Sluggish. Fewer transactions. Mega sales down by 75%. Why the Big Smoke is slipping

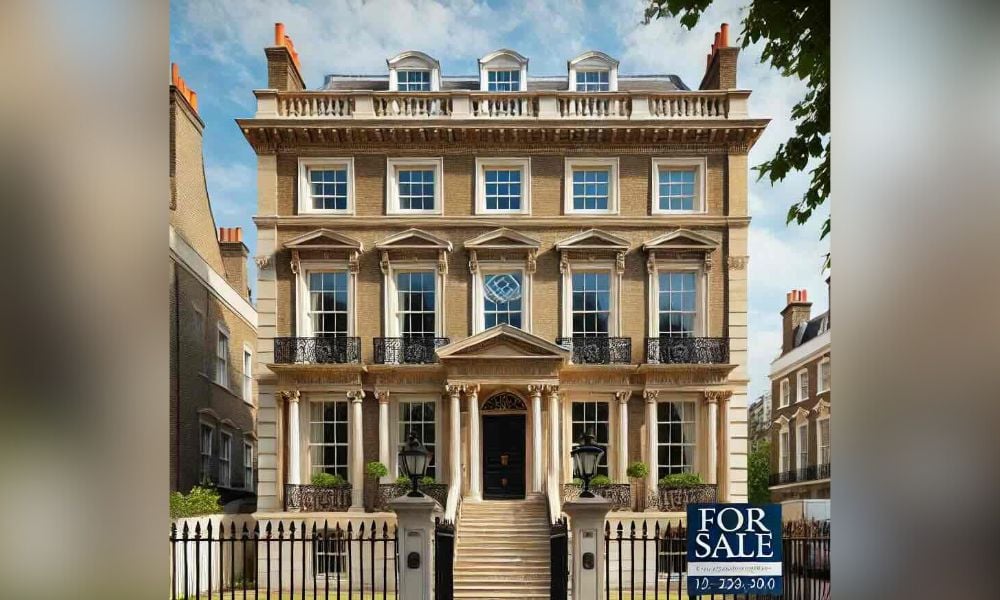

One thing that has always been constant in turbulent times is the allure of our capital city’s real estate. London has always been that best street to buy the worst house on – but maybe not right now.

London’s luxury housing market is sluggish, facing both a drop in demand and fewer transactions. A recent report by Baker Street-headquartered Knight Frank has highlighted a 22% reduction in the sale of homes priced above £10 million over the 12 months leading up to July 2024, compared to the previous year. The picture is particularly grim for the most expensive properties, with only 10 sales above £30 million, a steep fall from the 38 sales during the same period last year. The total value of high-end property sales in London reached £2.77 billion for the past year, substantially down from £4.3 billion.

Camilla Dell, founder of Black Brick told Bloomberg that things are gloomy, “Sentiment in prime central London is significantly down,” as she sees market conditions similar to those of the financial crisis. A substantial amount of inventory, price reductions, and general unease among sellers have characterised the current market.

Data company LonRes also agrees, with its figures showing that there were 7.5% fewer sales transactions in August compared to the same month in 2023. Its figures show that the number of transactions above £5 million were down a whopping 47.2% compared to the previous year – and it’s not due to a lack of stock – those numbers are up by over 30% compared to the same period the previous year.

Market uncertainties are compounded by broader economic factors. July's UK election, which saw the Labour Party take power, heightened market concerns due to expectations of policy shifts. Speculation surrounding tax increases—especially on capital gains and inheritance taxes—has further added to buyer hesitation. Stuart Bailey, head of super prime sales at Knight Frank, emphasises, “The budget is making people wait and see—so it doesn’t matter whether it is good, bad, or ugly. The point is that it’s uncertain, so people are hesitating now.”

Nick Gregori, head of research at LonRes agrees. “The PM and Chancellor are trying to find a balance between being too negative about the state of the economy and making their case for spending cuts and tax rises,” he told the negotiator.co.uk. “Either way, it is not the best for improving sentiment in the housing market. There is a danger that both buyers and sellers move back to a pattern of ‘wait and see’ ahead of the Budget and potential further interest rate cuts.“

Bailey also points out that prices in London’s prime property market are down 14% from their September 2015 peak, and 25% in dollar terms due to the weakening pound since the 2016 Brexit referendum.

As if to further complicate matters, broader economic shifts are influencing buyer behaviour. Recent data from the Office for National Statistics (ONS) shows UK house prices rising by only 2.2% in the year to July 2024, with London seeing a 0.4% decline—the weakest performance across the UK. Meanwhile, house price growth was more robust in other regions, particularly the North East, where prices increased by 3.8%. Despite this, London remains the most expensive housing market in the UK, with the average home costing £533,000.

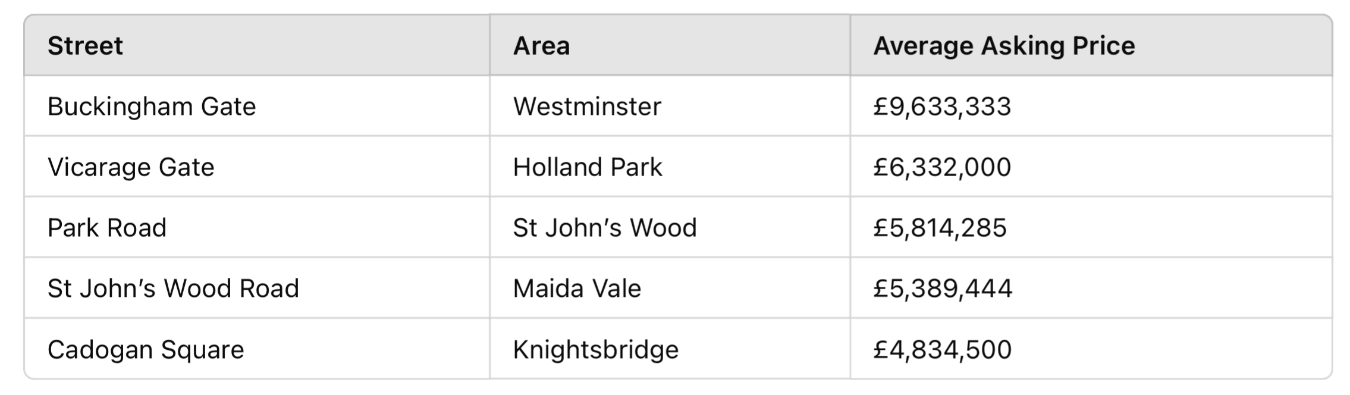

London’s most expensive streets

(Figures; Rightmove.co.uk)

Rising interest rates and rent inflation also contribute to the overall housing market dynamics. The Bank of England’s latest decision to cut interest rates for the first time in four years provided some temporary relief. However, private rents in the UK have continued to climb, with a national average rent increase of 8.4% in the year to August 2024, though London’s rent inflation outpaced the rest of the country, rising by 9.6% to an average of £2,129 per month.

This increasing pressure on the rental market may offset some of the challenges faced by the luxury sales market, as high interest rates and looming tax changes are causing potential buyers to hesitate. Bailey describes the current super prime market as “frustrating” and acknowledges that sellers are lowering prices to push deals through. He suggests that while this may be an opportune time for cash buyers due to reduced competition, the market remains in a holding pattern, with most buyers and sellers awaiting clarity from the upcoming UK budget on October 30.

Meanwhile, the broader UK property market is also feeling the strain. As demand for rental properties outpaces supply, especially in regions like London and Northern Ireland, rental prices are expected to remain elevated, even as inflation begins to stabilize. Experts predict that volatility in house prices could arise, especially as some property owners may rush to sell ahead of potential capital gains tax increases expected in next month’s budget announcement by Rachel Reeves, the Shadow Chancellor of the Exchequer.