August sees lowest year-over-year increase in over a year

Single-family home prices in the US grew at their slowest pace in more than a year, according to a new report from CoreLogic.

In August, single-family home prices rose 3.9% compared to the same month in 2023 – the lowest annual growth rate since last July.

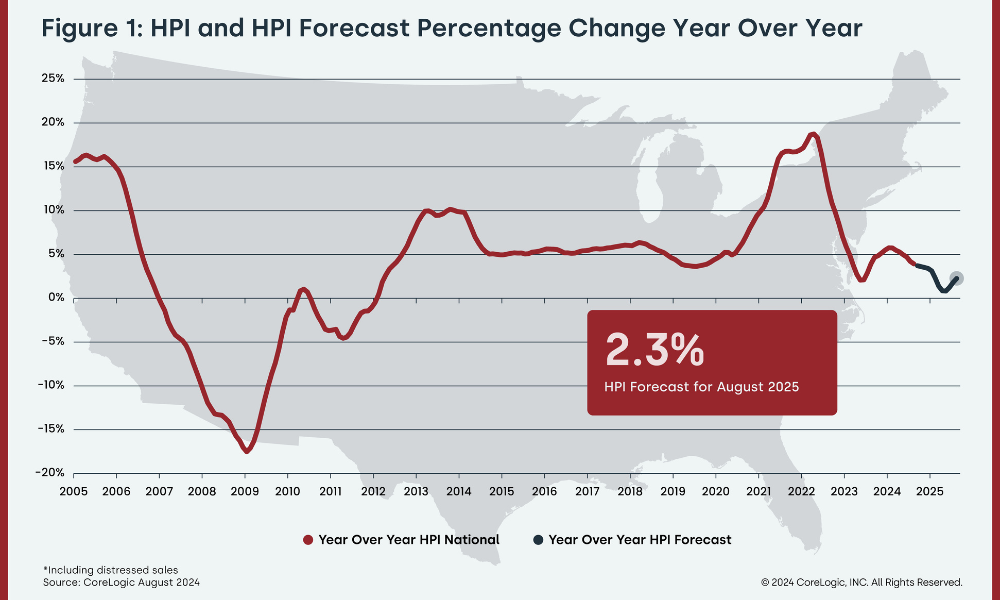

Although home prices continued to rise, the pace of growth has clearly slowed, with a monthly decline of 1% compared to July 2024. CoreLogic chief economist Selma Hepp attributed this to a combination of still-high mortgage rates and economic uncertainty that’s weighing on potential buyers.

“While mortgage rates have dropped in recent weeks, August home sales were by still-high rates in July and August, which lowered affordability,” Hepp said in the report. “The combined impact of high prices and high mortgage rates kept a lid on price growth, with annual gains falling to the lowest level in a year and the monthly gain falling well below what is typically observed in August.”

According to CoreLogic, detached properties saw higher appreciation rates in August, with prices rising by 4.2% year over year. Meanwhile, attached properties, like condos and townhouses, saw a slight decline in value, falling by 0.2%.

CoreLogic’s forecast suggested that home price gains will continue to ease, with the annual growth rate expected to drop to 2.3% by August 2025.

Regional differences in price trends were stark, with some areas seeing more significant price hikes. Miami led the way among metro areas, with an 8.9% year-over-year increase in August. Chicago followed with a 6.8% rise.

Among states, South Dakota posted the highest annual appreciation at 10%, with New Jersey close behind at 9.5%. On the flip side, Hawaii was the only state to report a year-over-year home price decline, with a modest drop of 0.1%.

Read next: Fewer homes are changing hands as turnover rate plummets to 30-year low

“Price gains in August were driven by areas in the Northeast but brought down by softening markets in Texas and Florida,” Hepp said.

Stay updated with the freshest mortgage news. Get exclusive interviews, breaking news, and industry events in your inbox, and always be the first to know by subscribing to our FREE daily newsletter.