Higher unemployment and rising costs impact homeowners

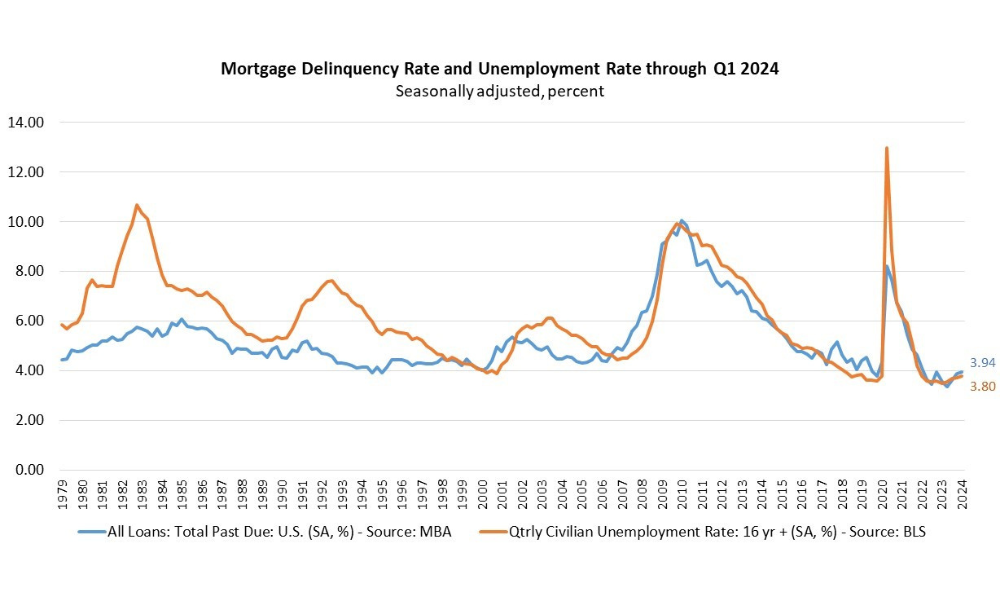

Overall mortgage delinquencies ticked up in the first quarter, but not across all three of the major loan types, according to the Mortgage Bankers Association’s (MBA) latest national delinquency survey.

The delinquency rate for one-to-four-unit residential mortgages rose to a seasonally adjusted 3.94% of all loans outstanding at the end of Q1 2024, up six basis points from Q4 2023 and up 38 basis points from a year ago. However, delinquencies declined for FHA loans, were relatively flat for conventional loans, and increased for VA loans.

“Delinquencies declined for FHA loans, were relatively flat for conventional loans, and increased for VA loans,” Marina Walsh, vice president of industry analysis for MBA, said in the report. “Notably, all three loan types saw an increase in delinquencies compared to one year ago.”

Walsh attributed the rise in delinquencies to several factors: “Higher unemployment, lower personal savings, increases in property taxes and insurance, and a run-up in credit card debt and delinquency have made it tougher for some homeowners to make their mortgage payments.”

The delinquency rate for conventional loans rose just one basis point quarter-over-quarter to 2.62%. For FHA loans, it decreased 42 basis points to 10.39%, while for VA loans it jumped 59 basis points to 4.66%.

Year over year, total delinquencies were up 18 basis points for conventional loans, 112 basis points for FHA loans, and 68 basis points for VA loans.

“At the end of 2023, the Department of Veterans Affairs encouraged mortgage servicers to implement a foreclosure moratorium until the end of May 2024,” Walsh explained. “With this pause came an increase in VA loans that remained delinquent, but not in foreclosure inventory.”

The percentage of loans in foreclosure remained at 0.46%, down one basis point from Q4 2023 and down 11 basis points from a year earlier.

Read next: Servicers not ready yet for VA foreclosure relief program - MBA

States with the largest yearly increases in overall delinquency rates included Louisiana (up 96 basis points), South Dakota (up 96 basis points), New Mexico (up 71 basis points), Texas (up 66 basis points), Georgia (up 56 basis points) and North Dakota (up 56 basis points).

Stay updated with the freshest mortgage news. Get exclusive interviews, breaking news, and industry events in your inbox, and always be the first to know by subscribing to our FREE daily newsletter.