However, with annual consumer price inflation averaging 2.9% in the same six-month period, landlords were provided with a real return of 2.3% on their investment.

Buy-to-let investors earned an average gross rental yieldof 5.2% in the second half of 2017, BM Solutions found.

However, with annual consumer price inflation averaging 2.9% in the same six-month period, landlords were provided with a real return of 2.3% on their investment. This was down from 4.3% in the six month period to the end of 2016.

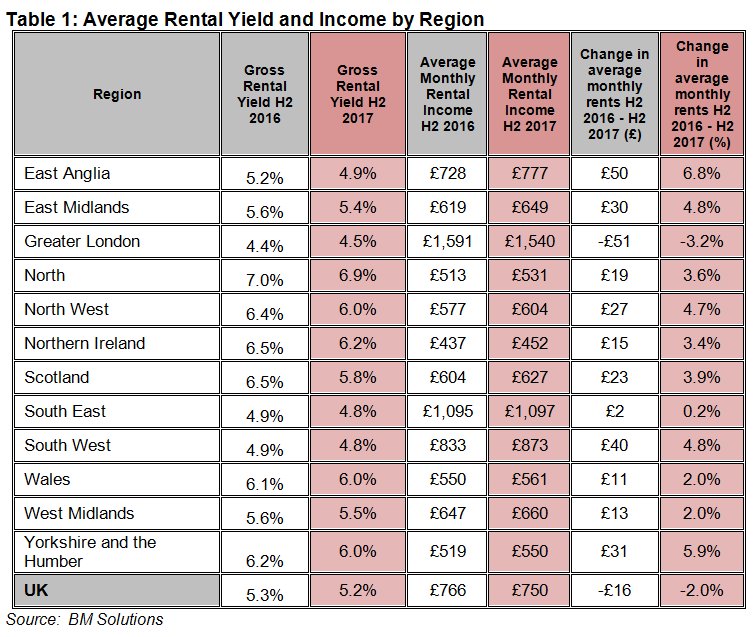

During the same period, they were earning an average rental income of £7502per month from their property. Rental yields in the North are largest, but London and the South East command the highest average rents.

Phil Rickards, head of BM Solutions, said:“At the end of last year, landlords will have seen rental yields remaining broadly stable.

“However, taking into account stamp duty changes in April 2016, the loss of tax relief on mortgage costs and the tighter regulation of affordability assessments, combined with higher prices, it’s not surprising that landlords in the southern regions and London are seeing the lowest yields.”

“More broadly, the market is holding up well following this period of change, which also included new rules for portfolio landlords introduced last year.

“In the second half of 2017, the market saw a small increase in transactions compared to the same period the previous year.”

A distinct North-South divide prevails with the highest yields in the North (6.9%), followed by Northern Ireland (6.2%) and then the North West, Yorkshire and the Humber and Wales (all 6.0%).

The lowest rental yields are in London (4.5%), followed by the South East and the South West (both 4.8%).

The average rent in Greater London remains significantly higher than elsewhere in the UK, at £1,540 per month, but London was the only region to see rents fall in the last six months of 2017 compared to the same period in 2016.

The average monthly rent in the capital is 105% higher than the UK average of £750 and 40% above that in the South East (£1,097), the next highest region. Northern Ireland has the lowest rent in the UK, at an average of £452pm, just over a quarter of the London average.(Table 1)

Buy-to-let market transactions remain broadly stable after tax changes implemented in April 2016 distorted the market

Market data for buy-to-let property purchases with a mortgage in the second half of 2017 showed transactions remaining broadly stable at 38,4003, up slightly by 100 transactions compared to H2 2016.

This follows a period of distortion in the market where many landlords brought forward purchases at the end of 2015 before the changes in stamp duty rules came into effect, and transactions subsequently dropped in 2016.

Overall, buy-to-let purchases with a mortgage in 2017 were 27% lower than in 2016 at 74,900. Transactions are now 59% below the pre-housing downturn peak of 183,280 recorded in 2007 but 52% higher than the market dip of 49,400 in 2010.