Small and medium enterprises are the lifeblood of a commercial broker’s business, so it’s vital you understand the challenges they’re facing in 2015

Small and medium enterprises are the lifeblood of a commercial broker’s business, so it’s vital you understand the challenges they’re facing in 2015

AS A BROKER, you already wear plenty of hats – product guide, negotiator and gateway to a host of other services. So we can see why adding ‘business expert’ to the mix might not seem worth the effort. But if you’re looking into commercial broking, or even just dealing with self-employed clients, it’s vital you have an understanding of the challenges Australian businesses are facing – and how you, the broker, can be an indispensable asset.

Confidence, or lack thereof

You’d have to have been living in a cave the past few months not to understand the first reality of Australian businesses: They’re lacking confidence. That, not the state of the housing market, is what has caused a succession of RBA rate cuts and a surprisingly toned-down budget. Business confidence slumped throughout late 2014, according to NAB’s Business Confidence Index, stabilising in April at +3 index points. Small and medium enterprises have slightly lower confidence, at +2 for the March quarter. Both measures were at their lowest level since mid-2013.

Why does confidence matter? As NAB’s April business survey notes, “until confidence lifts significantly, it is difficult to see a sustained economic recovery developing – to date, rate cuts have not appeared to do much”. More specifically, however, the confidence of the businesses you cater to should dictate your approach to marketing and the products you’re offering.

Why does confidence matter? As NAB’s April business survey notes, “until confidence lifts significantly, it is difficult to see a sustained economic recovery developing – to date, rate cuts have not appeared to do much”. More specifically, however, the confidence of the businesses you cater to should dictate your approach to marketing and the products you’re offering.

Alongside confidence lies business conditions, a measure that should correlate with confidence but in reality can fluctuate. Business conditions include labour costs, purchase costs and product price growth, amongst others, and they fell in April after rising considerably in March, according to NAB’s April survey. However, in trend terms, conditions are still improving, as they have been since the beginning of the year.

You need to understand the context of flat confidence and business conditions, but it shouldn’t put you off, says Cosi DeAngelis, head of commercial origination at ANZ bank. “Evidenced by the growth we have experienced in our commercial broker business, it’s clear that Australian businesses, whether seeking to start or in growth mode, are increasingly using brokers to source their funding.”

FAST CEO Brendan Wright points to the numbers. “While confidence and conditions have been mostly flat, business lending and asset finance for SMEs, written through brokers, has grown from 8% to circa 20% over the past four years.”

“From a broker perspective, it’s about having those conversations with your clients,” adds Wright, “particularly at a time where it’s advantageous for them to think about investing in commercial assets – get them thinking about where they want to be from a business growth perspective and how you may be able to help them get there.”

In order to help you start those conversations, MPA asked a variety of commercial lenders what they’re funding, and the areas of growth and contraction brokers should look out for.

Commercial property

One area highlighted by several lenders was SMEs that are purchasing their own premises. For specialist commercial lender Thinktank, commercial property purchases made up the majority of destinations for their funding, considerably outstripping refinancing, according to Thinktank’s head of sales and distribution, Peter Vala. Both Thinktank and ING Direct reported that commercial property purchases have been highly important over the last 12 months.

What’s really driving commercial property purchases are SMSFs, Vala notes. “There has been a definite increase in demand for financing the purchase of a commercial property under an SMSF structure, which is consistent with the taxation benefits to small business owners and investors.”

What’s really driving commercial property purchases are SMSFs, Vala notes. “There has been a definite increase in demand for financing the purchase of a commercial property under an SMSF structure, which is consistent with the taxation benefits to small business owners and investors.”

Whilst the Financial System Inquiry questioned the suitability of allowing SMSF investment in residential property, its role in commercial property acquisition is well established.

Cory Bannister, La Trobe’s vice president of sales and distribution, believes SMSFs require a very particular marketing approach from brokers. “[SMSF] is something we are actively promoting to brokers, encouraging them to review their database for self-employed clients to see if they are interested in purchasing commercial property via their SMSF,” he says. “Feedback from our brokers has been encouraging as to the level of untapped potential sitting in their CRM systems.”

In the long term, both domestic and foreign investors may continue driving commercial property investment. La Trobe observed a return of investors to small and medium commercial property (under $3m), suggesting those buyers are “looking to take advantage of the higher yields commercial property is generating in comparison to residential assets, which are performing at or just slightly above cash at present”.

Construction

Connected with commercial property investment is the construction industry. Construction was a major driver for commercial brokers in 2014; in fact, five of our Top 10 Commercial Brokers last year were construction specialists. However, NAB’s recent SME survey described construction as an ‘under performer’. Construction at the top end is also suffering – NAB’s May ASX 300 report (of Australia’s 300 biggest listed companies) noted that “sentiment is particularly weak around very big construction firms”.

Of course, when you’re talking about construction, you do need to draw a very clear distinction between commercial building projects (offices, hotels, etc) and residential construction, which, being tied to the housing market, thus remains strong. The Housing Industry Association’s National Outlook, which was released in May, claimed house building was at record levels, although it admitted that growth was more narrowly concentrated than last year.

HIA chief economist Dr Harley Dale commented that “super low interest rates are doing their job, but there is a lack of complimentary policy reform … the detached house construction cycle has peaked well below its potential because households can’t pay the cost of waiting up to 14 months for titled land, or multiple months for a simple building approval, or borrow the additional amount required to cover government-imposed gold-plating of user pays infrastructure”.

Manufacturing

Manufacturing

According to Thinktank’s Vala, “there is no doubt parts of the manufacturing sector are benefitting from rising home-building activity”. Indeed, NAB’s SME survey saw conditions in manufacturing ‘notably’ improving, albeit only to the neutral mark. That said, manufacturing firms were amongst the most confident SMEs. FAST also nominated manufacturing as an area to look at for the coming few months.

Not everyone is so confident about manufacturing: La Trobe Financial listed it as one of several sectors – including retail and transport – struggling because of ‘inadequate capital capacity’ as a restraint on profitability. They suggested brokers working with these sectors “may wish to focus on ways of releasing capital or consolidating business debts with a view to reducing cash flow drag on the business until conditions improve.”

Long-term challenges

The sectors above represent a small proportion of businesses out there; we picked them for their particular traits and relevance. Whilst it’s impossible to understand the situation of all industries, many businesses – SMEs in particular – do face similar challenges over the long term.

Bankwest’s recent Business Leadership Report contains a vast number of insights into the priorities and fears of small and medium-sized business leaders, which any trusted adviser should know. For example, productivity leadership – increasing profit through improving process and structural efficiencies – is the most popular managerial strategy, selected by one in five businesses.

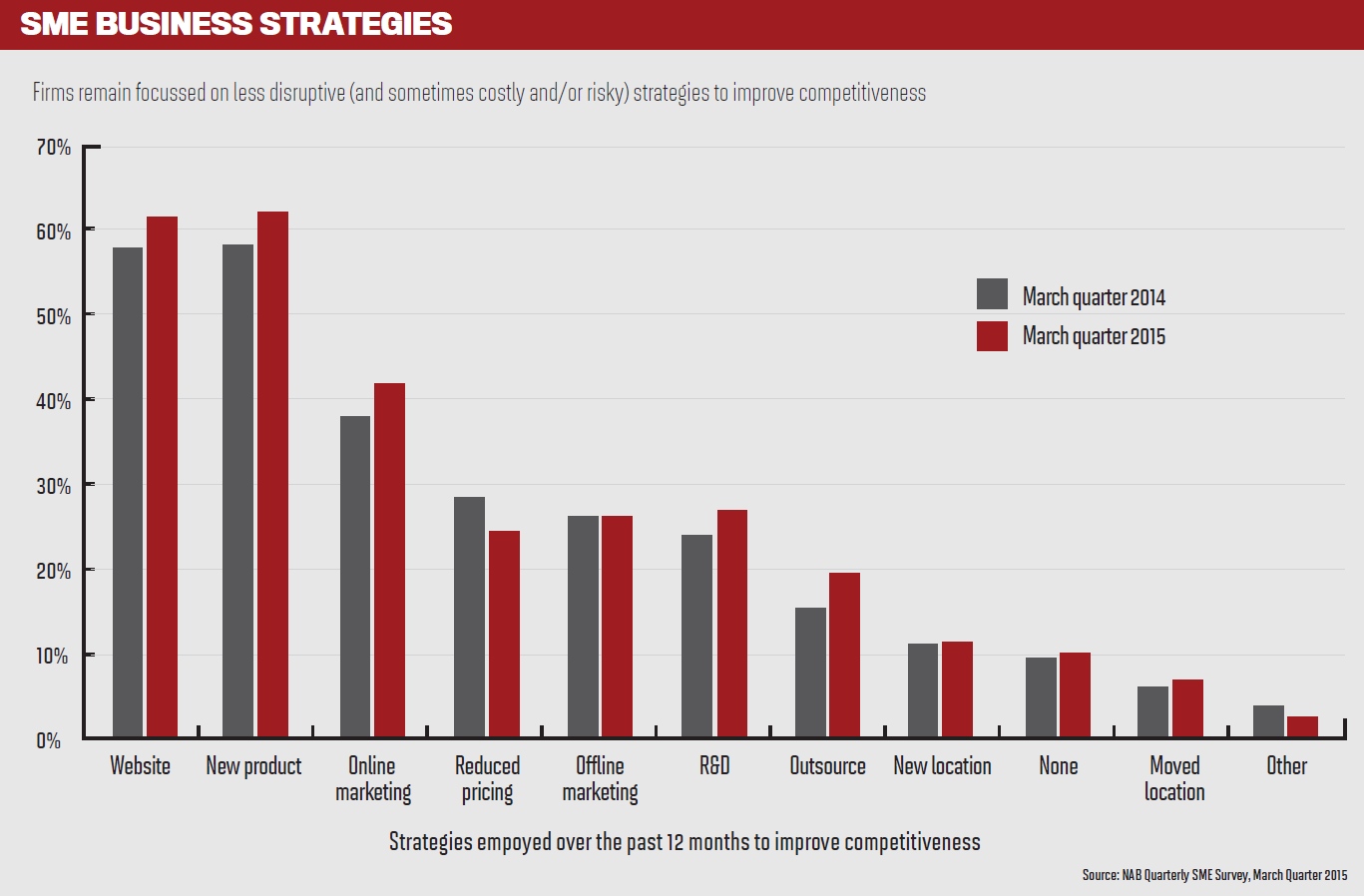

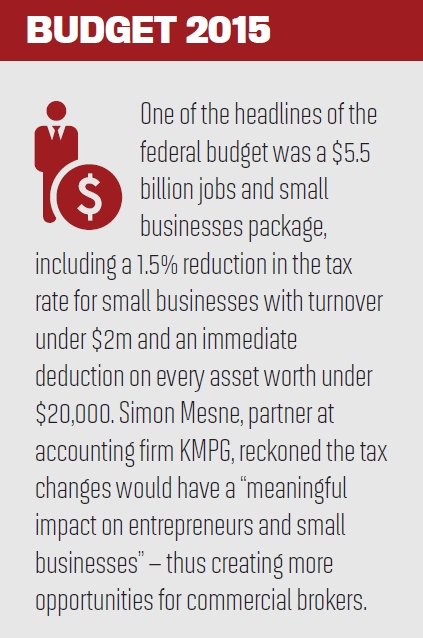

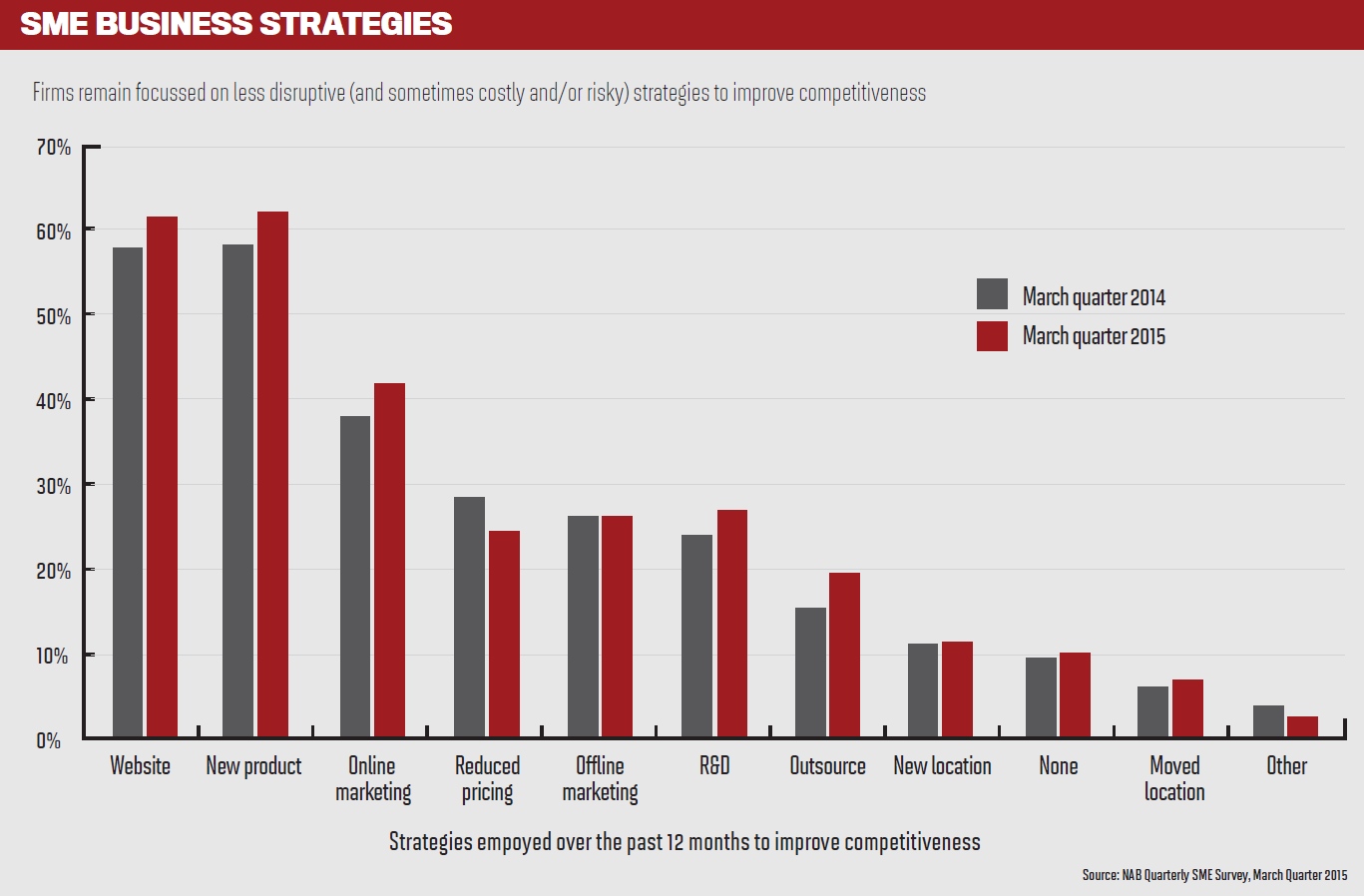

Another indication of strategies being utilised by businesses comes from NAB’s SME report, which looked at strategies adopted in March quarter 2014 and March quarter 2015 in order to increase competitiveness. The relevant statistics here are much more obvious – just over 10% of businesses had a ‘new location’, whilst around 6% ‘moved location’ – and both statistics were up from 2014, encouragingly.

The NAB SME report also looked at the long-term constraints facing SMEs, and found that cash flow, demand and staffing were the biggest constraints in 2014. These reduced in 2015, now that government policy and tax are perceived as more restrictive, as well as interest rates and credit “showing signs of becoming more restrictive”. Commercial brokers are, of course, expertly placed to respond to the latter two concerns.

Finally, ANZ’s De Angelis points to Australian businesses expanding abroad as an area of opportunity. “Research has revealed that 25% of Australian businesses operating internationally require additional debt funding every year, whilst 62% of those businesses said they found it difficult to source this funding from Australian financial institutions,” he says. “Australia has negotiated a number of significant free trade agreements with key trade partners, and there is huge potential for the country to broaden the mix of its export base.”

Knowing the cycle

Knowing the cycle

It’s important to know your current and potential business clients inside out – their industry, challenges, constraints and management philosophy. Some of that knowledge can come in useful when picking clients who suit your specialty, and many of our Top 10 Commercial Brokers are extremely selective; Adam Slade-Jacobson of Monark Property Finance, who came in second, wrote $93 million in 2013-14 over just three loans.

Lenders also can help provide you and your client with specific business intelligence. ANZ point to their ‘A-Z reviews’ of commercial clients, which they provide to broker-originated clients whilst utilising the expertise of business bankers. La Trobe Financial have senior credit analysts, and Thinktank and FAST have specialist BDMs, often with a credit background.

However, it’s not about picking a ‘winning’ industry; the commercial broker is there for the long term, Thinktank’s Vala argues. “Irrespective of the level of confidence within the consumer or business environment, a broker should be positioned as a member of a client’s circle of trusted advisers,” he says. “The broker is there to help facilitate any financial changes the client is seeking within their business, from either raising debt for expansion purposes or assisting with the restructure of debt to better terms and conditions. Rather than focusing on specific industry segments, looking for opportunity, a broker should constantly be considering where they can bring value to the table for their customer through the various cycles.”

FAST CEO Wright holds a similar view: “We’ve had brokers have great success in all sorts of industries, such as manufacturing, retail, healthcare, agriculture – the list goes on. I would advise brokers that, rather than picking a specialty based on which is easiest, they go with what feels most comfortable for them – both in terms of the customers they tend to speak to every day, and the industries that are most significant in the economy of their local area.”

For ING’s Woolnough, the broker plays a valuable role as a mediator between banks and SMEs. “Brokers can serve as a conduit in observing and experiencing the challenges that SMEs face and communicating these to the banks and wider industry for an opportunity to address these challenges.

“Similarly, over time, banks are required to change processes and request more of SMEs during the banking relationship,” he continues. “Whilst we try to accommodate this as much as possible by streamlining processes, a broker is vital to the customer experience, as they will work to simplify the overall finance process by acting as the dedicated intermediary, put more time back in the customer’s day, and allow the customer to focus on other issues and opportunities at hand in their business.“

And whilst knowledge is vital, it’s the broker’s core skills that make the difference, Woolnough concludes: “The key here is that regardless of which industry the customer is in, the commercial broker will navigate through their challenges and make what some people see as a rather daunting process simple.”

AS A BROKER, you already wear plenty of hats – product guide, negotiator and gateway to a host of other services. So we can see why adding ‘business expert’ to the mix might not seem worth the effort. But if you’re looking into commercial broking, or even just dealing with self-employed clients, it’s vital you have an understanding of the challenges Australian businesses are facing – and how you, the broker, can be an indispensable asset.

Confidence, or lack thereof

You’d have to have been living in a cave the past few months not to understand the first reality of Australian businesses: They’re lacking confidence. That, not the state of the housing market, is what has caused a succession of RBA rate cuts and a surprisingly toned-down budget. Business confidence slumped throughout late 2014, according to NAB’s Business Confidence Index, stabilising in April at +3 index points. Small and medium enterprises have slightly lower confidence, at +2 for the March quarter. Both measures were at their lowest level since mid-2013.

Why does confidence matter? As NAB’s April business survey notes, “until confidence lifts significantly, it is difficult to see a sustained economic recovery developing – to date, rate cuts have not appeared to do much”. More specifically, however, the confidence of the businesses you cater to should dictate your approach to marketing and the products you’re offering.

Why does confidence matter? As NAB’s April business survey notes, “until confidence lifts significantly, it is difficult to see a sustained economic recovery developing – to date, rate cuts have not appeared to do much”. More specifically, however, the confidence of the businesses you cater to should dictate your approach to marketing and the products you’re offering.Alongside confidence lies business conditions, a measure that should correlate with confidence but in reality can fluctuate. Business conditions include labour costs, purchase costs and product price growth, amongst others, and they fell in April after rising considerably in March, according to NAB’s April survey. However, in trend terms, conditions are still improving, as they have been since the beginning of the year.

You need to understand the context of flat confidence and business conditions, but it shouldn’t put you off, says Cosi DeAngelis, head of commercial origination at ANZ bank. “Evidenced by the growth we have experienced in our commercial broker business, it’s clear that Australian businesses, whether seeking to start or in growth mode, are increasingly using brokers to source their funding.”

FAST CEO Brendan Wright points to the numbers. “While confidence and conditions have been mostly flat, business lending and asset finance for SMEs, written through brokers, has grown from 8% to circa 20% over the past four years.”

“From a broker perspective, it’s about having those conversations with your clients,” adds Wright, “particularly at a time where it’s advantageous for them to think about investing in commercial assets – get them thinking about where they want to be from a business growth perspective and how you may be able to help them get there.”

In order to help you start those conversations, MPA asked a variety of commercial lenders what they’re funding, and the areas of growth and contraction brokers should look out for.

One area highlighted by several lenders was SMEs that are purchasing their own premises. For specialist commercial lender Thinktank, commercial property purchases made up the majority of destinations for their funding, considerably outstripping refinancing, according to Thinktank’s head of sales and distribution, Peter Vala. Both Thinktank and ING Direct reported that commercial property purchases have been highly important over the last 12 months.

What’s really driving commercial property purchases are SMSFs, Vala notes. “There has been a definite increase in demand for financing the purchase of a commercial property under an SMSF structure, which is consistent with the taxation benefits to small business owners and investors.”

What’s really driving commercial property purchases are SMSFs, Vala notes. “There has been a definite increase in demand for financing the purchase of a commercial property under an SMSF structure, which is consistent with the taxation benefits to small business owners and investors.”Whilst the Financial System Inquiry questioned the suitability of allowing SMSF investment in residential property, its role in commercial property acquisition is well established.

Cory Bannister, La Trobe’s vice president of sales and distribution, believes SMSFs require a very particular marketing approach from brokers. “[SMSF] is something we are actively promoting to brokers, encouraging them to review their database for self-employed clients to see if they are interested in purchasing commercial property via their SMSF,” he says. “Feedback from our brokers has been encouraging as to the level of untapped potential sitting in their CRM systems.”

In the long term, both domestic and foreign investors may continue driving commercial property investment. La Trobe observed a return of investors to small and medium commercial property (under $3m), suggesting those buyers are “looking to take advantage of the higher yields commercial property is generating in comparison to residential assets, which are performing at or just slightly above cash at present”.

Construction

Connected with commercial property investment is the construction industry. Construction was a major driver for commercial brokers in 2014; in fact, five of our Top 10 Commercial Brokers last year were construction specialists. However, NAB’s recent SME survey described construction as an ‘under performer’. Construction at the top end is also suffering – NAB’s May ASX 300 report (of Australia’s 300 biggest listed companies) noted that “sentiment is particularly weak around very big construction firms”.

Of course, when you’re talking about construction, you do need to draw a very clear distinction between commercial building projects (offices, hotels, etc) and residential construction, which, being tied to the housing market, thus remains strong. The Housing Industry Association’s National Outlook, which was released in May, claimed house building was at record levels, although it admitted that growth was more narrowly concentrated than last year.

HIA chief economist Dr Harley Dale commented that “super low interest rates are doing their job, but there is a lack of complimentary policy reform … the detached house construction cycle has peaked well below its potential because households can’t pay the cost of waiting up to 14 months for titled land, or multiple months for a simple building approval, or borrow the additional amount required to cover government-imposed gold-plating of user pays infrastructure”.

Manufacturing

ManufacturingAccording to Thinktank’s Vala, “there is no doubt parts of the manufacturing sector are benefitting from rising home-building activity”. Indeed, NAB’s SME survey saw conditions in manufacturing ‘notably’ improving, albeit only to the neutral mark. That said, manufacturing firms were amongst the most confident SMEs. FAST also nominated manufacturing as an area to look at for the coming few months.

Not everyone is so confident about manufacturing: La Trobe Financial listed it as one of several sectors – including retail and transport – struggling because of ‘inadequate capital capacity’ as a restraint on profitability. They suggested brokers working with these sectors “may wish to focus on ways of releasing capital or consolidating business debts with a view to reducing cash flow drag on the business until conditions improve.”

Long-term challenges

The sectors above represent a small proportion of businesses out there; we picked them for their particular traits and relevance. Whilst it’s impossible to understand the situation of all industries, many businesses – SMEs in particular – do face similar challenges over the long term.

Bankwest’s recent Business Leadership Report contains a vast number of insights into the priorities and fears of small and medium-sized business leaders, which any trusted adviser should know. For example, productivity leadership – increasing profit through improving process and structural efficiencies – is the most popular managerial strategy, selected by one in five businesses.

Another indication of strategies being utilised by businesses comes from NAB’s SME report, which looked at strategies adopted in March quarter 2014 and March quarter 2015 in order to increase competitiveness. The relevant statistics here are much more obvious – just over 10% of businesses had a ‘new location’, whilst around 6% ‘moved location’ – and both statistics were up from 2014, encouragingly.

The NAB SME report also looked at the long-term constraints facing SMEs, and found that cash flow, demand and staffing were the biggest constraints in 2014. These reduced in 2015, now that government policy and tax are perceived as more restrictive, as well as interest rates and credit “showing signs of becoming more restrictive”. Commercial brokers are, of course, expertly placed to respond to the latter two concerns.

Finally, ANZ’s De Angelis points to Australian businesses expanding abroad as an area of opportunity. “Research has revealed that 25% of Australian businesses operating internationally require additional debt funding every year, whilst 62% of those businesses said they found it difficult to source this funding from Australian financial institutions,” he says. “Australia has negotiated a number of significant free trade agreements with key trade partners, and there is huge potential for the country to broaden the mix of its export base.”

Knowing the cycle

Knowing the cycleIt’s important to know your current and potential business clients inside out – their industry, challenges, constraints and management philosophy. Some of that knowledge can come in useful when picking clients who suit your specialty, and many of our Top 10 Commercial Brokers are extremely selective; Adam Slade-Jacobson of Monark Property Finance, who came in second, wrote $93 million in 2013-14 over just three loans.

Lenders also can help provide you and your client with specific business intelligence. ANZ point to their ‘A-Z reviews’ of commercial clients, which they provide to broker-originated clients whilst utilising the expertise of business bankers. La Trobe Financial have senior credit analysts, and Thinktank and FAST have specialist BDMs, often with a credit background.

However, it’s not about picking a ‘winning’ industry; the commercial broker is there for the long term, Thinktank’s Vala argues. “Irrespective of the level of confidence within the consumer or business environment, a broker should be positioned as a member of a client’s circle of trusted advisers,” he says. “The broker is there to help facilitate any financial changes the client is seeking within their business, from either raising debt for expansion purposes or assisting with the restructure of debt to better terms and conditions. Rather than focusing on specific industry segments, looking for opportunity, a broker should constantly be considering where they can bring value to the table for their customer through the various cycles.”

FAST CEO Wright holds a similar view: “We’ve had brokers have great success in all sorts of industries, such as manufacturing, retail, healthcare, agriculture – the list goes on. I would advise brokers that, rather than picking a specialty based on which is easiest, they go with what feels most comfortable for them – both in terms of the customers they tend to speak to every day, and the industries that are most significant in the economy of their local area.”

For ING’s Woolnough, the broker plays a valuable role as a mediator between banks and SMEs. “Brokers can serve as a conduit in observing and experiencing the challenges that SMEs face and communicating these to the banks and wider industry for an opportunity to address these challenges.

“Similarly, over time, banks are required to change processes and request more of SMEs during the banking relationship,” he continues. “Whilst we try to accommodate this as much as possible by streamlining processes, a broker is vital to the customer experience, as they will work to simplify the overall finance process by acting as the dedicated intermediary, put more time back in the customer’s day, and allow the customer to focus on other issues and opportunities at hand in their business.“

And whilst knowledge is vital, it’s the broker’s core skills that make the difference, Woolnough concludes: “The key here is that regardless of which industry the customer is in, the commercial broker will navigate through their challenges and make what some people see as a rather daunting process simple.”