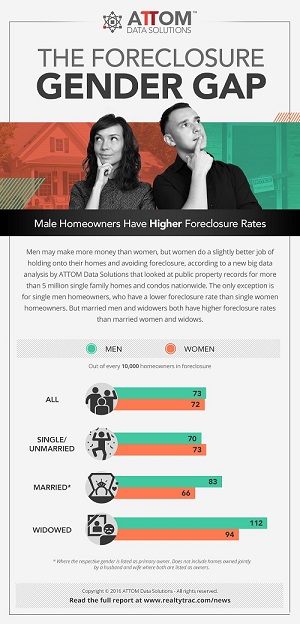

A new analysis finds that female homeowners are slightly less likely to be in foreclosure than male homeowners

Women are slightly better than men at paying their mortgage on time, according to a new analysis from ATTOM Data Solutions. Women also have a slightly lower foreclosure rate than men.

According to ATTOM, an average of 73 out of every 10,000 male homeowners are in foreclosure. Meanwhile, an average of 72 out of every 10,000 female homeowners are in foreclosure. Married men and widowers both have “significantly higher” foreclosure rates than married women and widows, according to ATTOM.

The exception to the trend seems to be among single homeowners. An average of 70 out of 10,000 single male homeowners are in foreclosure, while an average of 73 out of 10,000 single female homeowners are in foreclosure.

In an earlier study, ATTOM also found a significant “appreciation gap” between properties owned by single male and female homeowners. Specifically, single women tend to own less valuable homes that are appreciating in value more slowly than homes owned by single men. While the average single male homeowner has seen his home appreciate in value by 33% since purchase, the average single female homeowner has seen just 31% appreciation in her home’s value.