Fixed rates climb as banks react to economic uncertainties

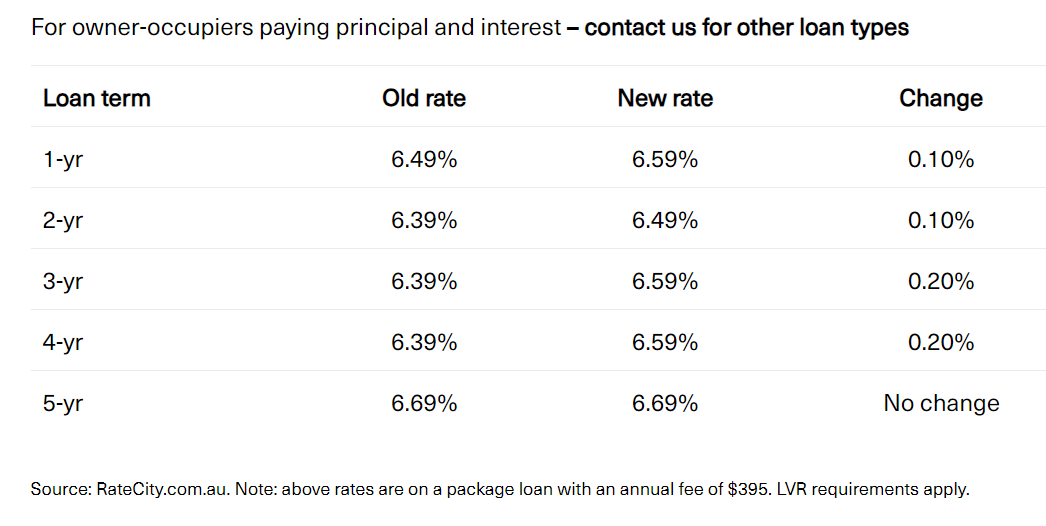

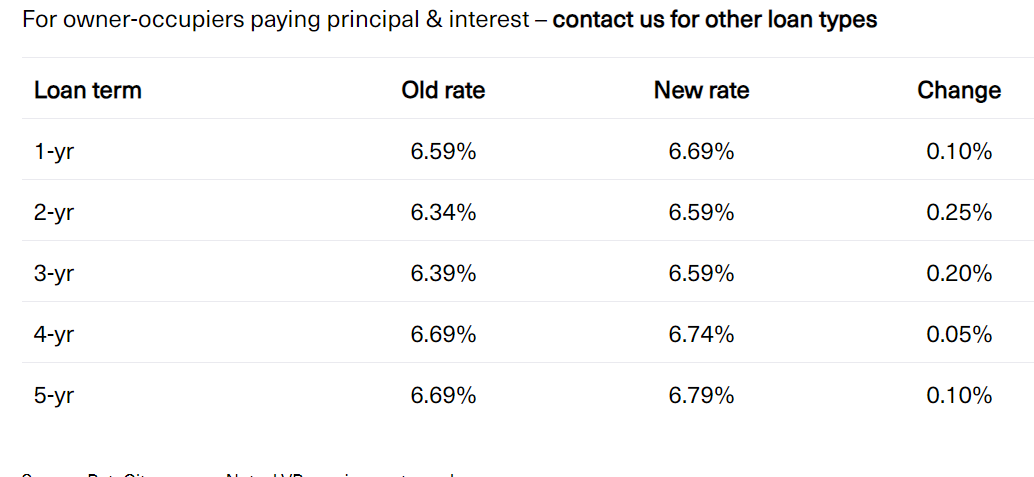

Westpac and NAB, Australia’s second and third-largest mortgage lenders, have raised the majority of their fixed rates for both owner-occupiers and investors, by up to 0.25 percentage points, RateCity.com.au reported.

Westpac has also lifted its lowest variable rate for new customers, in addition to the lender’s Reserve Bank rate rise on Tuesday.

Existing customers of Westpac and NAB will not be impacted by these changes unless they choose to transition to a fixed rate.

Westpac and NAB fixed rate changes

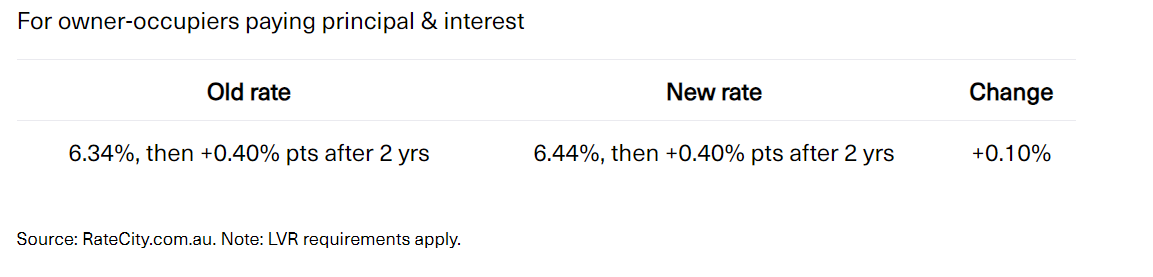

Westpac’s basic variable mortgage, the Flexi First Option Home Loan, has seen a 0.1 ppt increase, for owner-occupiers on principal and interest, as well as investors on both principal and interest and interest-only.

The bank’s lowest variable rate is now 6.44%, but this is an introductory rate for two years, after which it rises by 0.4 ppt.

NAB, meanwhile, has raised fixed rates by up to 0.25 ppt for both owner-occupiers and investors.

Fixed rates rising

Over the past month, 60 lenders – that’s around half the market and includes Commonwealth Bank, Adelaide Bank, AMP, ING, and Macquarie Bank – have increased at least one of their fixed-rate loans, RateCity.com.au research found.

Sally Tindall (pictured above), research director at RateCity.com.au, interpreted the fixed rate moves as a strategic effort.

The “fixed rate hikes from Westpac and NAB are a definitive move from both banks to protect their margins in the face of an uncertain economic outlook,” Tindall said.

“The home loan market has been flooded with hikes over the last month, as banks move their fixed rates to higher ground. With another cash rate hike potentially still on the cards, and a growing expectation that the cost of funding will remain high well into 2024, banks are racing each other to increase fixed rates.”

Tindall suggests that this strategy is a precautionary measure to avoid underpricing fixed-rate loans.

“With just a slither of borrowers opting for a fixed rate right now, this strategy isn’t going to rock the boat, because there’s next to no-one in it,” she said.

Westpac’s variable rate change

Westpac has raised the rate on its basic variable home loan by up to 0.1 ppt, in addition to the recent 0.25 ppt increase following the November cash rate decision. The additional increase is applicable solely to new customers opting for a Flexi First mortgage.

“As a result, Westpac and ANZ now have the equal lowest advertised variable rate out of the big four banks, however, Westpac’s is only a honeymoon rate that rises an additional 0.4 ppt after two years,” Tindall said.

Read the full RateCity.com.au report here. See this article for last week’s fixed and variable rate changes.

Get the hottest and freshest mortgage news delivered right into your inbox. Subscribe now to our FREE daily newsletter.