Rates below 7% and higher inventory levels contribute to better conditions for buyers

Homebuyer affordability in the US improved for the third consecutive month in July, driven by mortgage rates falling below 7% and an increase in housing inventory.

The national median mortgage payment requested by purchase applicants decreased to $2,140 in July, down from $2,167 in June, according to the Mortgage Bankers Association (MBA).

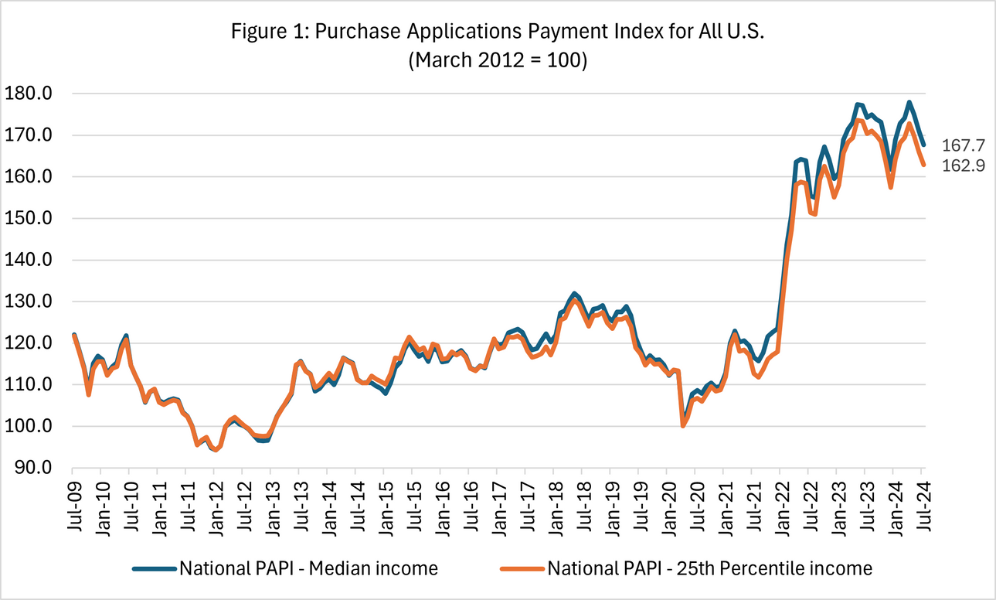

The improvement is reflected in MBA’s Purchase Applications Payment Index (PAPI), which tracks how new monthly mortgage payments change over time relative to income. A decrease in the PAPI indicates better affordability for borrowers, as it suggests lower loan application amounts, reduced mortgage rates, or increased earnings.

In July, the national PAPI decreased by 1.9% to 167.7, down from 170.9 in June. While median earnings increased by 2.9% compared to a year ago, the slight decline in monthly payments helped improve the affordability landscape. The PAPI is now down 3.8% year-over-year.

“MBA is expecting that slower home-price appreciation, coupled with lower rates, will ease affordability constraints and lead to increased activity in the housing market,” said Edward Seiler, AVP of housing economics at MBA and executive director of Research Institute for Housing America.

For those applying for lower-payment mortgages, the national median mortgage payment dropped to $1,444 in July, down from $1,460 in June. Additionally, the Builders’ Purchase Application Payment Index (BPAPI) revealed that the median mortgage payment for new home purchases decreased to $2,452 in July from $2,510 in June.

The report also noted a shift in the mortgage payment to rent ratio (MPRR), which decreased from 1.50 at the end of March 2024 to 1.46 by the end of June 2024. This means that while mortgage payments for home purchases have increased relative to rents, the overall affordability for homebuyers is improving slightly.

The states with the highest PAPI in July were Nevada (255.5), Idaho (252.8), Arizona (224.6), Rhode Island (215.2), and Tennessee (211.2). Meanwhile, the states with the lowest PAPI were Louisiana (119.8), New York (122.7), Connecticut (129.8), West Virginia (133.1), and Kansas (134.6).

Read next: How is Houston's mortgage market faring?

Affordability also improved across different demographics. The national PAPI decreased for Black households from 171.4 in June to 168.2 in July, for Hispanic households from 159.5 to 156.5, and for White households from 172.6 to 169.4.

Stay updated with the freshest mortgage news. Get exclusive interviews, breaking news, and industry events in your inbox, and always be the first to know by subscribing to our FREE daily newsletter.