, this year the top score was 4.03, and scorers starting at 2 were at 13th position and under.

What else has changed in the last 12 months? Well, ANZ has lost its top spot. Instead, the bank has fallen to fi fth place, and Bankwest has moved up from second position to claim the winning title. Another impressive move saw Macquarie jump from eighth to runner-up.

While the profi le of brokers who usually respond to these surveys remains more or less the same each year, interestingly, those taking this year’s survey have broken the mould. Usually, brokers from NSW and Victoria make up the majority of respondents, but Victoria took a step back in 2020 and brokers from the state made up less than 16%.

We saw more experienced brokers take part in the survey this year. While in 2019 the largest proportion of respondents had only been in broking for between three and five years, this year the majority have been brokers for more than six years, with most having worked in the industry for more than 15 years.

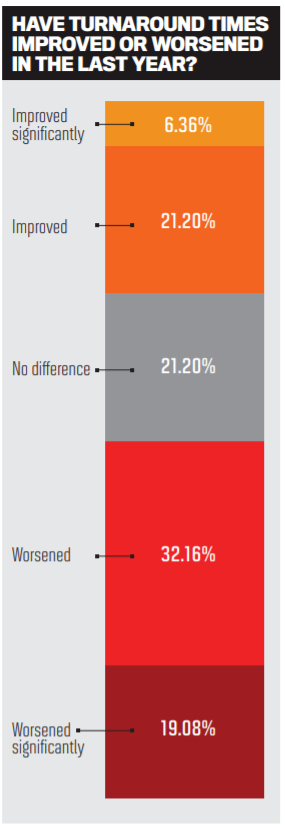

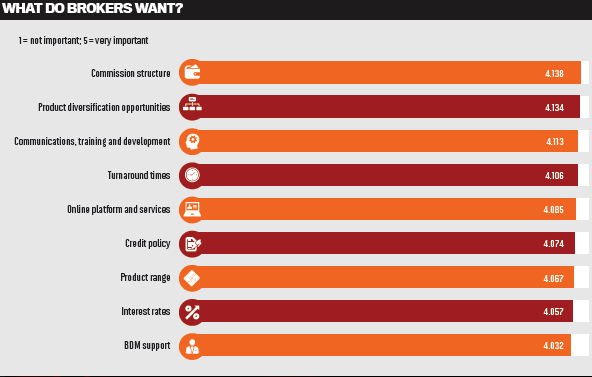

In an almost shocking twist, when brokers were asked what their most important priorities were, turnaround times was not ranked first, as it usually is. Instead, commission structure was was ranked as highest priority, with product diversification opportunities a close second.

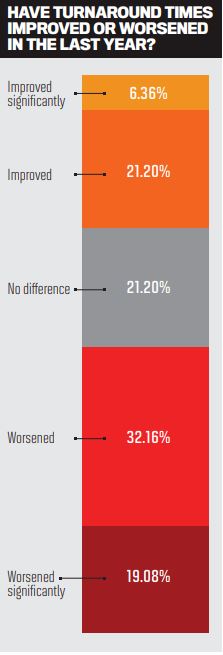

This is despite the fact that most brokers believe turnaround times have worsened over the last year, which would suggest it should become a more important issue. Product diversification opportunities, which is usually much lower down the priority list – last year hitting the bottom at ninth place – has grown substantially in importance, presumably as more brokers look to expand their portfolios. The importance of interest rates has also dropped, but this could be the result of banks’ rates decreasing so dramatically alongside the RBA rate cuts.

As you flick through the following report, the top three banks will soon become apparent. The bank in first place took out six of the nine categories and came second in the other three categories – so it’s a standout on every page. The bank in second place also received an award in every category and has a particular reason to celebrate after jumping from eighth place last year.

As always, thank you to everyone who took part in the survey. It provides a wonderful insight into the changing sentiments of brokers and enables not just us but the banks themselves to see where they can improve in the future.

PRODUCTS AND PRICING

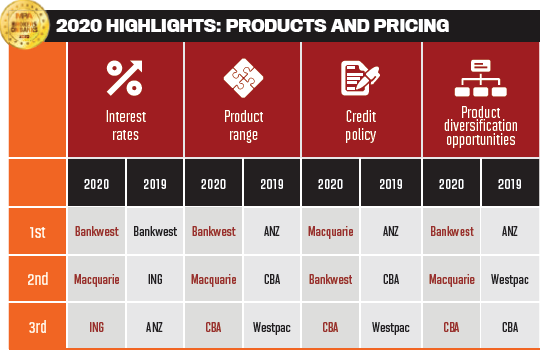

With the RBA cutting rates over the past 12 months, the pricing of home loans has certainly improved. One bank in particular has made great gains this year in the ranking not only of its interest rates but its product range, credit policy and diversification opportunities

Now, rates in Australia are at record lows. This possibly explains why more than 54% of brokers responding to our survey said product ranges and pricing had improved – although the response was similar last year.

In this year’s survey, we asked brokers whether they thought banks were passing on the best savings to customers, considering the low interest rates. Respondents listed banks like Bankwest, Macquarie and ING, which were the top three in the interest rate category. Other banks listed included AMP, St. George and regional bank Heritage.

“The non-majors have passed on greater savings, have better upfront rates without the need to ask for pricing, such as Macquarie Bank,” said one broker. While many said some were passing on savings, others were not so convinced.

“None of the banks are passing on the savings to existing customers. The gap between what banks are offering to new clients and what their existing clients are receiving is astonishing. Sometimes it can be as much as

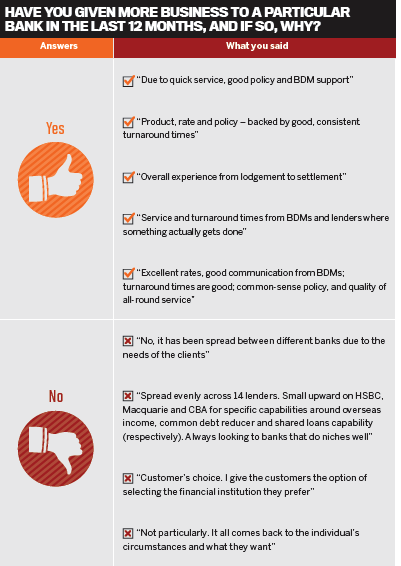

Interest rates and product ranges are an important factor when brokers choose to use certain banks. In the survey, we asked whether brokers had given more business to a particular bank in the past 12 months, and why.

Most brokers pointed to product ranges and policy as their main reasons for sending loans to banks. One broker said they had sent more business to certain banks because of their products, rates and policies – backed by good, consistent turnaround times.

“I have the majority of IO investment loans going to Virgin Money due to their competitive rates, velocity points and low fees, as well as servicing,” said another.

One respondent said they used Macquarie because of its rates and service and ANZ for its product offering and the number of different options it could provide.

Based on the survey feedback, product diversification opportunities are particularly important to brokers this year. Respondents placed this category as the second most important out of nine categories.

Bankwest did particularly well in the areas of product and pricing. The results in this category are in stark contrast to last year’s, when one major bank took home gold medals for product range, credit policy and product diversification opportunities and two other majors were also listed. This year, Commonwealth Bank was the only major to place at all in these areas.

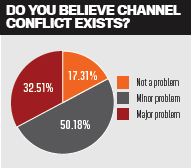

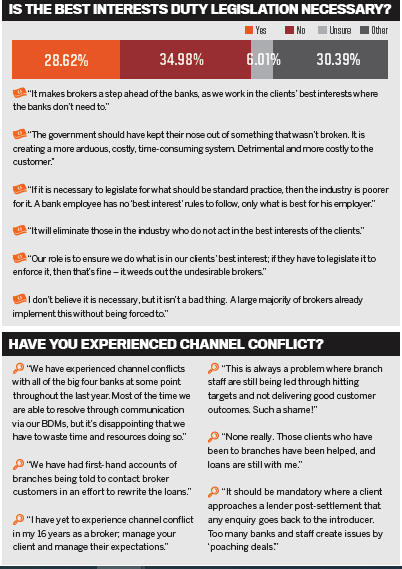

Channel conflict was also highlighted as a continuing problem. More than 80% of respondents said it was a minor or major issue, although this was a slightly lower proportion than in the previous two years. Asked at which banks they had had a particular experience with channel conflict, the top three picked by brokers were all major banks.

One broker said, “They all have best interest duty to themselves. Channel conflict is alive and well.”

Several brokers also talked about banks phoning their clients and trying to entice them away, but one said it was not necessarily the banks’ fault.

“I find that it is individuals at organisations that cause the conflict,” they said. “The lender can see in the system that the loan has been introduced to the bank via a broker, and yet they still internally refinance the loan, oddering lower rates and cashback, which is not available via the broker channel.

“I have had instances where the bank staff advise the client they should not have engaged a broker at all, and that we are only doing business to be paid a commission and not acting in the best interest of the client.”

SUPPORTING BROKERS

After all the scrutiny and regulatory changes, brokers are prioritising banks that are sticking up for the industry and making processes easier

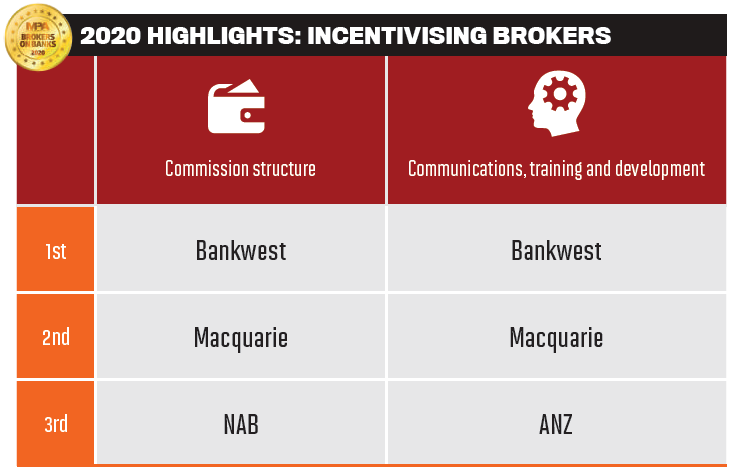

COMMISSION STRUCTURE came out on top as the most important category in this year’s survey, despite only being voted the eighth most important for the last two years. Brokers are asked to rank each category from 1 to 5 in terms of its importance, and then the average of these is calculated. Commission structure received a score of 4.138, while last year it received a score of just 3.63.

Although it seems interesting that commission is more of a priority this year, last year’s survey was completed just before the royal commission’s fi nal report came out, recommending the abolition of trail, and thus brokers may not yet have realised the risk to their remuneration.

While the Coalition government decided to keep trail and hold a review in 2022 to determine the consequences of changing broker pay, it is clearly still front of mind for brokers.

While the Coalition government decided to keep trail and hold a review in 2022 to determine the consequences of changing broker pay, it is clearly still front of mind for brokers.

The non-majors have made gains in the commission structure category this year, with Bankwest taking gold, knocking ANZ off the top spot from last year. NAB has managed to remain in the top three but has fallen to third place, giving Macquarie a spot at second.

These scores could also be a reflection of brokers’ attitudes towards the major banks that have supported them with their commission structure. For instance, Commonwealth Bank placed in fourth position last year, but this year it came in at 14th – which was possibly a reaction to comments made by the major bank’s CEO during the royal commission hearings.

Some brokers have also been turning more to the banks that provide support in areas beyond commission, for example through BDMs, online platforms and better communication.

One broker commented that they gave more business to those who supported them with “decent credit policy and, importantly, turnaround times”.

“This gives us a point of difference to the local bank branches, which have terrible turnaround times,” the respondent added, explaining that they gave more business to the likes of Bankwest, Commonwealth Bank, ING and Macquarie.

Communications, training and development was voted the third most important category for brokers, and banks have been making a point of focusing on these areas over the last year as they continue to push for diversification and keep track of the changing regulations.

Bankwest and Macquarie also took the top spots in this category, and respondents praised these two banks when asked whether brokers had given more business to any particular banks.

Talking of Macquarie, one broker said, “Their rates have remained reasonably competitive; [they have] a relatively broad policy and exceptional turnaround times. Their BDM is also exceptional!”

TECHNOLOGY, TURNAROUND TIMES AND SERVICE

Despite the fact that technology and online platforms are supposed to speed up the loan process for brokers, many have complained of having to do more work and wait longer for a decision

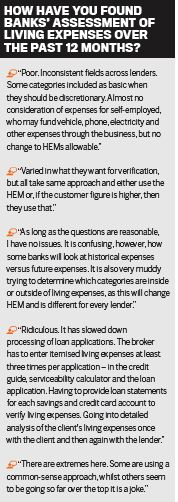

NOT ONLY did the royal commission call out bad behaviour by the banks when it came to lending money, but the industry has been subject to other reviews and scrutiny, such as from the Productivity Commission and ASIC.

Commissioner Kenneth Hayne, in his interim report released in 2018, noted the banks’ use of the Household Expenditure Measure benchmark. He said this “can lead only to the conclusion that in many of those cases the broker has not taken any effective steps to inquire into, or verify, the expense information supplied by the borrower”.

Since then, some have criticised banks for going too far the other way, requiring an increased amount of documentation to support their expenses, and in many cases they conduct extra follow-ups to scrutinise borrowers’ expenses.

There may be light at the end of the tunnel, though. One broker said banks had “spiked to the harsh end of the spectrum and then dropped back a little”.

There may be light at the end of the tunnel, though. One broker said banks had “spiked to the harsh end of the spectrum and then dropped back a little”.

Another broker said it had become “ridiculous”. “It has slowed down processing of loan applications. The broker has to enter itemised living expenses at least three times per application,” they added.

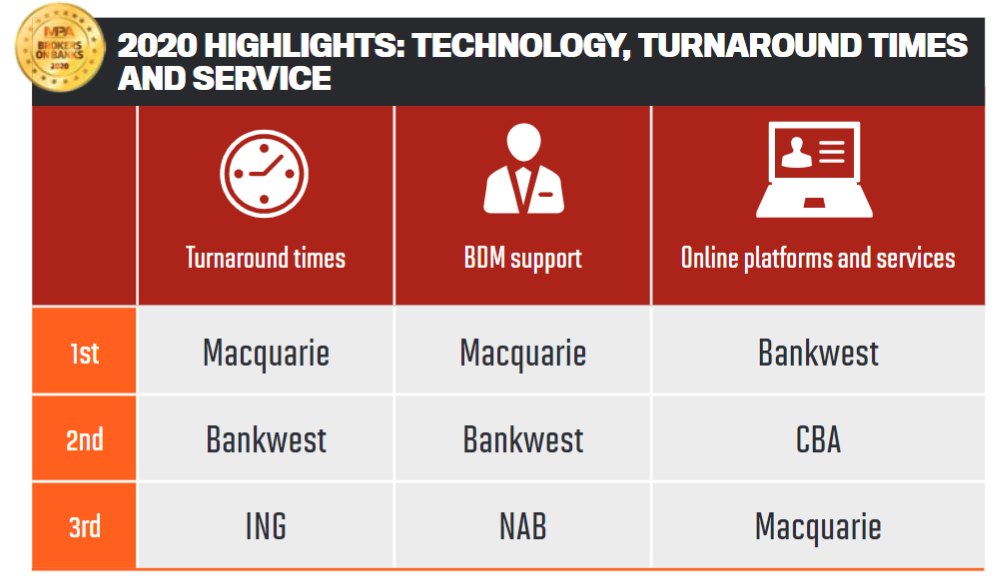

It’s no surprise then that turnaround times continue to be a problem for brokers, with more than 50% saying they had worsened or worsened significantly.

For some respondents, it was not just the increased workload making turnaround times worse. A number pointed to the banks reducing their staff and the impact this had.

When asked what technology had helped improve turnaround times, one broker said, “Upfront valuations have helped, but the staffing at banks continues to be a problem.” For others, technology had made much more of an impact. “Bankwest has continued to provide excellent turnaround times. Their platform and having a single file owner gives them consistently high service levels, which they meet,” another broker said, highlighting the bank’s use of electronic signatures for loan contract documents.

This was not the opinion across the board, however. Many brokers said turnaround times were not improving. “Technology seems to create situations where you have to repeat processes,” said one broker.

WHAT YOU’RE SAYING

AS A result of the royal commission’s final PRIZE QUESTION: BROKERS ON LENDER CHOICE report, the government has passed a bill to ensure mortgage brokers work in the customer’s best interests. Commissioner Hayne had raised concerns about a conflict of interest between brokers and their customers, and in the final report he recommended that, in relation to home lending, mortgage brokers must act in the interests of the borrower.

In August 2019 the legislation went out to consultation, and in November Parliament released a draft bill, to which the industry began responding with suggested changes. In February this year, the legislation was officially passed and is due to come into play on 1 July.

While there has been mixed reaction to the duty across the industry, a slightly higher proportion of survey respondents thought the legislation was unnecessary. Some said it would make the industry a better place, but others said it would create more work.

Another topic that continues to be an issue for many brokers is channel conflict. This year, more respondents than in 2019 said it was ‘not a problem’, but over 80% said it was a minor or major problem. The banks specifically called out were all major banks. According to ASIC research, the average broker sends 80% of loans to four lenders, so as our Prize Question we asked brokers if this was true for them. Again, there were mixed results, and some responses are highlighted on this page.

Becoming the first non-major bank to take the top spot in our Brokers on Banks survey, Bankwest has proved that with a commitment and focus on the broker industry, it can make an impact. Brokers have clearly noticed the improvements, ranking Bankwest signifi cantly higher than any bank in last year’s survey.

The bank appeared in the top two in every category and was the only bank to receive an overall rating of above 4. It did particularly well in the area of interest rates – keeping its gold medal from last year – and in a year of dropping rates this reflects just how much brokers trust that the bank is passing on those cuts.

Bankwest also ranked much higher than all other banks in the category of communications, training and development. After last year’s secondplace position, it made great gains by working closely with the broker industry to ensure brokers were not only kept up to date but were also continually trained.

Rising from a score of less than 2 in 2018 to second place last year with a score of 2.50 and now to the peak position with a score of 4.021, it will be interesting to see how Bankwest continues to work with the industry and where it places next year.

MACQUARIE

MACQUARIE

Position in 2019: 8th

Position in 2018: 9th

If Bankwest was the big story from last year, rising through the ranks to place second, Macquarie is certainly the story for this year. Leapfrogging into second place after coming in eighth and ninth in 2019 and 2018, respectively, is a huge accomplishment.

Throughout this year’s survey brokers continually praised Macquarie in areas such as BDM support and credit policy, which reflects the gold medals the bank achieved in those areas. While BDM support ranked bottom of the list in terms of importance to brokers, this was not refl ected in their wider responses.

Brokers talked about fantastic BDMs as key reasons for going back to lenders with more business, and whenever Macquarie was mentioned, so were its BDMs.

But the highest score across the board went to turnaround times, giving Macquarie its third gold medal. A win in this category, which brokers usually find most important, is an achievement in itself.

Position in 2019: 3rd

Position in 2018: 3rd

For the fourth year in a row, CBA has once again been awarded the bronze medal. Despite its poor results in categories like commission structure, it did take away medals in several categories. In fact, it won four medals in total – more than any other major bank.

Its biggest achievement was in online platforms and services, for which it gained a silver medal. CBA might be pleased to know this after investing in its technology and services; however, it did drop back in this category compared to last year, when it scored a gold. It also fell back from gold to a bronze medal for its credit policy, despite the scoring being so much higher than last year; however, the scores between the top three were incredibly close.

While the rest of the major banks have fallen back – a particular blow for last year’s gold medallist – the fact that CBA has remained in the top three is a huge deal and one it should be proud of. Let’s see how the major banks fare in another year’s time.

4TH ING

Position in 2019: 6th

Position in 2018: 8th

Climbing the ranks to narrowly miss out on a medal, ING is continuing to improve on its services, and brokers have noticed. After winning just one medal in 2019, the non-major has taken out three this year.

Its highest score was for its interest rates – the category the bank won its only medal for in last year’s survey – showing a consistent approach in this area. The two other medals it achieved this year were in important categories: BDM support and turnaround times.

ING was also praised for its Orange Advantage loan, which came in the top three best products when brokers were asked to list their favourite mortgage products of the last 12 months.

5TH ANZ

Position in 2019: 1st

Position in 2018: 1st

While ANZ scored much higher than it did last year, scores across the board were considerably higher, and this pushed the major bank down to fifth position. It is a huge change from last year’s results, which saw the bank achieve five gold, one silver and three bronze medals. This year, ANZ managed to rake in one bronze medal for its communications, training and development.

In fact, when brokers were asked if there were any banks they had stopped using in the last 12 months, ANZ was one of two major banks mentioned the most.

6TH AMP

Position in 2019: 9th

Position in 2018: 10th

AMP beat two of the four major banks in this year’s survey, as both NAB and Westpac have dropped off the Final Results page completely. Considering that AMP came in ninth place last year, making its way up to sixth position was a great achievement. While it didn’t take away any medals, it was hot on the heels of a couple of bronze medallists.

The bank’s highest score was for BDM support, in which it ranked fourth. Brokers also mentioned AMP when asked which banks were passing on the best savings to customers.

BANKWEST RISES TO GOLD

After coming in second place last year, Bankwest has claimed the crown in 2020, with brokers voting for the bank in an incredible six out of nine categories

You came first in six out of nine categories. Why do you think that is? Ian Rakhit, GM third party banking: We like to think it’s because we go that extra mile for our customers, something we’ve taken great pride in doing since 1895.

Our history of serving customers spans 125 years, and we’re incredibly proud that we’ve been recognised for our service to our customers and our contribution to the community and economy on many occasions.

Helping our customers purchase a home or investment property – a real milestone moment in their lives – is a big thing for Bankwest. We feel privileged to help our customers achieve their property goals and improve their financial wellbeing, whether they have come to us directly or through their broker.

Additionally, Bankwest was one of the first institutions to step into the brokering world, and today our relationships with brokers are still just as important to us as our relationships with customers.

After all, more than 80% of our customers choose Bankwest because of their broker! As we look to the future, brokers are a key part of the Bankwest strategy, and we’ll continue to make significant investments in the channel.

Our vision is to deliver brilliant customer experiences every day, and as we evolve our broker offering we stay in continual dialogue with brokers to ensure we’re designing products and services that meet their needs.

Ultimately, by listening to and working closely with brokers, we can help them deliver brilliant service to customers across Australia who own or aspire to own a home.

Your highest score, although a silver medal, was for BDM support. What have you been doing in this area, and why is it important to you?

IR: We’ve designed our support structure so that each broker is supported by a BDM and a desk-based business support manager (BSM), which means that a point of contact is always available. Over the past year, Bankwest has worked with a business management consultancy to support the ongoing development of our BDMs and BSMs.

Brokers tell me they also want to engage with Bankwest in a way that supports their specific business needs, so we’ve designed a flexible model of contact points that empowers brokers to choose how they connect with us for service and support. This means some brokers prefer our highquality phone support, or to use our web chat functionality to talk to our support teams; others prefer our self-service tools, and others want an ‘on the road’ BDM running through scenarios face-to-face in their offices.

The relationships our BDMs have with their brokers is essential to the way we do business, and by providing brokers with the digital tools they need to serve customers, we free up our BDMs to support brokers on other important aspects of the job.

I also want to call out the tremendous work my state managers perform, supporting their teams day in, day out, and for their passionate drive to support our broker partners via daily coaching and support of the frontline teams.

Although your score was high, you were pipped to the post in the turnaround times category. What will you be doing to ensure brokers aren’t waiting longer than they need to for loan approvals?

IR: This is a real focus area for us. The case ownership model has been in operation within the Bankwest broker-introduced housing loan assessment department for a number of years. The process ensures singleperson responsibility for the processing of an application from lodgement to the application being ready to book for settlement.

We feel a real benefit is the broker dealing with the same person through the process, meaning the notes are understood from day one; any mitigants are explained only once; and we can get on with approving the loan. Our broker portal allows our brokers to track home loan applications in real time and view their Bankwest customer details in one spot. We are using broker feedback to help expand our range of digital self-service tools on the portal to make dealing with us simple, consistent and efficient.

More recently, we launched digital signing for home loans. Bankwest home loan customers can now sign their home loan contracts digitally, from any device, within minutes. Previously it took about 13 days for a new home loan to be made ready for settlement. With the new service, this can be reduced to less than seven working days for new home loans and within 24 hours for increases to existing loans.

We also send the documents to brokers for review 12 hours prior to the customer. This not only gives the broker the chance to pick up on any errors and have them fixed; it also allows the broker to contact their customer and tell them the good news, which we know is an important moment in the broker-customer relationship.

Going forward, Bankwest is reviewing the updated responsible lending guidelines, which we expect will support turnaround times. We’ll continue to listen closely to brokers as we explore new ways to improve turnaround times and enhance our offering.

BROKERS’ PICKS

As well as ranking the banks in each of the nine categories, brokers were asked about their favourite mortgage products from the last 12 months. The following gained the most votes.

BANKWEST

BANKWEST