Black Knight report shows yet another record low for delinquencies

May proved to be another record-setting month for mortgage loan performance as the national delinquency rate hit its lowest ever.

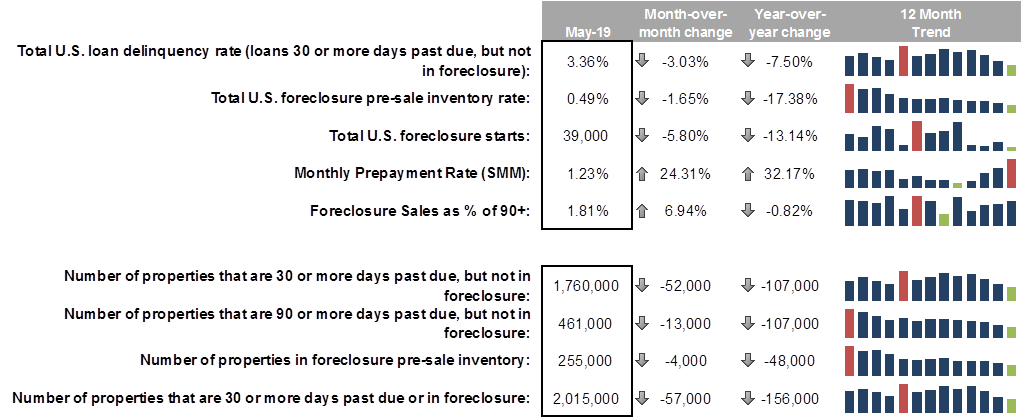

A ‘First Look’ report from Black Knight Inc. reveals the national rate fell to 3.6%, the lowest since the firm began tracking the data in 2000. This continued the strong performance seen in April and was driven by lower early-stage (30 days) and serious delinquencies (90+ days).

May was also a good one for foreclosure starts, which reached their lowest in 18 years at just 39,000 for the month. The number of loans in active foreclosure was at its lowest in more than 13 years; and the total non-current rate was at its lowest since 2005.

Prepayment activity jumped another 24% in May, more than doubling over the past four months to reach its highest level in more than two years.

The states with the highest non-current percentage are Mississippi, Louisiana, Alabama, West Virginia, and Arkansas; while those with the smallest non-current percentage are California, Idaho, Washington, Oregon, and Colorado.

The figures are month-end mortgage performance statistics derived from its loan-level database representing the majority of the national mortgage market.