Now that commercial property prices are on the rise thanks to low rates and high demand, brokers are increasingly willing to pay the price of learning something new to enter the commercial arena, writes Ben Abbott

John kolyvas began his first commercial property finance role in 1987. Taking an active interest in the market in the 30 years since, he’s witnessed both highs and lows, including Australia’s last recession in 1990 very early on in his career.

“My career has given me exposure to the market during the good times, as well as an insight into how quickly it can turn and what mistakes investors make during a strong market,” he says.

The good news is that Kolyvas, who is now ING Direct’s commercial national sales manager, sees no cause for worry in 2017.

“I’m excited about 2017 because the commercial property market seems somewhat insulated to the supply and demand volatility of the residential market,” he says. “Commercial property markets should continue to experience the steady growth achieved over the last few years.”

The property outlook

This outlook is largely shared by lenders across the commercial property spectrum. Despite some pockets of risk, lenders believe they – and brokers – can do good business this year.

“Generally speaking, commercial property values are driven by the health of, and outlook for, the economy,” says Peter Vala, head of sales and distribution at Thinktank. “We’re not expecting any further reductions in the official

cash rate during the course of this year, while employment and GDP conditions are looking reasonably steady. When combined, these factors tend to indicate that commercial property will remain well supported.”

Commercial property prices strengthened in the last 12 months, while yields compressed thanks to cash rate decreases. Tier 1 and Tier 2 properties in particular have been rising. Broad-based demand from international and domestic investors has also helped drive higher prices, especially in the Sydney and Melbourne markets. “Face rents have also started to rise more broadly with diminishing incentives, most noticeably on the East Coast,” Vala says.

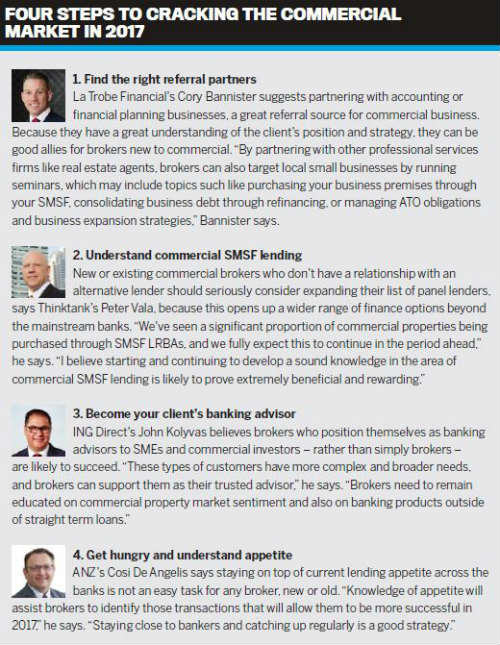

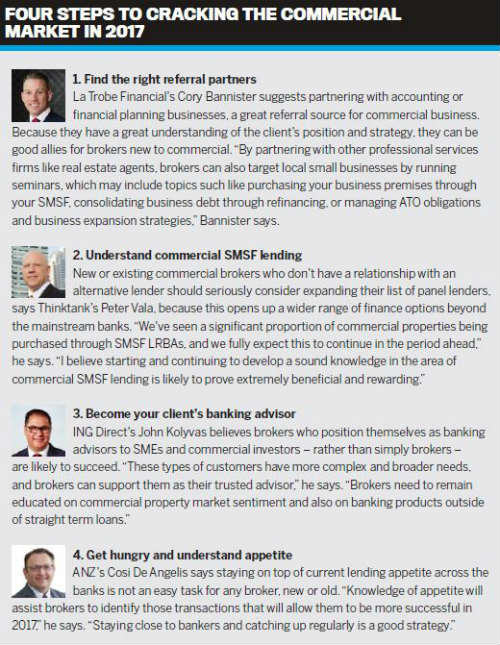

Cory Bannister, chief lending officer at La Trobe Financial, believes these market conditions benefit alternative lenders as well as brokers as major banks tighten their commercial appetites.

“The combination of low interest rates, steady yields that outperform residential assets, and interest from overseas investors, combined with tightening credit conditions from the major banks, has meant more and more borrowers are turning to finance brokers to seek alternate options,” he says. “These often land in the hands of a specialist such as ourselves. We strongly believe in assisting those underserved by the banks, and surprisingly, many commercial property owners and investors are currently in that bucket.”

This competition has not gone unnoticed by the major banks themselves. “With low interest rates and reduced barriers to entry, the competition in this market has provided customers with more choice,” says ANZ’s general manager of commercial origination, Cosi De Angelis. “There are a number of nonbank lenders that remain extremely aggressive in this market.

This competition has not gone unnoticed by the major banks themselves. “With low interest rates and reduced barriers to entry, the competition in this market has provided customers with more choice,” says ANZ’s general manager of commercial origination, Cosi De Angelis. “There are a number of nonbank lenders that remain extremely aggressive in this market.

“While we have seen a reduced appetite to lend for new-to-bank clients from most of the major banks,” he adds, “we continue to support our experienced clients with projects that are well structured and with little settlement risk.”

According to Bannister, other market trends include an uplift in the number of SMSFs acquiring commercial property, many for the purpose of operating their business, and solid interest in the office and light industrial property markets. ING Direct, meanwhile, has seen more non-self-employed PAYE applicants attracted to the returns available in commercial property.

The lender response

Lenders are responding to new market opportunities with both products and technology. For example, Thinktank’s SMSF LRBA product offers LVRs of up to 75%, extended loan terms of up to 30 years and a dedicated relationship manager on every transaction.

La Trobe Financial has tried to make commercial lending as easy and accessible for brokers as possible. “We have recently partnered with Simpology on their e-lodgement Loan App tool, which delivers a dynamically configurable online loan application for all of our products, including SMSF, commercial and construction/development finance,” Bannister says. “It keeps our external broker partners on the same page as our internal processing teams.”

ING Direct is investing in its application process, and the first half of 2017 will see it expand its lending proposition and make its broker experience more efficient. “This will benefit both residential brokers lodging their first commercial application and commercial specialist brokers with more complex needs,” Kolyvas says. “More lenders in the market are looking at efficiencies in how they process applications, and some are starting to digitise some of their processing. Particularly in the below $1 million market, lenders are conscious of appealing to less experienced commercial brokers and making their application process friendlier.”

Educating brokers is also a priority for lenders. Thinktank, for example, is adding to its education platform, which was initially built to provide relevant information and insights that help brokers identify, capture and convert more business opportunities. “This year will also see the launch of a series of strategy sessions intended to solicit market feedback and suggested enhancements on product development that will directly assist the broker market and continue to maintain Thinktank’s leadership in the commercial property finance sector,” Vala says.

La Trobe Financial has been working with aggregators over the past 12 months on localised commercial property master classes for brokers to give them the tools to write more business by educating them on not only how to write the business, but also how to identify the opportunities. “These master classes have been very well received and have resulted in brokers converting more enquiries, ultimately providing more solutions for their clients,” Bannister says.

Market predictions

Market predictions

De Angelis says the property market as a whole may face some challenges in 2017, particularly in the high-density residential sector. “While there will be some headwinds, I think the relatively low interest rates, strength in the NSW economy, continued flow of Chinese funds and Australia’s reputation as a safe haven will continue to support the market,” he says. “The tightening of appetite from the banks will work towards ensuring a sustainable commercial property market as we work into 2018.”

Thinktank’s Vala argues that, on the back of a reasonably stable domestic economy and in the absence of any major global shocks, further but moderating gains should be expected. “The keen interest from offshore buyers appears to be holding up, while low interest rates render commercial property attractive for Australian investors and owneroccupiers,” he says. “At the same time, SMSF lending can be expected to remain robust, with the long-term tax advantages for wealth accumulation drawing in more and more activity.”

Vala does acknowledge some ‘pockets of distress’ among various property types and areas, but he says this is not enough to shake a medium-term positive outlook for the industry. In fact, he says this is likely to bring Thinktank’s experience and structuring know-how to the fore. “The commercial market is made up of a patchwork of factors and dynamics, which makes having a relationship with a specialist lender like Thinktank a smart thing to do,” he says.

La Trobe Financial’s Bannister believes brokers are increasingly likely to take advantage of the opportunities in commercial property, as they see the value in diversification. “Thanks to the combined efforts of ourselves and other commercial lenders, as well as the MFAA and FBAA and aggregator groups, the diversification message has taken a firm hold, lifting finance broker participation in commercial property finance,” he says. “Combine this with the injection of talented new brokers keen to learn, and the forecast for 2017 is extremely positive.”

Kolyvas says ING Direct had a record year in commercial lending last year; settlements were up 28% on the previous year. Having added two new commercial business development managers and two new credit managers, he says the bank is ready to support further growth.

“Our business is 100% reliant on brokers, and we focus on building and maintaining close working relationships with them,” he says. “We’re continuously encouraging and listening to broker feedback, which has been instrumental in how we have shaped and developed our business.”

“My career has given me exposure to the market during the good times, as well as an insight into how quickly it can turn and what mistakes investors make during a strong market,” he says.

The good news is that Kolyvas, who is now ING Direct’s commercial national sales manager, sees no cause for worry in 2017.

“I’m excited about 2017 because the commercial property market seems somewhat insulated to the supply and demand volatility of the residential market,” he says. “Commercial property markets should continue to experience the steady growth achieved over the last few years.”

The property outlook

This outlook is largely shared by lenders across the commercial property spectrum. Despite some pockets of risk, lenders believe they – and brokers – can do good business this year.

“Generally speaking, commercial property values are driven by the health of, and outlook for, the economy,” says Peter Vala, head of sales and distribution at Thinktank. “We’re not expecting any further reductions in the official

cash rate during the course of this year, while employment and GDP conditions are looking reasonably steady. When combined, these factors tend to indicate that commercial property will remain well supported.”

Commercial property prices strengthened in the last 12 months, while yields compressed thanks to cash rate decreases. Tier 1 and Tier 2 properties in particular have been rising. Broad-based demand from international and domestic investors has also helped drive higher prices, especially in the Sydney and Melbourne markets. “Face rents have also started to rise more broadly with diminishing incentives, most noticeably on the East Coast,” Vala says.

Cory Bannister, chief lending officer at La Trobe Financial, believes these market conditions benefit alternative lenders as well as brokers as major banks tighten their commercial appetites.

“The combination of low interest rates, steady yields that outperform residential assets, and interest from overseas investors, combined with tightening credit conditions from the major banks, has meant more and more borrowers are turning to finance brokers to seek alternate options,” he says. “These often land in the hands of a specialist such as ourselves. We strongly believe in assisting those underserved by the banks, and surprisingly, many commercial property owners and investors are currently in that bucket.”

This competition has not gone unnoticed by the major banks themselves. “With low interest rates and reduced barriers to entry, the competition in this market has provided customers with more choice,” says ANZ’s general manager of commercial origination, Cosi De Angelis. “There are a number of nonbank lenders that remain extremely aggressive in this market.

This competition has not gone unnoticed by the major banks themselves. “With low interest rates and reduced barriers to entry, the competition in this market has provided customers with more choice,” says ANZ’s general manager of commercial origination, Cosi De Angelis. “There are a number of nonbank lenders that remain extremely aggressive in this market.“While we have seen a reduced appetite to lend for new-to-bank clients from most of the major banks,” he adds, “we continue to support our experienced clients with projects that are well structured and with little settlement risk.”

According to Bannister, other market trends include an uplift in the number of SMSFs acquiring commercial property, many for the purpose of operating their business, and solid interest in the office and light industrial property markets. ING Direct, meanwhile, has seen more non-self-employed PAYE applicants attracted to the returns available in commercial property.

The lender response

Lenders are responding to new market opportunities with both products and technology. For example, Thinktank’s SMSF LRBA product offers LVRs of up to 75%, extended loan terms of up to 30 years and a dedicated relationship manager on every transaction.

La Trobe Financial has tried to make commercial lending as easy and accessible for brokers as possible. “We have recently partnered with Simpology on their e-lodgement Loan App tool, which delivers a dynamically configurable online loan application for all of our products, including SMSF, commercial and construction/development finance,” Bannister says. “It keeps our external broker partners on the same page as our internal processing teams.”

ING Direct is investing in its application process, and the first half of 2017 will see it expand its lending proposition and make its broker experience more efficient. “This will benefit both residential brokers lodging their first commercial application and commercial specialist brokers with more complex needs,” Kolyvas says. “More lenders in the market are looking at efficiencies in how they process applications, and some are starting to digitise some of their processing. Particularly in the below $1 million market, lenders are conscious of appealing to less experienced commercial brokers and making their application process friendlier.”

Educating brokers is also a priority for lenders. Thinktank, for example, is adding to its education platform, which was initially built to provide relevant information and insights that help brokers identify, capture and convert more business opportunities. “This year will also see the launch of a series of strategy sessions intended to solicit market feedback and suggested enhancements on product development that will directly assist the broker market and continue to maintain Thinktank’s leadership in the commercial property finance sector,” Vala says.

La Trobe Financial has been working with aggregators over the past 12 months on localised commercial property master classes for brokers to give them the tools to write more business by educating them on not only how to write the business, but also how to identify the opportunities. “These master classes have been very well received and have resulted in brokers converting more enquiries, ultimately providing more solutions for their clients,” Bannister says.

Market predictions

Market predictionsDe Angelis says the property market as a whole may face some challenges in 2017, particularly in the high-density residential sector. “While there will be some headwinds, I think the relatively low interest rates, strength in the NSW economy, continued flow of Chinese funds and Australia’s reputation as a safe haven will continue to support the market,” he says. “The tightening of appetite from the banks will work towards ensuring a sustainable commercial property market as we work into 2018.”

Thinktank’s Vala argues that, on the back of a reasonably stable domestic economy and in the absence of any major global shocks, further but moderating gains should be expected. “The keen interest from offshore buyers appears to be holding up, while low interest rates render commercial property attractive for Australian investors and owneroccupiers,” he says. “At the same time, SMSF lending can be expected to remain robust, with the long-term tax advantages for wealth accumulation drawing in more and more activity.”

Vala does acknowledge some ‘pockets of distress’ among various property types and areas, but he says this is not enough to shake a medium-term positive outlook for the industry. In fact, he says this is likely to bring Thinktank’s experience and structuring know-how to the fore. “The commercial market is made up of a patchwork of factors and dynamics, which makes having a relationship with a specialist lender like Thinktank a smart thing to do,” he says.

La Trobe Financial’s Bannister believes brokers are increasingly likely to take advantage of the opportunities in commercial property, as they see the value in diversification. “Thanks to the combined efforts of ourselves and other commercial lenders, as well as the MFAA and FBAA and aggregator groups, the diversification message has taken a firm hold, lifting finance broker participation in commercial property finance,” he says. “Combine this with the injection of talented new brokers keen to learn, and the forecast for 2017 is extremely positive.”

Kolyvas says ING Direct had a record year in commercial lending last year; settlements were up 28% on the previous year. Having added two new commercial business development managers and two new credit managers, he says the bank is ready to support further growth.

“Our business is 100% reliant on brokers, and we focus on building and maintaining close working relationships with them,” he says. “We’re continuously encouraging and listening to broker feedback, which has been instrumental in how we have shaped and developed our business.”