Relief may be temporary, expert says

US mortgage rates continued their downward trend this week, although experts said they may not stay low for long.

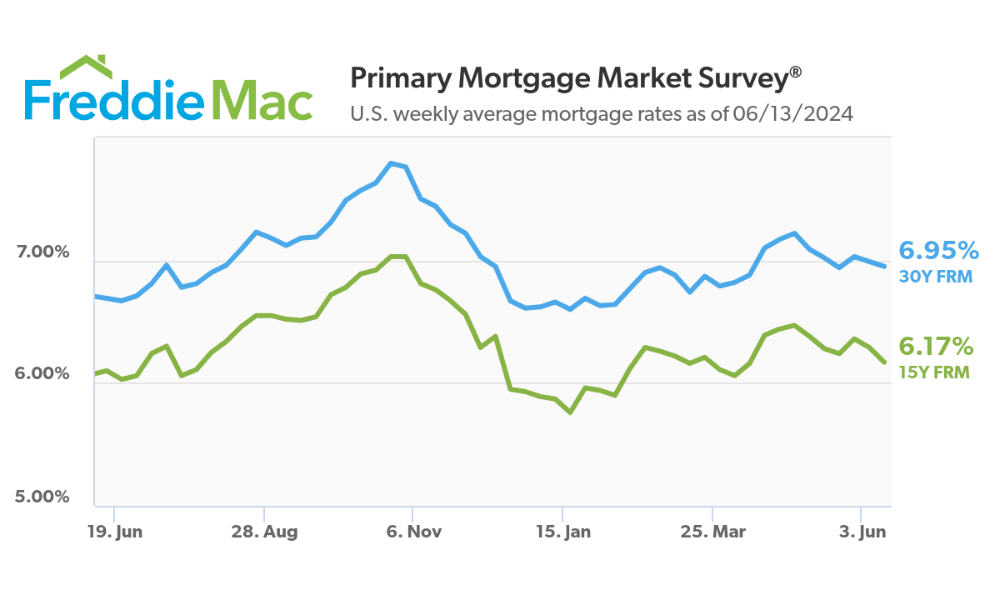

The average 30-year fixed-rate mortgage (FRM) fell to 6.95% as of June 13th, down from 6.99% the previous week, according to Freddie Mac's latest Primary Mortgage Market Survey.

The 15-year fixed-rate mortgage also decreased, averaging 6.17%, down from 6.29% the week prior. It averaged 6.10% a year ago. While small, the decreases followed a pattern of declining rates in recent weeks.

“Mortgage rates continued to fall back this week as incoming data suggests the economy is cooling to a more sustainable level of growth,” Sam Khater, chief economist for Freddie Mac, said in the report.

However, Khater noted that housing affordability remains a challenge.

“Top-line inflation numbers were flat, but shelter inflation, which measures rent and homeownership costs, increased, showing that housing affordability continues to be an ongoing impediment for buyers on the house hunt,” he said.

Read next: First-time homebuyer activity a bright spot in subdued market

While lower rates offer some relief to potential homebuyers, Holden Lewis, a home and mortgage expert at NerdWallet predicted they won't stay this low for long.

“Mortgage rates are likely to remain stubbornly above 6.5% for the rest of 2024,” Lewis said in a statement. “The Federal Reserve says it expects to cut short-term interest rates just one time this year. Three months ago, the Fed projected two rate cuts. The mortgage market might sulk the same way your dog does when you give it one treat instead of two.

“In other words, mortgage rates might move a little higher in the short term.”

The Federal Reserve's decision to maintain the federal funds rate between 5.25% and 5.5% for the seventh consecutive time has created some uncertainty in the mortgage market. While inflation is showing signs of improvement, the central bank remained cautious about declaring victory.

“The Fed is wrangling with tenacious inflation,” said Lewis. “The consumer price index for May was lower than expected, but the Fed won't claim success until inflation has improved several months in a row. Mortgage rates dropped slightly in the last week, but the decline doesn't imply a long-term trend.”

Stay updated with the freshest mortgage news. Get exclusive interviews, breaking news, and industry events in your inbox, and always be the first to know by subscribing to our FREE daily newsletter.